Solving for Shortages in Nova Scotia: Employer Experiences and the Labour Market Across Atlantic Provinces

Series | Atlantic Revitalization Employer ConsultationsPPF’s Immigration & Atlantic Revitalization project is examining immigrant retention and this report, in partnership with Memorial University, is looking at skilled labour shortages across Atlantic Canada.

All industrialized countries are experiencing some degree of labour and skill shortages. Low birthrates, aging populations, and technological change all contribute to these challenges. A long-term employer survey conducted across 43 countries and territories by Manpower Group, reveals increasing worldwide talent shortages over the last 13 years. Approximately 54 percent of companies globally reported difficulty in filling vacancies for skilled jobs in 2019 – the highest in over a decade, with 45% percent reporting this in 2018 and 30 percent in 2009. In Canada, 48 percent of employers reported difficulty in filling skilled job vacancies (Manpower Group, 2020). The trend is expected to continue into the foreseeable future. The sustainable growth of business, and the productivity, innovation, and competitiveness of the local economy will be constrained by labour and skill shortages in both the short and long run.

There are two major types of labour and skill shortages: cyclical and structural. Cyclical shortages are commonly driven by rises and falls of the economic cycle. They are short-run in nature and can be alleviated by wage increases, recruitment campaigns, and innovative workplace practices (Skills Canada BC, 2004). Structural shortages, however, can be difficult to mitigate in the short-run due to a shortage of potential workers with required skills and experiences, driven mostly by demographic and technological changes (Fang, 2009).

The Atlantic Provinces are geographically isolated, with small populations and resource-dependent economies, making them less attractive destinations for workers from other Canadian provinces and other countries. Additionally, population aging affects Atlantic Canada more severely than other parts of the country. In Atlantic Canada, the labour force shrank by 53,639 (3.3 percent) between 2012 and 2019, mainly due to retirement (Statistics Canada, 2019a). In 2019, people aged 65 and above comprised 21.0 percent of the Atlantic Canadian population, but just 17.3 percent of the population in the rest of Canada (Statistics Canada, 2019a). There are more retirees than new labour market entrants every year. For every seven workers entering the region’s labour market in 2020, there are ten retirees.

An employer survey conducted last Fall by Narrative Research and the Jarislowsky research team showed that 52 percent of employers in Atlantic Canada had difficulty filling job vacancies: among them, 27 percent of respondents reported having too few applicants, 21 percent couldn’t find applicants with the necessary experience, and 20 percent were unable to find applicants with the necessary skills. This indicates that most employers in Atlantic Canada are currently experiencing structural labour and skills shortages due to the interplay of demographic factors and new productivity boosting technologies.

Demographic, economic, technological, and public policy factors have direct effects on shortages of skilled workers. Demographic and technological factors are structural factors leading to the shortages of skilled workers, while economic and public policy factors can reinforce or mitigate skill shortages caused by structural factors. The effects on each of these factors on the Nova Scotia (NS) labour market are provided below.

Economic Growth

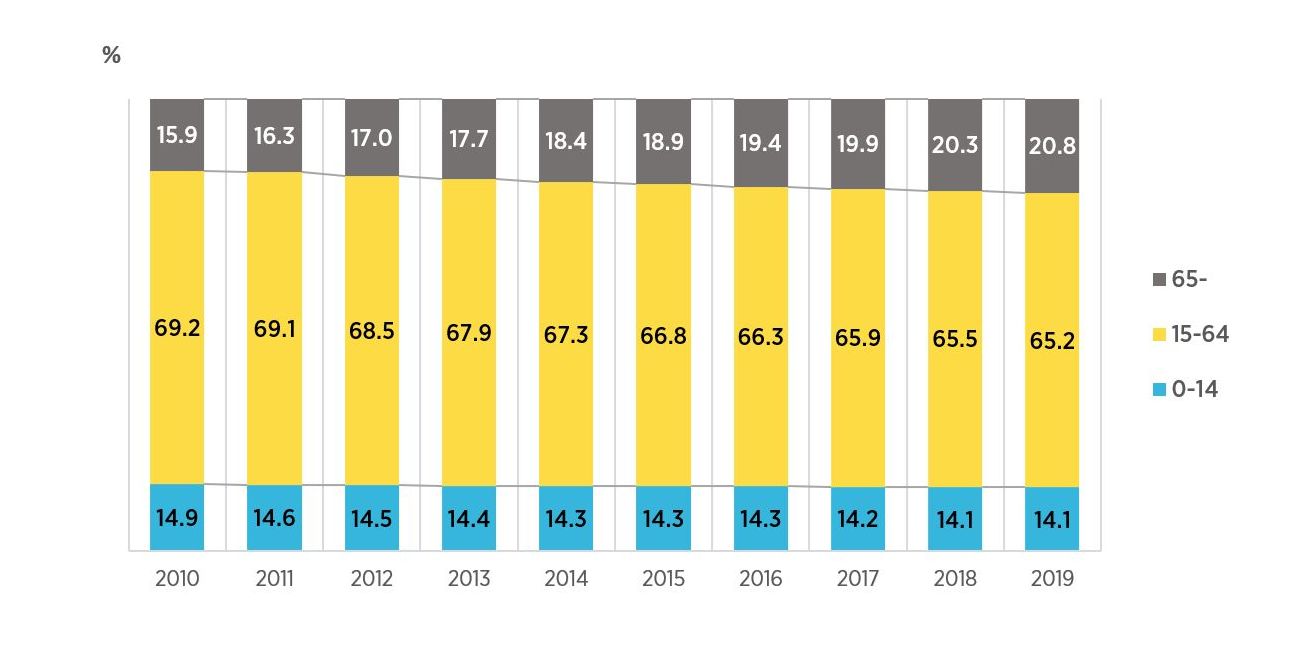

Demographic trends affect the skill and labour supply by changing the size and structure of the labour force. Population aging and stagnant growth and are the main demographic characteristics in Nova Scotia. The 10-year population growth in Nova Scotia was recorded at only 3.1 percent, compared to 10.5 percent in Canada during the last decade (2010-2019). The province had a significantly higher median age (44.9 vs. 40.8) and proportion of residents who were 65 and older than the Canadian average (20.8 percent vs. 17.5 percent) (Table 1).

Table 1. Demographic characteristics of Canada and the Atlantic Provinces (Statistics Canada, 2019a, 2019b, 2019c)

| Canada | NL | NB | NS | PEI | |

| Population, 2019 | 37,589,262 | 521,542 | 776,827 | 971,395 | 156,947 |

| Age 0-14 | 16.0% | 13.7% | 14.4% | 14.1% | 15.6% |

| Age 15-64 | 66.5% | 64.9% | 64.6% | 65.2% | 64.6% |

| Age 65+ | 17.5% | 21.5% | 21.3% | 20.8% | 19.7% |

| Median age (2019) (years) | 40.8 | 47.1 | 46.0 | 44.9 | 43.2 |

| Population change (2018-2019) (%) | 1.34 | -0.77 | 0.77 | 1.24 | 2.19 |

| Net interprovincial migration (2018-2019) | N/A | -4501 | 606 | 3306 | 129 |

| International migration (2019) | 295,205 | 1,550 | 5,235 | 6,630 | 2,155 |

| Percentage of annual international immigrants in the population in (2018) | 0.79% | 0.30% | 0.67% | 0.68% | 1.37% |

| Percentage of immigrants in the population (2016) | 21.9% | 2.4% | 4.6% | 6.1% | 6.4% |

The low birth rate, high mortality rates, low net interprovincial migration, and low international migration rate all contribute to the low population growth in Nova Scotia (Table 1). Despite this, the number of international immigrants increased dramatically between 2014 and 2018, from 2,797 to 4,610, and net interprovincial migration turned from negative to positive as well.

As for population structure, Table 1 shows that Nova Scotia had a median age of 44.9 in 2019, which is the third highest in the country, just behind NL and NB. Additionally, the work force in Nova Scotia has decreased over the past 10 years (2010-2019) by an average of 0.4 percent annually, while the percentage of people aged 65 and above has increased by about 0.5 percent annually in the same period. From these trends, it can be expected that 30 percent of the population will be aged 65 and above by 2039. Over the next 10 years, approximately 154,075 Nova Scotians will leave the work force, mainly due to retirement, while only 93,427 enter the work force (Table 1). Though the size of the labour force has increased since 2016 due to increased immigration, the percentage of labour force participation compared to the population has continuously declined. Without population inflow or external intervention, the labour force could shrink by 60,648 (9.6 percent) before 2028. This would cause a massive decline in labour supply, further intensifying labour and skill shortages, as well as increasing pressures on pensions and public health.

Figure 1. Population structure of Nova Scotia (by age)

Technology changes the nature of work and the skills needed for work. According to McKinsey & Company, approximately half of all work activities globally could potentially be automated by adopting advanced technologies (2017). This would lead to lower labour demand in some fields while higher demand in other fields, requiring many to switch occupations. In today’s knowledge-based and digital-heavy economy, the pace of the technological change has accelerated. Organizations need to constantly adapt their operations, processes, practices, and managerial technology to cope. As a result, the demand for high-skilled workers increases, while the demand for low-skilled workers whose jobs could be replaced by labour-saving technologies will diminish.

According to a report from the Atlantic Canada Opportunities Agency (ACOA), the top three industries for net growth in employment in Atlantic Canada between 2000 and 2017 were health care and social assistance (52,700), construction (25,100), and professional, scientific and technological services (20,900). The top three industries that recorded net loss in employment were manufacturing (-25,300), fishing (-8,000) and forestry (-5,000). It is estimated that 76 percent of new jobs will be created in highly skilled occupations from 2017-2026 (ACOA, 2019a). It is also estimated that from 2018 to 2020, the demand for workers with skillsets in technical and professional occupations made up 60 percent of job openings in Nova Scotia (ACOA, 2019b).

In coping with these skill shortages and mismatches driven by technological change, employers either upgrade their employees’ skills by training or hiring new workers with the necessary skills.

An employer survey by the World Economic Forum showed that at least half of all employees are required to undergo significant training to provide new or improved skills in order to cope with the rapid change of technology (World Economic Forum, 2018).

Economic & Immigration Policies

Economic expansion usually leads to more employment. The Nova Scotia economy has experienced growth over the past six years and is expected to maintain that trend in the medium-term, which is based on non-energy export growth, major project investment, and productivity growth led by innovation, highly skilled human capital input, and is guaranteed by improved demographics mainly driven by immigration. According to Memorial’s recent Atlantic employer survey, 52 percent of employers in Nova Scotia experienced sales growth and 45 percent experienced employment growth in the last three years. An even higher percentage of employers anticipated an increase in sales and employment in the next three years.

In 2019, Nova Scotia experienced the fastest employment growth since 2004, and the lowest unemployment rate since the early 1970s (Government of Nova Scotia, 2020b). The level of employment has steadily increased while the unemployment rate has declined (Table 2). Professional, scientific and technical services, and tourism related industries such as trade, accommodation, and food services have all experienced sustainable growth in terms of either GDP or employment in recent years. There is a significant labour market difference between Halifax and the rest of Nova Scotia; most growth (both population and employment) occurs in Halifax. The unemployment rate in Halifax is lower than that in Ontario, while the Nova Scotia unemployment rate outside Halifax is relatively high but has still improved significantly in the last decade (Table 2).

Table 2. Selected Economic Indicators (percentage change), Nova Scotia (Statistics Canada, 2019c, 2019d)

| Indicator | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

| GDP (%) | 2.61 | 0.31 | -0.94 | -0.27 | 1.06 | 0.77 | 1.36 | 1.74 | 1.54 | 2.0F[1] | |

| Labour force (%) | 0.69 | 0.69 | 0.69 | 0.68 | -1.04 | -1.02 | -0.06 | 0.22 | 0.36 | 0.66 | |

| Employment rate (%) | 58.2 | 58.1 | 58.5 | 57.9 | 57.2 | 57.0 | 56.6 | 56.7 | 57.1 | 57.7 | |

| Participation rate (%) | 64.3 | 63.9 | 64.4 | 63.7 | 62.8 | 62.4 | 61.7 | 61.8 | 61.7 | 62.2 | |

| Unemployment rate (%) | Halifax | 6.5 | 6.1 | 6.2 | 6.5 | 6.1 | 6.3 | 6.1 | 6.8 | 5.9 | 5.8 |

| Cape Breton | 16.0 | 16.0 | 14.4 | 14.3 | 15.0 | 15.0 | 14.7 | 14.1 | 15.1 | 13.3 | |

| North Shore | 11.0 | 10.3 | 10.9 | 11.0 | 10.7 | 9.2 | 8.9 | 8.9 | 8.5 | 7.3 | |

| Annapolis Valley | 9.2 | 9.8 | 9.3 | 9.1 | 8.9 | 8.4 | 8.0 | 7.7 | 7.1 | 6.4 | |

| Southern | 13.0 | 10.5 | 12.5 | 11.4 | 12.0 | 11.0 | 10.9 | 9.7 | 6.5 | 8.5 | |

To alleviate skills shortages and fulfil sustainable economic growth, a multi-faceted population and immigration strategy engaging multiple stakeholders is needed, as population growth is a driving force for coping with population aging and skill shortages. Such a strategy would work well with other policies that increase labour force participation rate of under-representative groups, re-skill or up-skill the existing labour force, bring back Nova Scotians who have moved away, and help develop a new pool of skilled workers. Immigrants, temporary foreign workers, refugees, and international students are important sources of this new pool. Policies relevant to this are expected to contribute to the success of the Canadian and regional labour market, economic growth, and long-term prosperity (IRCC, 2018).

IMMIGRATION RATE & CATEGORIES

International migration now accounts for over 80 percent of the population growth in Canada in 2019 (Statistics Canada, 2019c). According to Statistics Canada, population growth through immigration has been twice as important as the natural population increase (Statistics Canada, 2019b). There are three main categories of permanent immigrants in Canada: economic class (mainly skilled workers and business migrants), which accounts for about two thirds of all immigrants in Canada; family class (spouses, partners, and close family members), which accounts for about a quarter of all immigrants; and refugee class, which accounts for about eight percent of all immigrants (Statistics Canada, 2019d).

As part of the Government of Canada’s selection criteria, most economic immigrants are chosen by a points system based on applicants’ human capital characteristics including age, education, official language proficiency, and labour market experience. As a result, they tend to be more educated, highly skilled (Docquier and Marfouk, 2004; Grogger and Hanson, 2011), and younger than Canadian-born workers, which means they can be more productive if properly matched with jobs and for longer periods of economically active years. According to the 2016 census, 52.1 percent of recent immigrants have a bachelor’s degree or higher, compared to just 24.0 percent of the Canadian-born population aged 25 to 64 (Statistics Canada, 2017). In 2018-2019, 61.3 percent of immigrants are 20 to 39 years old, and only 4.3 percent of them are older than 65 (Statistics Canada, 2019e). In an open economy, immigrants may facilitate international trade due to their rich knowledge of the languages, markets, and products of both host and home countries (Dunlevy, JA, 2004; 2019).

In addition, some of the most important contributions of immigrants to the host country can be attributable to innovation and entrepreneurship. Immigrants are fundamentally heterogeneous in terms of their abilities and skills, as a result of their different educational and cultural backgrounds, as well as their diverse work experiences which can be considered important sources of innovation (Hanson 2012; Ozgen et al., 2013) and productivity growth (Hou et al., 2018; Harrison, Harrison & Shaffer, 2019). Due to their relatively high-risk appetite and persistent prevalence of barriers to employment, immigrants are also more likely to start their own business, which can create jobs for the host country’s economy. In Canada, between 2003 and 2013, the average annual net job growth per firm was higher among immigrant-owned firms than among firms with Canadian-born owners, as was the likelihood of being a high-growth firm (Picot et al. 2019).

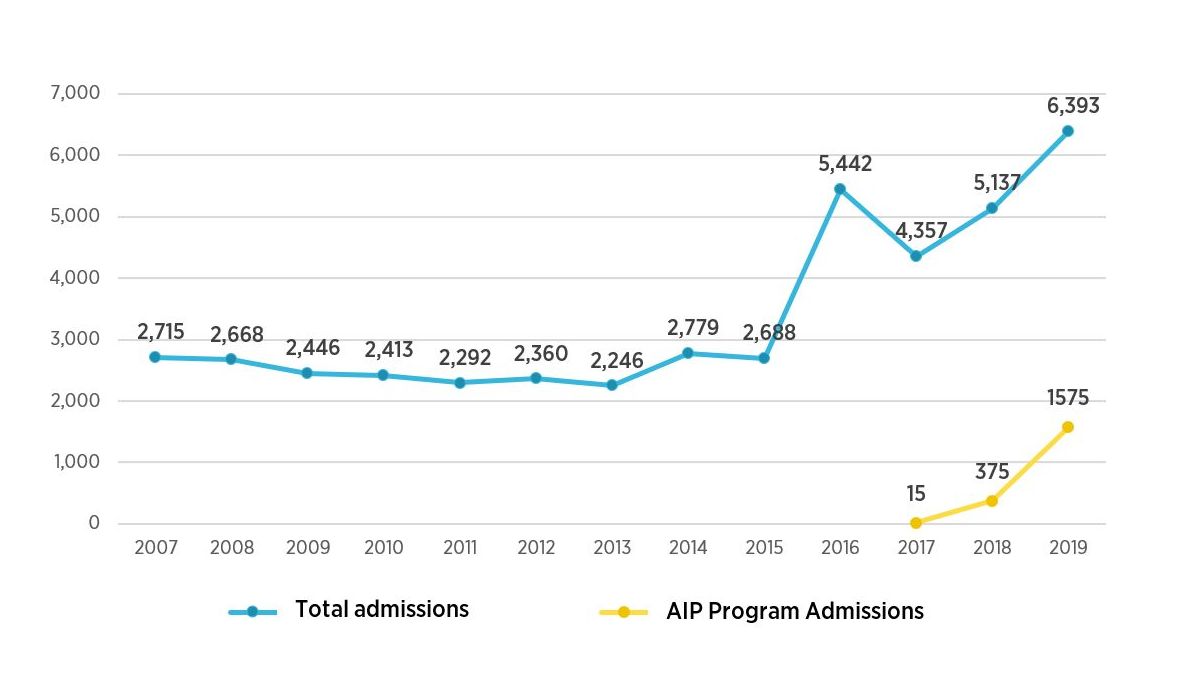

Attracting and retaining immigrants and international students is an important strategy for Nova Scotia and the Halifax Metropolitan Area, the economic and cultural center of Nova Scotia that supports economic growth in the province. As shown in Figure 2, the number of immigrants that arrived in Nova Scotia in a given year nearly tripled between 2013 and 2019 (IRCC, 2019a) and Nova Scotia experienced close to the largest net annual inflow of international migrants since 1975, thanks to the introduction of the Atlantic Immigration Pilot Program (AIPP) in 2017. However, Table 1 shows that the number of new immigrants in 2019 only represents 0.68 percent of the population of Nova Scotia, which is less than the national average (0.79 percent). There would be 2,069 more immigrants accepted if the national annual immigration rate were adopted. The government of New Brunswick has set an even higher target of attracting immigrants, welcoming up to 7,500 newcomers annually by 2024 (Government of New Brunswick, 2019c). This implies that more effort is needed to attract international immigrants to Nova Scotia.

Figure 2. Permanent Residents Admitted to Nova Scotia Annually (Statistics Canada, 2019d, IRCC, 2019b)

Nova Scotia welcomed record number of immigrants in 2019, especially sectors with the most need, such as the health care and social work sectors. However, as Figure 1 shows, Nova Scotia will need to seek more immigration to make up for the retirees leaving the workforce. Only 6.1 percent of the population in Nova Scotia is immigrants, while they make up 21.9 percent of the population of Canada as a whole (Statistic Canada, 2016a). The retention rate is rising (Government of Nova Scotia, 2019) due to innovative approaches and support that help immigrants learn more about Nova Scotia through pre-arrival programs, a one-stop service platform through https://novascotiaimmigration.com, and a mobile service APP.

INTERNATIONAL EDUCATION

Due to its high quality and affordability of higher education, and a multicultural society, Canada attracts increasing number of international students who attend Canadian educational institutions. In 2019, more than 400,000 new international students came to Canada (CIC, 2020). International education makes a large and growing contribution to Canada’s short-term and long-term prosperity in the forms of revenue growth, job creation, and supply of skilled workers. In 2018, international students brought $795 million in revenues and created more than 6,700 jobs in Atlantic Canada (CAMET, 2018). International students also promote global ties between Canada and other countries and facilitate international trade. In addition, international students possess high-quality human capital characteristics in education, skills and experience. To retain international students in Canada, the Canadian government has provided relatively seamless immigration services to international students as a part of their international education strategy (Government of Canada, 2018). In Atlantic Canada, besides Express Entry, international students can now apply for permanent residence through the International Graduate Stream of the AIP program.

In Atlantic Canada, each student spends about $34,188 annually, and collectively have created more than 1,291 full time equivalent positions (CAMET, 2018). By the end of 2019, there were 10,390 study permit holders at all educational levels in Nova Scotia (IRCC, 2019e). In 2019, 35 post-secondary institutions recruited 7,245 international students. At 11 out of the 35 institutions, international students had the option to apply for an open work permit after graduation.

Immigrants to Canada are facing barriers to integrate into the Canadian labour force, such as lower language proficiency, or a lack of Canadian work experience or credentials. International students with Canadian education credentials, strong language skills, and local work experience in Canada are ideal labour market participants. According to the report of the Council of Atlantic Ministers of Education and Training (CAMET) (2018), 14 percent of international students participated in co-op programs. The employer survey conducted by PPF last Fall also showed international students in Atlantic Canada were actively looking for employment. Approximately 23.8 percent of interviewed employers had received job applications from international students. In addition, the Atlantic Canada Study and Stay program, debuted in 2016, provides a unique support for Atlantic post-graduate international students looking for future career development in the region. In 2018, just 12.6 percent of international students stayed in Nova Scotia after graduation (One Nova Scotia, 2019), but 80 percent of international students in this program stayed in Nova Scotia. An open work permit of up to three years can be issued to most international students after graduation from a credible post-secondary program, encouraging them work and stay in Canada and providing them a chance to attain Canadian work experience (Lu & Hou, 2019). All these programs and initiatives can help improve international student retention in the region.

TEMPORARY FOREIGN WORKERS

Temporary Foreign Worker programs have had an increasing effect on the Canadian labour market and immigration system. There are two programs for Temporary Foreign Workers admitted to Canada: the Temporary Foreign Worker Program (TFWP), which requires a Labour Market Impact Assessment (LMIA), and the International Mobility Program (IMP), which is exempt from an LMIA. These two programs permit Canadian employers to hire temporary foreign workers to fill immediate skill and labour shortages on a temporary basis. These include positions that Canadian citizens and permanent residents are unable or unwilling to fill, such as seasonal work (Curry, 2016), high-skilled occupations in technology, and low-skilled occupations in the service industry (Lemieux and Nadeau, 2015). Temporary foreign workers can also transition into permanent residence through the Canadian Experience Class, Provincial Nominee Program and the Express Entry Program (Lu & House, 2017). Recently, TFWs have tended to stay longer in Canada and obtain permanent residence (Prokopenko & Hou, 2018). The transition rate of TFWs to permanent residents increased by 9% from the TFW cohort who arrived between 1995 and 1999 to 21 percent for the 2005-to-2009 arrival cohort (Lu & Hou, 2017).

Temporary foreign workers under TFWP and IMP are important to Nova Scotia. Memorial’s Atlantic employers survey found that 55.5 percent of employers who reported the difficulty with filling job vacancies over the past three years stated the major reasons for such hiring difficulties were too few applicants (19.8 percent) and lack of applicants with necessary skills (19.8 percent) or experiences (21.6 percent). Even more employers (60.5 percent) anticipated the province would face a shortage of skilled labour in the next three years. Shortages in skilled workers force employers to turn to temporary foreign workers for help (CBC News, 2019).

Various organizations, including government agencies, businesses, and academic institutions, have raised concerns over labour and skill shortages in Nova Scotia. Employers play a crucial role in the labour market, and the experiences and opinions of these employers provide important evidence to identify areas of labour and skill shortages and formulate solutions to address such challenges across Nova Scotia.

In February 2020, the Public Policy Forum organized a consultation to engage employers and professional service providers and discuss topics such as:

- Types of skills shortages faced by employers;

- Challenges experienced by employers in hiring skilled workers (including newcomers);

- Policies or practices that can help overcome these challenges; and

- Suggestions to alleviate these skills shortages and improve the hiring and retention of skilled workers (including newcomers).

The consultation had several objectives:

- Identify sectors that experience labour and skills shortages;

- Examine factors influencing employers’ decisions to hire immigrants, refugees, international students, and temporary foreign workers;

- Identify government (and other stakeholder) practices that can benefit employers’ recruitment of skilled workers and newcomers; and

- Identify measures to increase the retention rate of skilled workers in the province.

Findings

Skills shortages

- Entry-level skill shortages which require college-level skills are lacking. For example, employers from the aerospace and biotech industry need production workers, quality controllers, mechanics, quality engineers, etc.

- Many employers experience industrial-specific mid- and high- level skill shortages, such as specific engineers.

- Many experience shortages in positions with managerial and leadership skills.

Challenges to make up for shortages

- Organizations have difficulty finding applicants with the right skills due to their remote location, or uncompetitive salaries when compared to other locations, other provinces, and because of long processes required to employ immigrants.

- Small and medium-sized organizations expressed difficulty hiring immigrants without larger HR departments to deal with lengthier processes.

- Housing issues, transportation issues, lack of ethnic clusters, lack of job for the immigrant’s spouse, and difficulty getting ESL training are the main challenges for immigrants in accessing work and staying with a given area.

- Employers cited observing frequent duplication or misuse of resources complicating processes and shared sectoral or local challenges further.

Employer efforts to recruit and retain workers

- Employers are using various sources for recruiting such as campuses, retirees groups, overseas workers.

- Many attempt to maintain close collaboration with government, settlement agencies, professional organizations to attain supports and resources for hiring skilled workers including newcomers.

- Some employers try to improve retention by help employees find housing, and community-based and family-oriented supports.

- Employers may recruit a cluster of people from similar origins to act as a cultural and support network and community for integration.

- Employers are trying to improve face-to-face communication with employees, provide clear managerial goals and career path for employees.

Stakeholder efforts to recruit and retain workers

- Stakeholders are establishing online databases for semi-retirees or retirees; launching job fairs on campuses; providing professional training to students on campus, employer-employee matching services, online pre-arrival programs, in-person family supports and workplace English training programs. There is desire to do these things better and to better scale and to set up a skill development hub.

Nova Scotia is facing an aging population and workforce due to the large number of retirees, but Halifax is solving this with significant population inflow from immigration and interprovincial migration.

Small cities and rural areas are still struggling in attracting and retaining skilled workers caused by younger people moving away, an increasing number of retirees, and reduced attraction to immigrants. Skill shortages restrict organizations’ sustainable growth and push them to subcontract to others. Employers are actively mobilizing all available resources to fill in these shortages with fresh graduates, older workers, and immigrants.

Employers are willing to hire international immigrants because they have a strong work ethic and diverse skills and experiences. Some barriers exist however, especially to small and medium organizations. Long immigration processes, immigrants leaving prematurely due to housing issues, transportation, lack of job opportunities for employees’ spouses, and lack of ethnic groups may hinder employers in hiring and retain immigrants.

In addition to efforts from employers to attract and keep people, especially immigrants and international students, systematic, supportive, and complementary policies and solutions from other stakeholders are also necessary. Employers and sector representatives consulted in Amherst, made the following recommendations:

- Take advantage of the underutilized labour force. Younger population (15-24 years old), women, older workers, people with disabilities, indigenous people and immigrants normally have a lower employment rate. Policies and practices that aim to remove employment obstacles to improve employment opportunities and capacities to such groups will provide increased supply in labour and skills.

- Provide more precise labour market information. Labour market information is vital for immigrants. It shows them where job opportunities are located, what skills are required, how they could prepare for a job, and how the labour market is trending. Labour market information services help employers access suitable job applicants and improve human resource management practices in response to labour market changes.

- Develop technical support tools to alleviate labour and skill shortages in rural areas. Use online training systems to improve language and skills; use remote office platforms for some positions that cannot be filled locally in the short-term; set up a dynamic skill database for tracking skill demand.

- Develop programs to retain international students. Programs that connect international students with local employers and provide them with professional skills for future career opportunities will keep them in the province. Examples include internships, workshops, entrepreneurship training program, and co-op programs.

- Collaborate closely with diverse stakeholders. Establish feasible cooperation mechanisms and modes to decrease the duplication of programs, improve the efficiency of funding utilization, and bring the comparative advantages of different types of organizations into play.

- Support HR capacity for small and medium sized organizations. Insufficient professional HR capacity is one of the main obstacles that small and medium organizations face in learning immigration policies, coping with recruiting, and training/retaining immigrant employees. Government and settlement agencies need to provide stronger supports to employers as HR consultants, and collaborate to attract many immigrants from the same country to meet various organizational needs.

- Prioritize key industries for solving skill shortages. With limited resources, special attention and supports should be given to industries with strategic importance for future economic development. It is important to know their skill demands and hiring challenges, and follow up with assessments and solutions.

- Analyze and show case successful practices in recruitment and retention of skill workers. This would help identify key factors for success and develop practical methods that other employers could follow. Governments, settlement agencies, NGOs and other stakeholders could also use this to improve their services.

- Recruit a cluster of immigrants from the same origin country to create small immigrant communities in rural areas. This would help small and remote rural communities to fill acute labour and skill shortages and address the long-term challenges of population aging and population decline. Such recruitment practice may also help the newcomers to build a sense of belonging to their own community and facilitate long-run retention of the skilled immigrants and their families in the rural areas.

Atlantic Canada Opportunities Agency (ACOA). (2019a). Economic information observatory for Atlantic Canada.

Atlantic Canada Opportunities Agency (ACOA). (2019b). An exploration of skills and labour shortages in Atlantic Canada.

Atlantic Canada Opportunities Agency (ACOA). (2019). An exploration of skills and labour shortages in Atlantic Canada.

Canadian Bureau for International Education. (2018). International students in Canada, 2018.

Citizenship and Immigration Canada (CIC) News. (2019). Employers in Moncton, New Brunswick, turning to foreign workers to fill labour needs.

Citizenship and Immigration Canada (CIC). (2020). Canada welcomed more than 400,000 new international students in 2019.

Conference Board of Canada. (2019). Nova Scotia provincial outlook economic forecast.

Council of Atlantic Ministers of Education and Training (CAMET). (2018). International students contribute significantly to the Atlantic economy.

Council of Atlantic Ministers of Education and Training (CAMET). (2019). Economic impact of international students

Curry, B. (March 2016). Ottawa allows seasonal exceptions to Temporary Foreign Worker rules. Globe and Mail.

Docquier, F., and Marfouk, A. (2004). Measuring the international mobility of skilled workers (1990–2000): release 1.0. The World Bank.

Dunlevy, J. A. (2004.) Interpersonal networks in international trade: Evidence on the role of immigrants in promoting exports from the American states. Working article. Miami, FL: Miami University.

EI-Assal, K. and Goucher, S. (2017). Immigration to Atlantic Canada: Toward a prosperous future.

Fang, T. (2009). Workplace responses to vacancies and skill shortages in Canada. International Journal of Manpower, 30(4), 326-348.

Global News. (2018). Labour shortages in New Brunswick a ‘major’ issue, says Chamber of Commerce.

Government of Canada. (2018). Building on success: International education strategy (2019-2024).

Government of Nova Scotia. (2019). NS Births and deaths with rates and natural increase.

Government of Nova Scotia. (2020). 2019 Marks second year of strong employment growth.

Green, D., H. Liu, Y. Ostrovsky, and G. Picot. (2016). Immigration, business ownership and employment in Canada. Analytical Studies Branch Research Paper Series, no. 375. Statistics Canada Catalogue no. 11F0019M. Ottawa: Statistics Canada.

Haan, M. (2018). International student recruitment and retention in Canada.

Halifax Immigration Partnership. (2017). Halifax economic growth plan 2016-2021.

Hanson, G. (2012). Immigration, productivity, and competitiveness in American industry. In K. Harrison, D. A., Harrison, T., and Shaffer, M. A. (2019). Strangers in strained lands: Learning from workplace experiences of immigrant employees. Journal of Management, 45(2), 600–619.

Hassett (ed.) Rethinking Competitiveness, 95-129. Washington D.C.: The AEI Press.

Hou, F., Gu, W. and Picot, G. (2018). Immigration and firm productivity: Evidence from the Canadian Employer-Employee Dynamics Database.

Immigration, Refugees and Citizenship Canada (IRCC). (2018). 2018 Annual report to Parliament on Immigration.

Immigration, Refugees and Citizenship Canada (IRCC). (2019b). Permanent Residents – Monthly IRCC Updates.

Immigration, Refugees and Citizenship Canada (IRCC). (2019c). Temporary Residents: Study Permit Holders – Monthly IRCC Update.

Immigration, Refugees and Citizenship Canada (IRCC). (2020). Temporary Residents: Study Permit Holders – Monthly IRCC Updated.

Lemieux, T., and Nadeau, J-F. (2015). Temporary Foreign Workers in Canada: A look at regions and occupational skill. Report by the Office of the Parliamentary Budget Officer (PBO).

Lu, Y. and Hou, F. (2017). Transition from Temporary Foreign Workers to Permanent Residents, 1990 to 2014.

Lu, Y. and Hou, F. (2019). Over-education among university-educated immigrants in Canada and the United States. https://www150.statcan.gc.ca/n1/daily-quotidien/191203/dq191203b-eng.htm

Manpower Group. (2018). Solving the talent shortage-Build, buy, borrow and bridge. 2018 Talent shortage Survey.

Manpower Group. (2019). Talent shortage 2020 – Closing the skills gap: what workers want.

McKinsey & Company. (2017). Jobs lost, jobs gained: What the future of work will mean for jobs, skills, and wages.

One Nova Scotia. (2019). Retention of international students.

Picot, G. and Rollin, A.M. Immigrant entrepreneurs as job creators: The case of Canadian private incorporated companies.2019.Prokopenko, E. and Hou, F. (2018). How temporary were Canada’s temporary foreign workers?

Roslyn Kunin & Associates, Inc. (2016). Economic impact of international education in Canada – 2016 Update.

Skills Canada BC. (2004), Skill Shortages in BC, Ministry of Skills Development and Labour, Government of British Columbia, Victoria.

Statistics Canada. (2016). Education Highlight Tables, 2016 Census.

Statistics Canada. (2017). Education in Canada: Key results from the 2016 Census.

Statistics Canada. (2018a). Retention rate five years after admission for immigrant tax filers admitted in 2011, by province of admission.

Statistics Canada. (2019a). Population estimates on July 1st, by age and sex.

Statistics Canada. (2019b). Estimates of the components of interprovincial migration, quarterly.

Statistics Canada. (2019b). Temporary Residents: Temporary Foreign Worker Program (TFWP) and International Mobility Program (IMP) Work Permit holders – Monthly IRCC Updates.

Statistics Canada. (2019c). Estimates of the components of international migration, by age and sex, annual.

Statistics Canada. (2019d). Unemployment rate, participation rate and employment rate by educational attainment, annual.

Statistics Canada. (2019e). GDP for Canada, Provinces and Territories, 1999 to 2018

The Chronicle Herald. (2019). Labour shortage has Atlantic Canadian employers sweetening job offers.

This Project is Funded By

Thank You to our Event Partners

This report is part of PPF’s Immigration & Atlantic Revitalization project that is examining immigrant retention and skilled labour shortages across Atlantic Canada.