Solving for Shortages in Prince Edward Island: Employer Experiences and the Labour Market Across Atlantic Provinces

Series | Atlantic Revitalization Employer ConsultationsPPF’s Immigration & Atlantic Revitalization project is examining immigrant retention and this report, in partnership with Memorial University, is looking at skilled labour shortages across Atlantic Canada.

“Employers are struggling to find the skills and the labour that they need for their operations. It affects every business from the largest business, to the smallest business.”

Penny Walsh-McGuire, CEO, Greater Charlottetown Area Chamber of Commerce

Most industrialized countries are experiencing growing worker shortages caused by low birthrates and aging populations, as well skill gaps due to new technologies that require workers with new skill sets. A global survey of nearly 40,000 employers in 43 countries and territories shows that 45 percent of employers reported having skills shortages (Manpower Group, 2019). Labour and skill shortages may have significant short and long-term negative impact on sustainable growth, productivity, innovation, and competitiveness for firms and the national economy.

The Atlantic Provinces are facing severe demographic challenges driven by several factors including the lowest birth rate in Canada, the highest average age, and significant out-migration. The provinces in the region share many features, including remote and isolated geography, historically low population growth, and dependence on natural resources. The ongoing decline in natural population, growing number of retiring baby boomers, and low immigration and retention rates compared to other parts of Canada paint a picture of a regional workforce that is likely to shrink even further without external intervention. From 2012 to 2018, Atlantic Canada’s labour force shrank by 54,400 (Statistics Canada, 2019a). As for the aging population, in 2018, those aged 65 and above comprised 20.5 percent of the Atlantic population (Statistics Canada, 2019a). This age group is forecast to increase to 30.9 percent by 2035, along with a projected five percent decline in the region’s total population (Kareem & Goucher, 2017).

There are two major types of labour and skill shortages: cyclical and structural. Cyclical labour and skill shortages, which are short-run and can be alleviated by increasing wages, recruitment campaigns, and innovative workplace practices (Skills Canada BC, 2004). However, structural labour and skill shortages can be difficult to mitigate in the short-run due to a shortage of potential workers with the required quality of skills and experiences, driven by demographic and technological changes (Fang, 2009).

Many industries and businesses in Atlantic Canada are currently facing structural labour and skills shortages due to the interplay of demographic factors and new productivity boosting technologies.

Prince Edward Island has more than doubled its immigration rate over the last decade. Approximately 16 percent of these immigrants stay longer than five years.

Demographic, economic, technological, and public policy factors have a significant effect on shortages of skilled workers. Demographic and technological factors are structural factors leading to the shortages of skilled workers, while economic and public policy factors could reinforce or mitigate skill shortages caused by structural factors. The specific effects of these factors on Prince Edward Island’s (P.E.I.) labour market are provided below.

Demographics

Demographic trends impact the skill and labour supply by changing the size and structure of the labour force.

Since 2014, P.E.I. experienced continuous population growth, and has the highest population growth among all provinces and territories at 2.19 percent in 2019. The growth comes from the province’s committed and successful immigration efforts (P.E.I. government, 2019).

Table 1. Demographic characteristics of Canada and the Atlantic Provinces (Statistics Canada, 2016a; 2018a; 2019a)

| Canada | Newfoundland & Labrador | New Brunswick | Nova Scotia | Prince Edward Island | |

| Population, 2019 | 37,589,262 | 521,542 | 776,827 | 971,395 | 156,947 |

| Age 0-14 | 16.0% | 13.7% | 14.4% | 15.6% | 15.6% |

| Age 15-64 | 66.5% | 64.9% | 64.6% | 65.2% | 64.6% |

| Age 65+ | 17.5% | 21.5% | 21.3% | 20.8% | 19.7% |

| Median age, 2019 (years) | 40.8 | 47.1 | 46.0 | 44.9 | 43.2 |

| Population change, 2018-2019 (%) | 1.34 | -0.77 | 0.77 | 1.24 | 2.19 |

| Net interprovincial migration, 2017-2018 | N/A | -2733 | 481 | 3048 | 177 |

| International migration, 2019 | 295,205 | 1,550 | 5,235 | 6,630 | 2,155 |

| Percentage of annual flow of international immigrants in the population, 2018 | 0.79% | 0.30% | 0.67% | 0.68% | 1.37% |

| Percentage of immigrants in the population, 2016 | 21.9% | 2.4% | 4.6% | 6.1% | 6.4% |

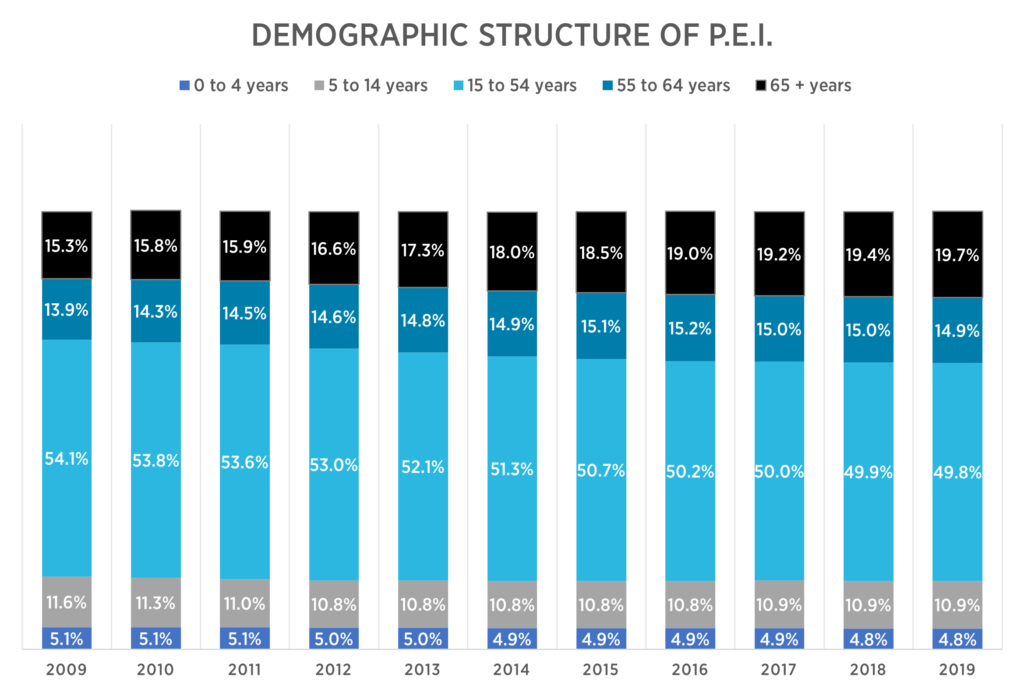

Figure 1. Demographic structure of Prince Edward Island (Statistics Canada, 2019a).

However, in 2019, deaths outnumbered births for the first time (P.E.I. government, 2019). Figure 1 helps imagine the shrinking labour force, showing far fewer people aged 5-14 years than aged 55-64. The population of 15-54 years old has been shrinking from 54.1 percent in 2009 to 49.8 percent in 2019, while the group of people age 65 years and older has been steadily climbing. These older Canadians have grown in population size from 15.3 percent in 2009 to 19.7 percent. The median age of the province is 43.2, which is 2.4 years higher than the national average in 2019 (Statistic Canada, 2019a). This makes a strong case for P.E.I. to grow its population through immigration (see Table 1).

Economic Growth

P.E.I. experienced continuous economic growth in the last decade from 0.2 percent to 4.4 percent. Economic expansion typically leads to more employment. According to a recent employer survey Memorial University conducted with the Public Policy Forum across Atlantic Provinces, 68 percent of employers in P.E.I. experienced sale growth and 65 percent experienced employment growth in the last three years. The majority of employers also expected continuous increase in sales and employment over the next three years. At the same time, the province has seen a massive housing boom, rising 319 percent in July 2019 compared to a year ago (CMHC, 2019). This growth is expected to continue into 2020, which is projected at 1456 units. Demand for housing has been outpacing supply as international migration continues to fuel population growth in the province. In addition, the resale housing market has seen a sharp decline in supply. The increased demand for new housing will push construction and transportation industries into double-digit growth through to 2020 according to the government forecast (P.E.I. Government, 2018).

Economic growth has improved P.E.I.’s labour market over the last couple of years and is forecast to keep trending that way. The provincial unemployment rate was 8.8 percent in 2019, which is the lowest it has been since 1976. There were 4,000 more jobs created in 2019, which is the largest annual growth since 1976 (Government of P.E.I., 2019). The success of labour market performance in the province will depend on availability of labour and matching of labour demand with labour supply. However, the province continues to experience an aging population constraining the labour market, especially in healthcare-related services.

Manufacturing is one of the largest private sectors in the province. Table 4 shows that manufacturing has grown from 8.12 percent in 2013 to 11.27 percent in 2018. The demand for P.E.I.’s products in the export market have been impressive. Exports to India and China continue to grow in Europe, with products related to aerospace, chemical products and food processing. Biotechnology science is an area where the province plans to expand. In 2017, bioscience exports increased 17.5 percent. In 2018 the federal government invested in P.E.I.’s biotech company, BioVectra. Biotech expansion for the province is creating an immediate demand for skilled labour and key stakeholders in the province are working quickly to meet these needs (Government of P.E.I., 2017).

Table 4: GDP and Employment by Industry (Statistics Canada, 2019)

| GDP (%) | PEOPLE EMPLOYED

(% OF TOTAL) |

|||||||||||

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |

| Retail and wholesale trade | 9.38 | 11.07 | 8.98 | 8.97 | 8.97 | 9.00 | 16.5 | 17.3 | 17.0 | 16.8 | 17.0 | 16.8 |

| Real estate and rental and leasing | 12.99 | 13.08 | 12.95 | 12.84 | 12.48 | 12.41 | 1.5 | 1.2 | 1.2 | 1.2 | 1.3 | 1.2 |

| Construction | ||||||||||||

| Public administration | 13.33 | 12.92 | 12.38 | 11.93 | 11.95 | 11.95 | 12.4 | 12.0 | 11.9 | 12.0 | 11.6 | 11.8 |

| Manufacturing | 8.12 | 8.79 | 10.19 | 11.12 | 11.09 | 11.27 | 7.7 | 7.3 | 7.7 | 7.6 | 7.8 | 7.8 |

| Health care and social assistance | 10.28 | 10.64 | 10.71 | 10.57 | 10.32 | 10.39 | 13.8 | 14.0 | 14.4 | 14.8 | 14.5 | 14.6 |

| Agriculture, forestry, fishing and hunting | 6.57 | 6.01 | 6.55 | 7.00 | 7.46 | 7.32 | 8.8 | 8.4 | 7.7 | 7.7 | 7.6 | 8.8 |

| Accommodation and food services | 2.95 | 3.02 | 2.97 | 3.07 | 3.09 | 3.10 | 8.9 | 9.1 | 9.5 | 9.3 | 9.8 | 9.1 |

| Professional scientific and technic services | 2.69 | 2.66 | 2.97 | 3.07 | 3.02 | 2.99 | 3.5 | 3.2 | 3.1 | 2.9 | 2.9 | 3.0 |

In terms of employment, the accommodation and food services sector plays a large role in P.E.I.’s labour market as it contributes roughly 9 percent of total employment. Also, the province’s agriculture sector jumped 29 percent from 2017 to 2018 further illustrating P.E.I.’s popularity in exports. The retail and wholesale trade sectors have been the province’s largest sectors for employment, while employment in health care and social assistance is increasing over time as the population continues to age.

Technology & Skills

Technology changes the nature of work and skills needed at work. About half of all work activities globally have the technical potential to be automated (McKinsey & Company, 2017). This can decrease labour force demand in some fields, while creating other jobs requiring new skills in other fields. Potential skills mismatches may persist, coexisting with a shortage of skilled workers.

According to Memorial’s Atlantic employer survey, 37 percent of employers in P.E.I. reported skill shortages in professional, technical, and trade occupations. A survey by ACOA pointed out that 2,640 opportunities are expected in technical occupations by 2020 (ACOA, 2019). The growth of biotech and aerospace in the province has also resulted in a strong outlook for biologists, chemists and various engineers (Government of Canada, 2019). In fact, 20 percent of employment gain in the last year was from professional, scientific and technical sector (Government of P.E.I., 2019).

Economic & Immigration Policies

To cope with the declining labour force and alleviate skills shortages and skills mismatch, a multi-faced strategy should be applied to increase the quantity and improve the quality of P.E.I.’s labour force. The government should focus on increasing participation rate of untapped sources of labour, including women, older workers, indigenous peoples, and persons with disabilities; re-skilling and upskilling the existing labour force; attracting Islanders who have moved away home to move back; as well as developing a new pool of skilled workers. Immigrants, temporary foreign workers, refugees, and international students are the important groups of the new pool. Policies aiming recruitment and retention of those groups of potential workers have contributed to the success of Canada’s labour market, economy and social outcomes (IRCC, 2018).

Immigration Rate & Categories

International migration accounts for most of the population growth in Canada. Its contribution to the population growth has exceeded 80 percent in 2019 (Statistics Canada, 2019c). According to Statistics Canada, population growth through immigration has been twice as much as the natural increase (Statistics Canada, 2019b).

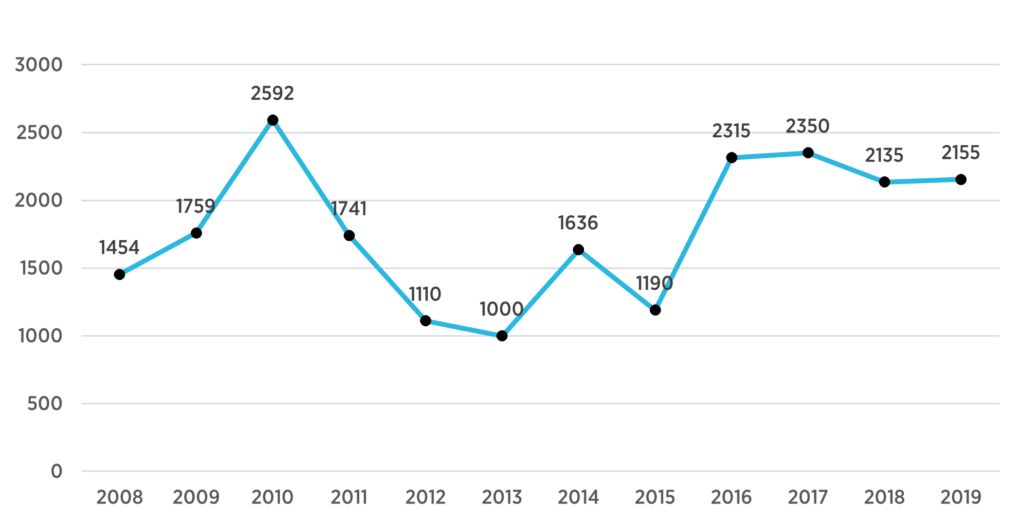

As Figure 2 shows, the number of immigrants admitted each year in P.E.I. increased gradually since 2015, with the inception of Atlantic Immigration Pilot Program (AIPP) in 2017 and termination of the immigrant entrepreneur program under the Provincial Nominee Program (PNP). This increase is the main reason for population growth in P.E.I. in recent years despite fewer babies born and more Islanders leaving.

Approximately two thirds of all immigrants in the economic class are skilled workers and business entrepreneurs admitted though the points system, which is based on several factors including education, experience, language, and age (Statistics Canada, 2019d). As a result, immigrants admitted through these classes tend to be more educated and younger than Canadian-born workers (Docquier and Marfouk, 2004; Grogger and Hanson, 2011), which means they are theoretically more productive and will have more economically active years. Immigration policies are more effective if they connect with regional labour demand, especially in remote and rural areas. This feature is part of the PNP, MNP (Municipal Nomination Program), AIPP, RNIPP (Rural and Northern Immigration Pilot Program), and AFIPP (Agri-Food Immigration Pilot program). Through these programs, more and more immigrants come to Atlantic province based on their skills and working experience specific to the region or province, meeting the demand of the local labour market.

Figure 2. Number of Immigrants Admitted in P.E.I., 2008-2019

Number of Immigrants

P.E.I. is experiencing the largest annual inflow of migrants ever. As Figure 2 shows, the number of immigrants in P.E.I. in 2018 has more than doubled since 2013 (IRCC, 2019a) as P.E.I. has shown recent success with the AIPP (Atlantic Immigration Pilot Program). In the half year of 2019 alone, the number of permanent residents admitted through the AIPP was 640, which was almost two times as high the number in 2018, 375. As successful as attracting immigrants has been for the province, P.E.I. will still need to recruit more immigrants to replace the large number of retiring boomers soon leaving the workforce in the coming years.

P.E.I. has also been struggling to retain newcomers in recent years. As showed in Figure 3, only 16 percent of immigrants stayed in Prince Edward Island five years after landing. Strikingly, the island’s retention rate is much lower than the rest of Canada and even far behind New Brunswick (48 percent) and Newfoundland and Labrador (53 percent) (Statistics Canada, 2018c). Both the public and private sector have acknowledged the challenge to retain immigrants and have made many program changes to improve overall retention rates, including eliminating the escrow deposit stream of the PNP immigrant entrepreneur stream, partnering with communities across the Island who are keen to welcome immigrants to their communities, and making major improvements to settlement services and language training (CBC News, 2019).

Figure 3. Five-year Immigrant retention rate by Province, 2011-2015 (Statistics Canada, 2018c)

International Education

International students make significant and increasing contributions to Canada’s short-term and long-term prosperity. International students brings in billions of revenue and tens of thousands of jobs. International students with high-quality human capital, combined with Canadian education experience, strong language skills, and familiarity with the local culture, they make an ideal pool for the skilled workforce (John McCallum, former Minister of Immigration). In fact Canadian international students who become permanent residents outperform their foreign-educated counterparts with similar academic programs (Hou & Lu, 2017). In addition, international students are active in acquiring working experience related to their field of study. According to the report of Council of Atlantic Ministers of Education and Training (CAMET, 2018), 14 percent of international students participate in co-op programs, which give them working experience in their field of specialization.

In Atlantic provinces, each international student spends about $34,188 annually (CAMET, 2018). There were 3,385 international students at all levels in P.E.I. in 2017 (Government of Canada, 2018). Currently in P.E.I. there are eight post-secondary institutions who can recruit international students. International students from Collège de l’Île, Holland College, Maritime Christian College, and University of Prince Edward Island can apply for a three-year open work permit after graduation, which provides them a chance to attain Canadian working experience and encourages them to stay in Canada. In Atlantic Canada, international students can apply for permanent residence through the International Graduate Stream in the AIP program. All these efforts are aimed to attract international students to come and to encourage them to stay in P.E.I. The government of P.E.I. has set a goal to retain 10 percent of international students graduating from Prince Edward Island post-secondary institutions. Memorial’s Atlantic employer survey showed that international students were active in finding part-term employment. Approximately 47 percent of employers received job applications from international students. Among those employers, 30 percent hired international students. Among international students who were hired, 62 percent worked in retail trade and accommodation sectors. Such experiences also provided international students to immerse themselves in Canadian business practice and culture, to practice English and build social and professional networks.

Temporary Foreign Workers

There are two streams for temporary foreign workers: the Temporary Foreign Workers Program (TFWP), which requires a Labour Market Impact Assessment (LMIA), and the International Mobility Program (IMP), which is exempt from an LMIA for reasons such as reciprocal agreements that promote economic, social and cultural exchange between Canada and other countries (IRCC, 2019). These two programs permit Canadian employers to hire temporary foreign workers to fill short-term skills and labour shortages on a temporary basis. These include positions that Canadian citizens and permanent residents are not able or not willing to fill, such as seasonal work (Curry, 2016), highly-skilled occupations in technology and low-skilled occupations in the service industry (Lemieux and Nadeau, 2015). In 2019, 84,145 temporary foreign workers were admitted through the TFWP and 229,320 were admitted under the IMP.

Temporary foreign workers can also transition into permanent residence through the Canadian Experience Class, Provincial Nominee Programs, and the Express entry program (Lu & House, 2017). There is an increasing share of new immigrants with Canadian working experience prior to landing since 2002. The transition rate of TFWs to permanent residents five years after receiving their first work permits increased from nine percent for those who arrived between 1995 and 1999 to 21 percent for the 2005-to-2009 arrivals (Lu & Hou, 2017).

Memorial’s employer survey shows that 58 percent of employers in P.E.I. reported difficulties in filling the job vacancies in the past three years, and the major reasons for hiring difficulty were “too few applicants” and “applicants without necessary skills and experiences”. Even more employers (74 percent) believed that the province will face more severe shortage of skilled labour in the next three years. This shortage in workforce pushes employers to turn to foreign workers. Temporary foreign workers are an important solution to alleviate the labour and skill shortage in Prince Edward Island at least in the short-run, as some businesses are in a “very competitive” fight for employees (CBC, 2019). In 2019, 950 and 1760 work permits were issued under TFWP and IMP respectively in P.E.I., which accounts for 3.12 percent of the workforce. These inflows mitigated serious labour and skill shortages to some extent, particularly in highly demanding sectors, such as health care, agriculture, accommodation, construction and high-tech sectors.

Major stakeholders in P.E.I., including government agencies, businesses, and academic institutions have raised concerns about labour and skills shortages in the province. Employers play a crucial role as they create jobs and hire workers and develop innovative workplace practices to mitigate labour and skill shortages. Their experiences and opinions are extremely valuable to identify areas of shortages by industry and occupation and potential solutions to alleviate such shortages in P.E.I.

In December 2019, in collaboration with Professor Tony Fang and his research team, PPF organized a consultation session in Charlottetown in P.E.I. with about 50 employers from different sectors across the province to discuss topics such as:

- The kind of skills shortages that employers are facing;

- Challenges that employers are experiencing in hiring skilled workers including newcomers;

- Examples of successful policies or practices that can help overcome these challenges; and

- Suggestions to overcome these skills shortages and improve hiring and retention of skilled workers including newcomers.

Through the discussion, the consultation was intended to:

- Identify sectors that experience labour and skills shortages;

- Examine factors influencing employers’ decisions to hire skilled workers including immigrants, refugees, international students, and temporary foreign workers;

- Identify factors that enhance, and those that negatively impact, employers’ decisions to hire skilled workers and newcomers;

- Identify practices from the government and other stakeholders that can help employers’ recruitment of skilled workers and newcomers; and

- Identify measures to increase the retention rate of skilled workers in the province.

Main findings:

Employers expressed experiencing very similar skill or labour shortages. The industries facing shortages of hard skills are IT, construction, trucking and transportation, hospitality, fishing, plants and farming, and education. Employers also suggested these shortages are creating spillover effects. For example, the construction industry needs more carpenters and heavy equipment operators but there is a local shortage of these skills and a shortage of accommodation to attract these skills. The housing shortage in the island is inflating the price of homes which is creating affordability issues. Employers are losing out on potential candidates when they have nowhere to house them. There was a discussion on the lack of soft skills among recent immigrants. Specifically, immigrants needed help developing Canadian soft skills and norms. Employers also agreed that everyone, both employers and employees in public and private sectors, need diversity training to improve intercultural awareness, skills and communication.

Employers have attempted to address these shortages by regularly reviewing their compensation packages and offering better wages and benefits. They agreed that monetary compensation is not enough, and they are creating more accommodating and culturally sensitive workplace practices. Some employers are inviting newcomers to community events and are prioritizing the value they place on diverse cultures in the workplace. Local programs such as the Newcomers in Trades and Newcomers Restaurant training program have been particularly helpful. CGI Group Inc., the world’s fifth largest IT and business-process services company, also provides good solutions on workplace diversity support.

The list of challenges employers face with attracting and retaining employees is considerable. Similar to other Atlantic provinces, many small businesses in P.E.I. lack HR capacity, which limits their ability to recruit immigrant. Small businesses also reported they need help overcoming first time hiring challenges. A challenge that is common to all employers is the high costs of LMIAs. Several employers acknowledged the lack of spousal support that is hurting retention rates.

Even though Prince Edward Island attracts a disproportionally large number of immigrants relative to its small population, the province is facing extensive shortage of labour and skilled workers with specific hard or soft skills. Employers have also had trouble retaining workers because of lack of housing, transportation, community-based support including spousal and family support. The skill shortages are more prevalent in sectors like IT, construction, health care, hospitality, fish plants and farming. These shortages are forcing some businesses to operate only seasonally or at lower production capacity. In rural parts of the province, there is lack of public transportation and internet access for newcomers, which prevents them from staying in the rural area. The island is experiencing many problems that other Atlantic Provinces are facing, such as a lack of public awareness about immigration, and the limited ability for small businesses to recruit. Employers are willing to hire immigrants and international students because they have the specific skill sets for the jobs and strong work ethic. However, complicated qualification certification systems, lengthy and costly immigration processes, especially LMIAs, and concerns for low retention rates and culture differences hinder employers efforts to hire and retain immigrants. As P.E.I.’s economy is poised for continuous growth, it is a pivotal time to resolve these issues for long-term prosperity.

The employers and sector representatives consulted in Charlottetown voiced the following key recommendations.

Develop and improve immigration policies that meet the needs of local employers, including the PNP, MNP (Municipal Nomination Program), AIPP, RNIPP (Rural and Northern Immigration Pilot Program), AFIPP (Agri-Food Immigration Pilot program).

The government, employers, and developers need to work together to solve housing shortages in P.E.I. Towns such as Tofino, BC that have very recently experienced and successfully dealt with the same issues provide good examples to turn to. Initiatives such as pocket neighborhoods, increased employee accommodation, and affordable public housing could mitigate housing shortages in the province.

Increase community-based support to newcomers including spousal and family support. Provide a focused pilot on improving spousal support and family support such as affordable childcare, health care, child education, and so on to support settlement where skills are needed.

Develop accessible transportation and infrastructure to support immigrant retention in rural communities. Local government and employers should work together to develop infrastructure such as internet access and networks.

Work with third party credential agencies to accelerate the improvement of foreign credential assessment.

Settlement agencies need to work with employers and training institutions to develop and improve job-specific language training and bridge programs to newcomers to align with the skill needs of the local labour market. Promote vocational training programs to immigrants such as the Newcomers in Trades and Newcomer Restaurant Training program.

Provide culture sensitivity and diversity training to both employers and employees in both public and private sectors to better mutual understanding and reduce cultural conflicts and labour market discrimination.

Establish P.E.I. as a welcome community. Use all kinds of channels, especial social networks and social media to demonstrate immigrants’ contributions to P.E.I. and build awareness around how to address immigrants’ real challenges in working and living in P.E.I.. Engage newcomers in community events to enhance their sense of belonging.

Atlantic Canada Opportunities Agency (ACOA). (2019). An Exploration of Skills and Labour Shortages in Atlantic Canada.

Canadian Bureau for International Education. (2018). International Students in Canada, 2018.

Canada Mortgage and Housing Corporation (CMHC). (2019). Canada Mortgage and Housing Corporation, housing starts, under construction and completions, all areas, quarterly.

CBC News. (2019). Shortage of workers on P.E.I. has some businesses in ‘very competitive’ fight for employees.

Council of Atlantic Ministers of Education and Training. (2019). Economic Impact of International Students.

Fang, T. (2009). Workplace responses to vacancies and skill shortages in Canada. International Journal of Manpower, 30(4), 326-348.

Government of Canada. (2018). Building on Success: International Education Strategy (2019-2024).

Government of Canada. (2019). Job outlook report.

Government of P.E.I.. (2017). PEI economic update 2017.

Government of P.E.I.. (2018a). Recruit, retain, and repatriate – A population action plan for Prince Edward Island.

Government of P.E.I.. (2018b). Economic Highlights 2018.

Government of P.E.I., Department of Finance. (2019). Prince Edward Island Population Report 2019.

Green, D., et al. (2016). Immigration, Business Ownership and Employment in Canada. Analytical Studies Branch Research Paper Series, no. 375. Statistics Canada Catalogue no. 11F0019M. Ottawa: Statistics Canada.

Haan, M. (2018). International Student Recruitment and Retention in Canada.

Hanson, G. (2012). “Immigration, productivity, and competitiveness in American industry.” In K. Hassett (ed.) Rethinking Competitiveness, 95-129. Washington D.C.: The AEI Press.

Harrison, D. A., Harrison, T., & Shaffer, M. A. (2019). Strangers in Strained Lands: Learning from Workplace Experiences of Immigrant Employees. Journal of Management, 45(2), 600–619.

Hou, F., and Lu, Y. (2017). International Students, Immigration and Earnings Growth: The Effect of a Pre-immigration Canadian University Education.

Hou, F., Gu, W. and Picot, G. (2018). Immigration and Firm Productivity: Evidence from the Canadian Employer-Employee Dynamics Database.

IRCC. (2017). Facts and Figures 2016: Immigration Overview – Permanent Residents – Annual IRCC Updates.

IRCC. (2018). 2018 Annual Report to Parliament on Immigration.

IRCC. (2019a). Permanent Residents – Monthly IRCC Updates.

IRCC. (2019b). Temporary Residents: Study Permit Holders – Monthly IRCC Update.

Lu, Y. and Hou, F. (2017). Transition from Temporary Foreign Workers to Permanent Residents, 1990 to 2014.

Manpower Group (2018). Solving the Talent Shortage-Build, Buy, Borrow and Bridge. 2018 Talent shortage Survey.

McKinsey & Company (2017). Jobs lost, jobs gained: What the future of work will mean for jobs, skills, and wages.

Roslyn Kunin & Associates. (2017). Economic Impact of Education in Canada.

Skills Canada BC. (2004). Skill Shortages in BC, Ministry of Skills Development and Labour, Government of British Columbia, Victoria.

Statistics Canada. (2019a). Estimates of the components of demographic growth, annual.

Statistics Canada. (2019). GDP and Employment by Industry.

Statistics Canada. (2019b). Temporary Residents: Temporary Foreign Worker Program (TFWP) and International Mobility Program (IMP) Work Permit holders – Monthly IRCC Updates.

Statistics Canada. (2019c). Canada’s population estimates, first quarter 2019.

This Project is Funded By

Thank You to Our Event Partners