Solving for shortages in New Brunswick: Employer Experiences and the Labour Market Across Atlantic Provinces

Series | Atlantic Revitalization Employer ConsultationsIntroduction

Most industrialized countries are experiencing labour shortages and skill gaps due to low birthrates, aging populations, and advanced technologies that require workers with new skill sets. A global survey of nearly 40,000 employers in 43 countries and territories found 45 percent of employers reported having skills shortages (Manpower Group, 2019). Labour and skill shortages have significant negative impact on sustainable growth, productivity, innovation, and competitiveness of the local economy, in both the shorter term and the longer run.

The Atlantic Provinces are facing even more severe demographic challenges with labour and skill shortages. The region shares many common features, including remote and isolated geography, small and declining population growth, and the economy that heavily depends on natural resources. Current trends show a decline in natural population with more deaths than births being recorded, with the growing number of retiring baby boomers, and low immigration and retention rates, compared to the other parts of Canada the workforce in Atlantic Canada is likely to shrink even further in the future without external intervention. From 2012 to 2018 the labour force shrank by 54,400 (Statistics Canada, 2019a). Additionally, the proportion of aging population is higher in Atlantic Canada compared to the rest of the country. In 2018, those aged 65 and above comprised 20.5 percent of Atlantic Canadians (Statistics Canada, 2019a). This age group is forecasted to increase to 30.9 percent by 2035, along with a projected 5 percent overall decline in the total population in the region (Kareem & Goucher, 2017).

There are two major types of labour and skill shortages in the market: cyclical and structural. Cyclical labour and skill shortages are short-run and can be alleviated by increasing wages, recruitment campaigns, and innovative workplace practices (Skills Canada BC, 2004). However, structural labour and skill shortages can be difficult to mitigate in the short run due to a shortage of potential workers with the required quality of skills and experiences, driven by demographic and technological changes (Fang, 2009). The structural labour and skill shortages has been identified as one of the key challenges to the New Brunswick economy (Government of NB, 2019a).

Many industries and businesses in Atlantic Canada are currently experiencing structural labour and skills shortages due to the interplay of demographic factors and new productivity boosting technologies.

Immigrants are fundamentally heterogeneous in terms of their abilities and skills as a result of their different education and cultural backgrounds, and working experiences, which can be considered important sources of innovation and productivity growth.

Demographic, economic, technological, and public policy factors all have a significant effect on shortages of skilled workers. Demographic and technological factors are structural factors leading to the shortages of skilled workers, while economic and public policy factors could reinforce or mitigate skill shortages caused by structural factors. Specific effects on each of these factors on New Brunswick’s (NB) labour market are provided below.

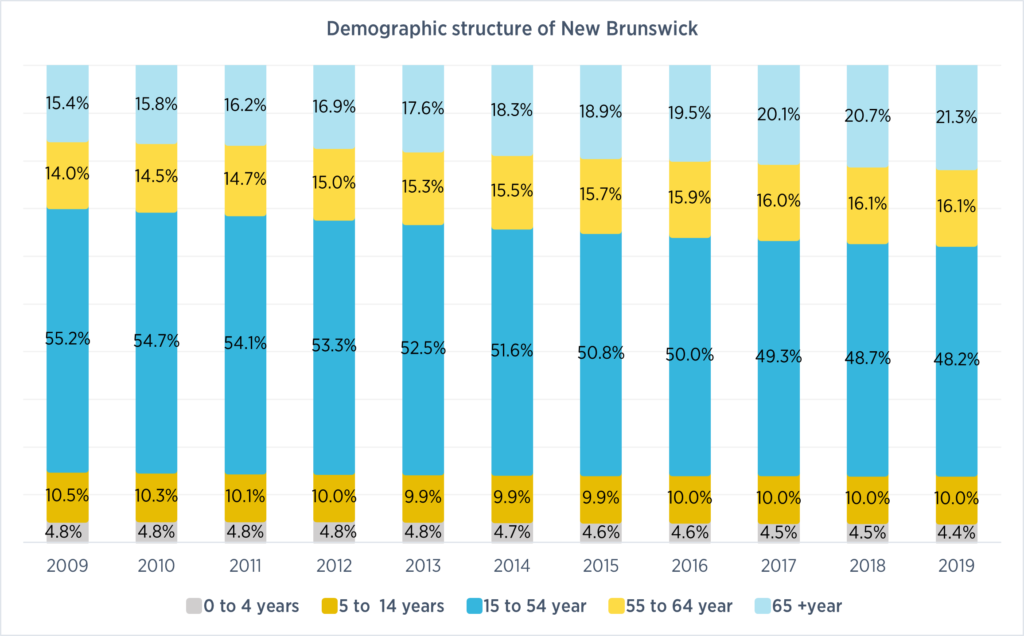

Demographic trends have impact on skill and labour supply by changing the size and structure of the labour force. Low population growth and an aging population are the main characteristics of the demographics of New Brunswick. While population growth in Canada is 9.3 percent in the last decade (2009-2018), New Brunswick recorded only 2.8 percent of population growth during the same period, which has accelerated the aging population (Statistics Canada, 2019). The province also had a significantly higher median age (45.9 vs. 40.8) and a higher proportion of residents who were 65 and older than the Canadian average (20.7 percent vs. 17.1 percent, Table 1).

Table 1. Demographic characteristics of Canada and the Atlantic Provinces (Statistics Canada, 2016a; 2018a; 2019a)

| Canada | Newfoundland & Labrador | New Brunswick | Nova Scotia | Prince Edward Island | |

| Population, 2019 | 37,589,262 | 521,542 | 776,827 | 971,395 | 156,947 |

| Age 0-14 | 16.0% | 13.7% | 14.4% | 15.6% | 15.6% |

| Age 15-64 | 66.5% | 64.9% | 64.6% | 65.2% | 64.6% |

| Age 65+ | 17.5% | 21.5% | 21.3% | 20.8% | 19.7% |

| Median age (2019) (years) | 40.8 | 47.1 | 46.0 | 44.9 | 43.2 |

| Population change, 2018-2019 (percent) | 1.34 | -0.77 | 0.77 | 1.24 | 2.19 |

| Net interprovincial migration (2017-2018) | N/A | -2733 | 481 | 3048 | 177 |

| International migration, 2019 | 295,205 | 1,550 | 5,235 | 6,630 | 2,155 |

| Percentage of annual international immigrants in the population in 2018 | 0.79% | 0.30% | 0.67% | 0.68% | 1.37% |

| Percentage of immigrants in the population (2016) | 21.9% | 2.4% | 4.6% | 6.1% | 6.4% |

The reasons for the low population growth in New Brunswick are a lower birth rate, high death rates, low net interprovincial migration, and lower international migration rate than national average (Table 1 & 2). The bright side is that the number of international immigrants has increased dramatically since 2014, from 2,797 to 4,610 in 2018, and net interprovincial migration turned from negative to positive.

Table 2. Estimates of the components of demographic, growth, annual of New Brunswick (Statistics Canada 2019a)

| Components of population growth | 2014 / 2015 | 2015 / 2016 | 2016 / 2017 | 2017 / 2018 | |

| Births | 6,693 | 6,647 | 6,593 | 6,550 | |

| Deaths | 7,349 | 6,954 | 7,393 | 7,609 | |

| International Immigrants | 2,797 | 4,458 | 3,448 | 4,610 | |

| Net interprovincial migration | -2,790 | -1,113 | 434 | 481 | |

Changes in demographic structure also effects the labour market. As Table 1 shows, New Brunswick had a median age of 46 in 2019 and 21.3 percent of people aged 65+ in Canada. These are the second highest in the country only behind Newfoundland and Labrador. Over the next ten years, approximately 123,955 New Brunswickers will permanently leave the work force mainly due to retirement, while only 77,082 enter the work force (Calhoun, 2018). Without outside population inflow or external intervention. The labour force is shrinking by 46,873 by 2028, which represents approximately 9.4 percent of the total labour force. If we take a gradually decreasing participation rate since 2009 into account, which declined from 64.6 percent in 2009 (the highest in the recent 20 years) to 61.5 percent in 2017. The labour and skill shortages will only be more serious over time.

Economic expansion usually leads to more employment. From the macroeconomic point of view, the New Brunswick economy has experienced continuous growth over the past five years and is expected to grow at an average annual growth rate of 0.9 percent within the next ten years (Government of NB, 2019a). The level of employment has also steadily increased while the unemployment rate has declined (Table 3). From the micro business point of view, employers are positive to their own sales and employment growth in the past three years and are even more optimistic in the next three years, according to a survey of employers conducted by PPFacross the Atlantic provinces[2]. More than half the employers in New Brunswick experienced sales and employment growth in the last three years, and expect it to increase even more in the next three years. However, Table 3 also shows, the labour force gradually shrinks, combined with declining participation rate, which contributes to even more severe labour and skill shortages in the years to come.

Table 3. Selected Economic Indicators, New Brunswick (Statistic Canada)

| Indicator | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

| GDP percent change, real | 0.27% | -1.06% | -0.27% | 0.12% | 0.65% | 0.81% | 2.14% | 0.84% |

| Labour Force (in thousands) | 520.5 | 518.0 | 513.8 | 509.2 | 504.9 | 503.2 | 501.2 | 499.7 |

| percent change, real | -1.94 | -0.48 | -0.81 | -0.90 | -0.84 | -0.34 | -0.40 | -0.30 |

| Employment (in thousands) | 317.8 | 313.0 | 308.8 | 301.9 | 302.7 | 306.0 | 310.3 | 316.3 |

| percent change, real | -1.4 | -1.5 | -1.3 | -2.2 | 0.3 | 1.1 | 1.4 | 1.9 |

| Unemployment Rate (percent) |

9.5 | 10.2 | 10.3 | 9.9 | 9.8 | 9.5 | 8.1 | 8.0 |

| Participation Rate (percent) |

63.3 | 63.2 | 63.5 | 63.2 | 62.7 | 62.3 | 61.5 | 61.3 |

Tourism related industries, such as trade, accommodation and food services, health care and social assistance, public administration, education services, manufacturing and construction are traditional pillar industries in terms of GDP or employment in New Brunswick. According to the economic growth plan of New Brunswick, information and communication services especially in the areas of network security, and professional, science and technical services, as well as business services will be the key sectors for future economic development (Government of NB, 2019b), which implies potential employment demand in those sectors. However, skill shortages and skill bottlenecks present a major constraint to the growth of information and communication services sectors in New Brunswick.

Technology changes the nature of work and skills needed at work. About half of all work activities globally can potentially be automated by adopting advanced technologies (McKinsey & Company, 2017). This can lead to less labour demand in some fields, which requires many to switch jobs to other occupations. At the same time, new jobs are being created in response to technological changes, creating skill shortages and mismatches. An employer survey by the World Economic Forum shows that at least half of all employees are required to undergo significant re-skilling or up-skilling in order to cope with the rapid change of technology (World Economic Forum, 2018).

As technology progress, the demand for high-skilled workers would increase, while the demand for low-skilled workers would diminish. According to The Atlantic Canada Opportunities Agency (ACOA, 2019), the demand for workers with higher skilled set will increase significantly in New Brunswick with 9,615 opportunities in technical occupations to be created. Education and training play continuous roles in providing skilled workforce. There will be approximately 120,000 job openings from 2018 to 2027 in New Brunswick, with 27.2 percent of jobs falling in management and professional occupations, which usually require a university education or significant work experience; and another 32 percent of jobs that normally require college education or apprenticeship training (Government of New Brunswick, 2019c).

In order to cope with the aging population, and alleviate skills shortages, multi-faceted population, and immigration a strategy will be implemented in NB. Such strategy has included a number of important policy initiatives, including increasing the labour force participation rate in underrepresented areas (eg: women, older workers, indigenous peoples, persons with disabilities), re-skilling/upskilling the existing labour force, bringing New Brunswickers who have moved away back home, ands developing a new pool of skilled workers. Immigrants, temporary foreign workers, refugees and international students are important components of the new pool. Policies relevant to those are expected to contribute to the success of Canadian and regional labour market, economy and long-term prosperity (IRCC, 2018).

Immigration Rate & Categories

International migration accounts for most the population growth in Canada, over 80 percent in 2019 (Statistics Canada, 2019c). According to Statistics Canada, population growth through immigration has been twice as important as the natural increase (Statistics Canada, 2019b). There are three main categories for permanent immigrants in Canada:

- economic class, mainly skilled workers and business migrants

- family class including spouses, partners, and close family members

- and refugees, (Statistics Canada, 2019d).

Economic class accounting for roughly 66 percent of immigrants, family class accounts for 25 percent, and refugees account for about 8 percent (Statistics Canada, 2019d).

As part of the Government of Canada’s selection criteria, most newcomers to Canada are economic immigrants chosen by “point system” using a number of factors, including age, education, official language proficiency, and labour market experience. As a result, they tend to be more educated and skilled (Docquier and Marfouk, 2004; Grogger and Hanson, 2011), and younger (Statistics Canada, 2019a), than Canadian-born workers, which means they are more productive if properly matched with jobs and in economically active years. In addition in an open economy, immigrants may facilitate international trade due to their rich knowledge of the language, the markets and products of their home countries (Dunlevy, JA, 2004; 2019).

The most important contributions of immigrants to the host country are those towards innovation and entrepreneurship. Immigrants are fundamentally heterogeneous in terms of their abilities, skills, and working experiences as a result of their different education and cultural backgrounds, which can be considered important sources of innovation (Hanson 2012; Ozgen et al., 2013) and productivity growth (Hou et al., 2018; Harrison, Harrison· & Shaffer, 2019). Due to their high-risk appetite, and lack of employment opportunities that provide decent income, immigrants are also more likely to start their own business, which can create more jobs for the local community. In Canada, between 2003 and 2013, the average annual net job growth per firm was higher among immigrant-owned firms than among firms with Canadian-born owners, as was the likelihood of being a high-growth firm (Picot et al. 2019).

Significantly expanding the number of newcomers to New Brunswick is one of the five key policies to support the economic growth in New Brunswick. The provincial government has made a population growth strategy that focuses on attracting and retaining more international immigrants to New Brunswick (Government of NB, 2019c). As shown in Table 4, the number of immigrants to New Brunswick in 2018 nearly tripled from 2007 (IRCC, 2019a) and New Brunswick experienced nearly the largest net annual inflow of international migrants since 1975, thanks to the introduction of the Atlantic Immigration Pilot Program (AIPP) in 2017. However, Table 1 shows that the number of new immigrants in 2018 only represents 0.6 percent of the population of New Brunswick, which is less than the national average (0.9 percent). There should be 2,069 more immigrants accepted if the national annual immigrant rate is adopted. The Government of New Brunswick has set an even higher target to attracting immigrants, which is to welcome up to 7,500 newcomers annually by 2024 (Government of New Brunswick, 2019c). This implies that more effort is needed to attract international immigrants.

Table 4. Permanent Residents Admitted to New Brunswick Annually (IRCC, 2019b)

| Year | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019

(Q1-Q3) |

| Total Immigrants Welcomed | 1643 | 1856 | 1913 | 2125 | 1971 | 2216 | 2020 | 2837 | 2580 | 4675 | 3650 | 4610 | 4710 |

| Immigrants under AIP Program | – | – | – | – | – | – | – | – | – | – | 484 | 1108 | 613 |

As Figure 1 shows, New Brunswick will need to see bigger waves of immigration to make up for the retiring boomers leaving the workforce. At the same time, only 4.6 percent of the total population belongs to immigrants in New Brunswick, while it is 21.9 percent for Canada as a whole (Statistic Canada, 2016a). Not only does New Brunswick attract relatively fewer immigrants, but also it struggles to retain newcomers. As shown in Figure 2, just under half of immigrants stayed in New Brunswick five years after admission, slightly lower than Newfoundland and Labrador, but higher than that in Prince Edward Island (Statistics Canada, 2018c). The New Brunswick government has made action plans to enhance immigrant retention rate to the national average rate, 85 percent, by 2024.

International Education

International students make up a large and growing contribution to Canada’s short-term and long-term prosperity. International students mean billions of dollars in revenue and tens of thousands of jobs.

Figure 1. Demographic structure for New Brunswick (Statistics Canada, 2019a)

Table 1. Demographic characteristics of Canada and the Atlantic Provinces (Statistics Canada, 2016a; 2018a; 2019a)

In fact, international students created more than $21.6 million of revenues in 2018 and 170,000 jobs in 2016 (Roslyn Kunin & Associates, 2016). International students also promote global ties between Canada and other countries and facilitate international trade. International students represent highly qualified human capital to Canadian workforce. The Canadian government has provided relatively seamless immigration services to international students as a part of international education strategy (Government of Canada, 2018).

Lacking Canadian work experiences and credentials, and lower language proficiency are the main barriers for immigrant’s integration into the Canadian labour force. International students with Canadian education credentials, strong language skills, and some of them work while studying, so they are ideal candidates as labour market participants. According to the report of the Council of Atlantic Ministers of Education and Training (CAMET) (2018), 14 percent of international students participated in co-op programs. In addition, the employer survey conducted by our team last Fall also showed international students were actively looking for jobs in Atlantic Canada. About 32.7 percent of interviewed employers received job applications from international students. At the same time, international education could increase the local consumption and investment, thus create jobs. Currently, 25 post-secondary institutions may recruit international students in New Brunswick; and international students from 13 institutions of the 25 may apply an open work permit after graduation. By the end 2018, there were 6680 study permit holders at all educational levels in New Brunswick (IRCC, 2019b). Each student spends about $34,188 annually and created more than 1,291 fulltime equivalent positions (CAMET, 2018). Though the five-year retention rate of international students rose from 12 percent to 18 percent in New Brunswick between 2004 and 2015 (Hann, 2018), it is much lower compared to the figures in Ontario and Quebec.

In order to retain international students in Canada, an up to three year open work permit can be issued to most of international students after graduation from creditable post-second programs to encourage them stay and work in Canada, which provide them a chance to attain Canadian working experience. In Atlantic Canada, most international students could apply for permeant residence through the International Graduate Stream of the AIP program. All these programs and initiatives can improve international student retention in New Brunswick.

Temporary Foreign Workers

There are two programs for Temporary Foreign Workers admitted to Canada: the Temporary Foreign Worker Program (TFWP) and International Mobility Program (IMP). These two programs permit Canadian employers to hire temporary foreign workers to fill immediate skill and labour shortages on a temporary basis. These include positions that Canadian citizens and permanent residents are not able or not willing to fill, such as seasonal work (Curry, 2016), highly-skilled occupations in technology, and low-skilled occupations in the service industry (Lemieux and Nadeau, 2015).

In 2017 78,788 temporary foreign workers were admitted, which includes caregivers, agricultural workers and other workers who require a Labour Market Impact Assessment (LMIA). In addition, 224,033 work permits were issued under IMP, which are exempt from an LMIA for reasons such as reciprocal agreements that promote economic, social and cultural exchange between Canada and other countries (IRCC, 2018). Temporary foreign workers can also transition into permanent residence through Canadian Experience Class, Provincial Nominee Program and the Express Entry Program (Lu & House, 2017). The transition rate of TFWs to permanent residents increased from 9 percent for the TFWs who arrived between 1995 and 1999 to 21 percent for arrivals between 2005 and 2009(Lu & Hou, 2017).

Temporary foreign workers under TFWP and IMP are important to New Brunswick. The survey by our team found 58.5 percent of employers surveyed who reported the difficulties in filling the job vacancies in the past three years gave as the major reasons for such hiring difficulties too few applicants and lack necessary skills. Even more employers (61.5 percent) thought the province would face a shortage of skilled labour in the next three years. The shortage in skilled workers force employers to turn to foreign workers for help (CBC News, 2019).

Various organizations including government agencies, businesses, and academic institutions have raised concerns about labour and skills shortages in New Brunswick. Employers have a crucial role, and the experiences and opinions of the employers provide important evidence to identify areas of labour and skill shortages and formulate solutions to address such challenges across New Brunswick.

In November 2019, PPF organized consultations with employers in Dieppe and Fredericton (in French and English respectively) to engage employers from different sectors across New Brunswick and discuss topics including the following:

- The kind of skills shortages that employers face;

- The challenges that employers experience in hiring skilled workers including newcomers;

- Examples of successful policies or practices that can help overcome these challenges; and

- Suggestions to overcome these skills shortages to improve hiring and retention of skilled workers including newcomers.

Through the discussion, the consultation was intended to:

- Identify sectors that experience labour and skills shortages;

- Examine factors influencing employers’ decisions to hire skilled workers including immigrants, refugees, international students, and temporary foreign workers;

- Identify factors that enhance, and those that negatively impact, employers’ decisions to hire skilled workers and newcomers;

- Identify practices from the government and other stakeholders that can help employers’ recruitment of skilled workers and newcomers; and

- Identify measures to increase the retention rate of skilled workers in the province

Table 5: Summary of NB employer experiences with skills and labour shortages (English and French consultations, October 2019)

| Sector | Skill shortages | Challenges |

| Engineering and energy | Specific skill sets | Difficulty comparing unfamiliar credentials and educational qualifications

Mismatches of qualifications between applicants and employer needs |

| Education, government and service | Matched experience

Need for certifications for the police department Bilingual services positions (French and English) Inadequate people with skills in administration, hospitality and mechanics Lack of healthcare professionals |

Slow career development path and unionization makes change slow; workers may find it faster to advance career by seeking jobs in other sectors.

Prevalence of temporary positions, which are less desirable to new workers Hard to maintain regular work-life balance in some positions. |

| Business | Bilingual services positions (French and English)

Skilled workers with necessary experience Understanding of Multi-culture |

Hard to retain skilled workers |

| IT | Specific IT hard skills and soft skills in customer-centric positions

Developers, programmers, and cyber security specialists. Bilingual workers (English-French) |

Too few qualified people in local labour market and among new applicants, especially for positions requiring more experience. |

| Nursing Home/Senior Care | Skilled individuals in registered nurses (RNs), licensed practical nurses (LPNs), resident assistants (RAs), etc.

French – speaking staff |

Lack of qualified people

Very complicated process to get foreign credentials recognized Lack of people willing to work in rural communities Lack of human resources and management capacity |

| Fisheries | There are no skill shortages in this sector because jobs in this sector are low skilled or semi-skilled | Too few people who are willing to work in this sector, so this sector relies heavily on TFWs

Little support from the government Hard to retain even heavily invested in human capital of TFWs and in infrastructure to keep them Compete workers with other industries |

| Others | Specific skill sets in their Industries | Hard to retain because of uncompetitive salary, transportation barrier, seasonal work.

Applicants with unmatched skills High cost to use certain immigration streams and long processing time Employers know little about immigration policy, process, the reality of immigrants’ life Immigration policy and social work focuses on short-term interests. Immigrants get less attention and respect |

After discussing their experiences with skills and labour shortages in their respective sectors, the employers consulted offered a number of potential solutions. New Brunswick employers thought it would be helpful if employers collaborated more, such as partnering with associations, settlement agencies and other civic actors to help find and support immigrant workers. For instance, employers recommended community partnerships to provide diversity training to both employers, employees and immigrants to bridge cross-cultural and communication challenges to integration and hiring. Employers supported the idea of initiatives that take a holistic approach and support newcomers’ daily life, such as daycare, education and spousal employment. Overall, they recommended employers and communities be conscientious to value and recognize newcomer’s contributions to workplaces, businesses and communities.

New Brunswick employers supported policies that involved= easier access to all the services and information that both immigrants and employers need and that bridge programs across civic providers and businesses. Employers also generally supported policies to support spousal employment, policies targeted at small businesses to help attract and train immigrants, and pre-arrival and follow-up activities built into programs. Employers also made unanimous calls to reduce the complexity of the immigration process and to accurately portray expected settlement and integration challenges to newcomers.

Employers also identified a number of things that may be supported to help immigrants and international students secure jobs matching their skills, including volunteering and bridging experiences, application mentoring and resume writing supports, facilitation in meeting other community members or attending events, and learning the local culture.

Employers recommend increasing public awareness of immigrant workers and international students’ contributions, and integrated settlement, and employment services as complimentary aids to their efforts to attract and retain workers.

New Brunswick is facing ageing population and ageing workforce. The province used to welcome fewer international migrants because of the remote location and fewer job opportunities due to small economy size. New Brunswick is also losing people through interprovincial outmigration. However, existing business expansion created more jobs, and the growth of the economy demands for more skilled workers. Organizations in New Brunswick are facing severe labour and skill shortages, which pushes employers into automating jobs or even shrinking their business, especially in information technology, health care, hospitality, and bilingual customer services. While attracting people back and keeping the young people in New Brunswick, how to attract and attain skilled workers and immigrants is crucial to solve the shortages.

Employers are willing to hire international immigrants because they have the specific skill sets for the jobs and good work ethic. However, complicated credential recognition and skills certification system, long and costly immigration process, concerns about culture differentiation and that those immigrants will leave soon all hinder employers in hiring and retain immigrants.

By conducting consultations with employers and sector representatives in Fredericton and Shediac, the following key recommendations were made:

Employer Recommendations:

- Develop a long-term strategic planning in addressing the challenge of labour and skill shortages that New Brunswick is facing. In this planning process, each stakeholder, including all levels of government, employers, professional societies and associations, settlement agencies, educational institutions and NGOs, will be given different roles according to their capability and resources.

- Build up a one-stop service platform to provide clear and sufficient information about labour market, immigration policies and social services. This platform needs to engage all stakeholders who support newcomers to integrate the New Brunswick’s social and economic fabrics. A certain number of staff members are needed to maintain operation of the service platform.

- Enhance pre-arrival services and conduct fellow-up check services. More effort should be made to help newcomers better understand the accurate picture of working and living in New Brunswick before they arrive. Settlement agencies also need to be equipped to provide continuous follow-up check and services within two years of arrival in New Brunswick.

- Develop an integrated language-training program. In order to avoid overlapping and duplication, and provide systematic language training, the government needs to maintain the training contents and standards and ensure training efficiency. The training system will be divided into several sub-systems to target specific needs for newcomers with different backgrounds, such as age, time, content, occupation, etc. The system should also be provided with different training modes, on-line or on site.

- Improve employment-oriented services. Comprehensive employment services should be provided, including resume-writing workshops, interview training, employment information, career consulting, credential recognition and skill certification, skill-upgrading programs, networking activities, and bridging program.

- Building a welcome community. Use all kinds of channels, especial social media to promote immigrants’ contribution to New Brunswick and help understand immigrants’ challenges in working and living in New Brunswick. Conduct culture sensitivity education among the public in order to reduce possible culture conflict. Engage newcomers in community events such as communal events, food festivals, family days, food, etc.

New Brunswick is experiencing serious labour and skill shortages at every skill level and in almost every business sector. This in turn has negative impact on business performance, economic growth, and long-term prosperity of the province. The public needs to be aware of the potential contributions of the immigrants, temporary foreign workers, refugees and international students. To better attract and retain them, an integrated service system needs to be established. Concerted effort is also required from all major stakeholders, including government, employers, training institutions, and settlement agencies, to ensure successful recruitment, integration, and retention of skilled workers including newcomers and international students to New Brunswick.

References

Atlantic Canada Opportunities Agency (ACOA). (2019). An exploration of skills and labour shortages in Atlantic Canada.

Canadian Bureau for International Education. (2018). International Students in Canada, 2018.

Calhoun, J. (2018). Implications of New Brunswick’s Labour Market Trends and Forecasts.

CIC News. (2019). Employers in Moncton, New Brunswick, turning to foreign workers to fill labour needs.

Curry, B. (2016). Ottawa allows seasonal exceptions to Temporary Foreign Worker rules. Globe and Mail.

Conference Board of Canada. (2019). Provincial outlook economic forecast: New Brunswick.

Council of Atlantic Ministers of Education and Training. (2019). Economic impact of international students.

Docquier, F., and Marfouk, A. (2004). Measuring the international mobility of skilled workers (1990–2000): Release 1.0. The World Bank.

Dunlevy, J.A. (2004). Interpersonal networks in international trade: Evidence on the role of immigrants in promoting exports from the American states. Working article. Miami University.

Fang, T. (2009). Workplace responses to vacancies and skill shortages in Canada. International Journal of Manpower, 30(4), pp. 326-348.

Hou, F., Gu, W. and Picot, G. (2018). Immigration and firm productivity: Evidence from the Canadian employer-employee dynamics database.

Picot, G., Rollin, A-M. (2019). Immigrant entrepreneurs as job creators: The case of Canadian private incorporated companies.

Global News. (2018). Labour shortages in New Brunswick a ‘major’ issue, says Chamber of Commerce. https://globalnews.ca/news/4728676/labour-shortages-nb/

Government of Canada. (2018). Building on success: International education strategy (2019-2024). https://www.international.gc.ca/education/index.aspx?lang=eng.

Government of New Brunswick (2016). New Brunswick Economic Growth Plan.

Government of New Brunswick. (2018). 2019-2020 Economic outlook.

Government of New Brunswick. (2019a). Gross domestic product by industry.

Government of New Brunswick. (2019b). New Brunswick labour market outlook 2018-2027.

Government of New Brunswick. (2019c). New beginnings: A population growth strategy for New Brunswick 2019-2024.

Green, D., H. Liu, Y. Ostrovsky, and G. Picot. (2016). Immigration, business ownership and employment in Canada. Analytical Studies Branch Research Paper Series, no. 375. Statistics Canada Catalogue no. 11F0019M. Ottawa: Statistics Canada.

Haan, M. (2018). International student recruitment and retention in Canada.

Hanson, G. (2012). Immigration, productivity, and competitiveness in American industry, pp. 95-129. In Hassett, K. (Ed.). Rethinking competitiveness. Washington D.C.: The AEI Press.

Harrison, D. A., Harrison, T., and Shaffer, M. A. (2019). Strangers in strained lands: Learning from workplace experiences of immigrant employees. Journal of Management, 45(2), pp. 600–619.

Immigration, Refugees and Citizenship Canada (IRCC). (2018). 2018 Annual report to Parliament on immigration.

Immigration, Refugees and Citizenship Canada (IRCC). (2019b). Permanent Residents – Monthly IRCC updates.

Immigration, Refugees and Citizenship Canada (IRCC). (2019b). Temporary Residents: Study Permit Holders – Monthly IRCC update.

Kareem, E-A. and Goucher, S. (2017). Immigration to Atlantic Canada: Toward a prosperous future.

Lemieux, T., and Nadeau, J-F. (2015). Temporary Foreign Workers in Canada: A look at regions and occupational skill. Report by the Office of the Parliamentary Budget Officer (PBO).

McKinsey & Company. (2017). Jobs lost, jobs gained: What the future of work will mean for jobs, skills, and wages.

Manpower Group. (2018). Solving the talent shortage: Build, buy, borrow and bridge. 2018 Talent shortage Survey.

New Brunswick Multicultural Council (NBMC). (2018). New conversations: Post-tour report.

Roslyn Kunin & Associates, Inc. (2016). Economic impact of international education in Canada – 2016 update.

Skills Canada B.C. (2004). Skill shortages in B.C. Ministry of Skills Development and Labour, Government of British Columbia, Victoria.

Statistics Canada. (2016). Education highlight tables, 2016 census.

Statistics Canada. (2018). Population estimates on July 1st, by age and sex.

Statistics Canada. (2018c). Retention rate five years after admission for immigrant tax filers admitted in 2011, by province of admission.

Statistics Canada. (2019a). Annual demographic estimates: Canada, provinces and territories, 2018.

Statistics Canada. (2019b). Temporary Residents: Temporary Foreign Worker Program (TFWP) and International Mobility Program (IMP) Work Permit holders – Monthly IRCC updates.

Lu, Y. and Hou, F. (2017). Transition from Temporary Foreign Workers to Permanent Residents, 1990 to 2014. Statistics Canada.

- Global News, 2018. ↑

- Results can be found in the forthcoming report series According to Atlantic Employers: Perceptions on Hiring, Retention, Immigration & Growth at https://ppforum.ca/. ↑

This Project is Funded By

Thank You to our Event Partners