Project of the Century

A Blueprint for Growing Canada’s Clean Electricity Supply – and FastCanada is going all in on electricity. It is shaping up as the number one national undertaking of the 21st century – dwarfing in ambition even the 19th-century construction of the Grand Trunk and Canadian Pacific railways and the mid-20th-century nation-building trifecta of the St. Lawrence Seaway, Trans-Canada Highway and Trans-Canada natural gas mainline.

In its 2023 budget, the Government of Canada forecasted that demand for electricity will double between now and 2050, while supply capacity will have to grow by an astounding 2.2 to 3.4 times today’s volume (a discrepancy to which we will return). Imagine every dam, turbine, nuclear plant and solar panel across Canada – and then picture a couple more next to them. Two more James Bays in Quebec. Two more Point Lepreaus in New Brunswick. Two more Niagara Falls in Ontario. Two more Site Cs in British Columbia. Canada’s national landscape is currently dotted by more than 100 power plants of at least 250 MW, each big enough to supply a city of 180,000. Soon we will need 220-340 of them.

Another way to look at it: together, the gargantuan Churchill Falls, Robert-Bourassa and Bruce Nuclear generating stations account for 11 percent of Canadian electricity generation capacity. We would need at least another 18 of each.

At the same time as adding all that new capacity, we also must subtract from the current electricity generating stock the remaining coal plants, particularly in Saskatchewan and Nova Scotia, that are regulated to go out of business by 2030, as well as those plants that are ready for normal retirement. Ontario, for instance, is spending billions refurbishing its nuclear plants with little impact on supply.

The ambition of this Project of the Century is without precedent. We are, in fact, wrestling with two distinct yet enmeshed policy challenges simultaneously: ensuring an emissions-free grid by 2035 (clean grid) and engineering a more than doubling of grid capacity by 2050 (more grid).

These conjoined objectives touch everything from the mining and processing of critical minerals, to the capture and sequestration of the carbon in hydrocarbons, to the shrinkage of nuclear plants into small modular reactors, and to the erection of tens of thousands of kilometres of transmission lines, much of it across Indigenous territories. Electrification entails an end to our 100-year-plus love affair with the internal combustion engine in favour of new zero-emission vehicles. Gas stations will give way to charging stations, furnaces and air conditioners to hyper-efficient heat pumps, and centuries of steelmaking will be reinvented.

We find ourselves in the midst of a massive shift change from the age of electricity abundance with which Canadians grew up to one of possible scarcity should we falter in the task of adding new and clean supplies at pace. It constitutes nothing short of a revolution – exciting, daunting, necessary, and littered both with trap doors and climbing rope. Revolutions furnish the breeding grounds both for new ways in which societies organize themselves or, should they fail to deliver the goods, for counter-revolutionary forces to reverse a new order before it can get fully established. It will be important for the agents of electrification to be sure-footed and carry the population every step of the way. A project this complex and drawn-out over the lives of multiple decades and governments simply cannot be brought to the finish line without the continually reaffirmed consent of the governed.

Managed well, the energy system coming out the other end of a quarter-century of change may well be more efficient, stable, secure and competitive.

Efficient: Integrating information and communications technologies into power systems to better match demand and supply in real time would alleviate one of the major weaknesses of today’s electricity systems: the necessity to overbuild in order to meet the highest peaks in demand, often on the coldest and hottest days.

Stable: A more technologically driven system would be less vulnerable to volatile commodities prices. Once capital is in the ground, operating costs should be lower and more predictable.

Secure: A more technologically intensive system would be less susceptible to the disruptive geopolitical machinations so prevalent in international energy markets.

Competitive: Nations spending heavily on decarbonizing their economies are increasingly looking to erect barriers (border carbon adjustments) to imports from countries failing to make the same effort. Goods produced via a clean grid would enhance the competitiveness of Canadian exports.

Still, getting from here to there won’t be easy. There are many hills to climb, many rocks to stumble over, and many false shortcuts to avoid on the way to net-zero emissions. Policymakers must ensure that affordability and reliability are treated as core values of the transition – alongside, of course, cleanliness – or else risk losing support from Canadians accustomed to electricity abundance and allergic to rate hikes.

If we play our cards well, Canada can retain and restore its historic advantage of a relatively plentiful and inexpensive electricity supply. This entails finding the means to build new clean capacity in a period of slow approval processes, labour shortages and supply chain upheavals.

The severe challenge to our electricity supply provides a rare point of convergence among environmentalists, industries and governments. In Canada’s cleanest and most electricity-abundant province, Hydro-Québec has forecasted that power surpluses will vanish by the end of 2026. “Our surpluses have melted like glaciers under the sun of climate change,” Pierre Fitzgibbon, minister of economy, innovation and energy, told the Montreal Chamber of Commerce in May 2023.

Canada’s electricity abundance has long served as a strategic competitive asset. Inexpensive and reliable hydropower allowed industries like aluminum manufacturing to flourish in Quebec and British Columbia. In the future, it will figure even more prominently as carbon content joins cost as key factors of pricing and competitiveness. B.C.’s LNG industry is attractive to Asian buyers in part because it is situated near sources of clean hydropower. One of the world’s first large-scale clean hydrogen and biofuels facilities is being built near Montreal, a $1.2-billion investment attracted by Quebec’s clean hydroelectricity. Multinational mining giant Umicore has chosen to construct a first-of-its-kind battery materials production plant in Ontario in part based on the ability to tap 100 percent renewable power on-site, as have big-name global battery manufacturers (with public subsidies also playing their part). Large-scale hydrogen export projects have been proposed for Atlantic Canada to be powered by clean electricity. To the west, Alberta has used its significant wind and solar capacity and market-based policies to snag power purchase agreements with global tech giants Amazon and Microsoft as well as Budweiser Canada and RBC, all looking to support clean power development and reduce their carbon footprints by collecting renewable energy credits.

Canadian consumers are the primary beneficiaries of our electricity abundance. According to World Bank data, Canada enjoys one of the highest international scores for Quality of Electricity Supply (a measure of interruptions and voltage fluctuations) among peer countries. We are top 10 in the OECD. Another important reliability metric is Loss of Load Expectation (LOLE), defined as the expected number of hours per year when a system’s hourly demand is projected to exceed its generating capacity. The LOLE values for most Canadian provinces are near zero, meaning our grids are generally stable and sufficient. In contrast, European Union member states expect somewhere between two to 15 hours of load loss per year. Brownouts and blackouts can lead to production interruptions for industry and loss of light and heat for residents. Canada has also enjoyed a significant affordability advantage with residential prices lower than the United States and almost half of the EU average (although that has not blunted strong political reactions to rate increases).

Maintaining these advantages requires keeping demand and supply in a reasonable balance. Given the threats from climate change, Canada has naturally adopted a slew of policies designed to shift energy consumption toward electricity, most prominently in favour of electric vehicles. But until recently, markedly little attention has been given to the other side of the equation. Where will all that clean supply – the 2.2 to 3.4 times more – come from? And will its development be synchronized with the policy-induced new demand? Too much demand butting up against too little supply risks price spikes and even brownouts, potentially undermining long-term support for the wider and non-negotiable clean energy transition.

For those dedicated to a successful transition, the principles of affordability and reliability must be safeguarded every step of the way, particularly in light of expectations built up over generations. It is in nobody’s interest to have Canadians whipsawed between anxiety over extreme weather and anxiety over their own access to electricity at prices they can afford.

While the “what” of the electricity revolution is, to say the least, ambitious, or even audacious, the “how” largely remains TBD – to be determined. How much will it cost? Who will pay? Where will the skilled workers come from? Will the global supply chain buckle under the competing demands of scores of countries all vying for net zero? Can different orders of government get on the same page? What will the role of Indigenous nations look like and how will it be financed? Which technologies merit support? Must we inevitably back technology losers to be sure we can lift up the winners? How do 2030 and 2035 mandates line up with 2050’s net zero? What role will natural gas play, and how will regulatory flexibility accommodate it? What about hydrogen? Or renewable fuels? Or carbon capture, utilization and storage (CCUS)? Will we finally experience an energy efficiency breakthrough? Will battery storage and the digitally enabled balancing of supply and demand leap forward fast enough to relieve electricity of its inbred peak-supply inefficiency?

The massive expansion of our electricity system is not without at least some precedent. Tommy Douglas was voted the 20th century’s greatest Canadian largely for having introduced medicare to Saskatchewan. But he was most proud of rural electrification. Only 300 farm households were hooked up to the grid when his party, the Co-operative Commonwealth Federation, was first elected in 1944. Even into the 1950s, the vast majority lived by the lantern. By 1964, 65,000 farms had been electrified – radically upgrading both productivity and quality of life. Canada has a history of rising to occasions like this through meticulous planning, resolute policy application and resistance to instant gratification.

Twenty-first-century electrification will require unprecedented policy clarity, decisiveness and coherence; a risk-and-reward regimen that promotes technological ingenuity and investment mobilization; the assurance of labour and skills availability; full and unfettered Indigenous participation; and the political will to act quickly and hold the public imagination along the grand journey to a cleaner, healthier future.

Clean electrons and more electrons – either one presents a monumental challenge. But this paper is not about the impossibility of Canada’s electrification journey, overwhelming as it sometimes appears.

It is about how to get back to an abundant system, one built on the back of technology rather than fossil fuels and, therefore, ultimately less susceptible to price shocks, supply interruptions and planned inefficiency. All nations are capable of doing the seemingly impossible, which is why people constantly invoke the Kennedy moonshot example of the 1960s. Thanks to a compelling vision and detailed work in the trenches, Americans reached the moon within that decade. In different circumstances last year, a desperate Germany showed that multiple new LNG energy intake facilities could be built in months, not years. Where there’s a will, there’s apparently a way. We need not so much to muster our will as organize and act on it.

The salient question for Canadians now is what it will take to realize the net-zero vision. Or perhaps, more to the point, the twin visions – the net-zero-or-better electricity system by 2035 (15 years before the economy as a whole) and the doubling or tripling of the electricity supply by 2050. Just as with postwar Saskatchewan, the potential gains for the environment, quality of life, innovation and shared prosperity are as significant as the challenge is formidable.

As much as there’s a holy grail of the energy transition (and there isn’t), electrification is it. This paper is the product of deliberations among thinkers, doers and deciders in the electricity policy space brought together by PPF’s Energy Future Forum. They stared into the abyss and helped us map a way back to solid ground. In so doing, we have all endeavoured to eschew the temptations of romantic notions in favour of putting on our hard hats. As one member of our electrification table commented: “The grid is one of mankind’s most amazing machines, as it allows all of us to have power when we need it. But electricity, unlike other energy sources, needs to be balanced in real time in terms of voltage and frequency 24/7/365, or else switches start tripping and the lights go out.”

The second quarter of the 21st century – the next 25 years – is crunch time. We as a country must traverse a treacherous course, to be sure, but one brimming with opportunity for those who treat this amazing machine with the respect it deserves and keep switches from tripping and the lights from going out. This is our blueprint for putting the electrification challenge onto the path of the possible.

In its March 2023 budget, the federal government put the price tag to build a net-zero economy at an astronomical $125 billion to $140 billion every year until 2050. That compares, the budget said, with current energy transition expenditures of between $15 billion and $25 billion. No breakdown of electrification expenditures was made available.

The Conference Board of Canada has put the cost of the clean electricity transformation before us at $1.7 trillion, nearly the size of the entire Canadian economy in 2023. Université de Montreal’s Canada Energy Outlook report estimates the price tag at $1.1 trillion, although that did not include such infrastructure expenses as charging stations. Incredibly for the national Project of the Century, there is very little economic modelling publicly available.

In Ontario, the Independent Electricity System Operator (IESO) estimates a price tag of $375 billion to $425 billion for greening and expanding the province’s grid to a capacity of 88 GW from today’s 42 GW. A 2022 study by Enbridge put the net-zero costs for the province at about $700 billion, with about half of that going toward electrification. While the total energy sector contributes about two percent to the province’s GDP, the Enbridge researchers calculated it would take 100 percent of one year’s GDP to pull off a net-zero electrification plan. And Ontario already has a 93 percent clean grid. According to a 2022 report by the Alberta Electric System Operator (AESO), “relative to a non-net-zero future, transitioning will require an additional $44 to $52 billion … from 2022-2041” in the province.* In a case study of Kelowna, FortisBC – a utility that delivers both natural gas and electricity to the British Columbia city of 150,000 – found that full electrification of gas (home and water heating, cooking, etc.) would require tripling grid capacity from 472 MW to 1,429 MW by 2040 in order to deal with winter peaks. The study put the cost at $2.6 billion to $3.4 billion.

The first point to note is the range of estimates. We seem to know very little about the costs of this national project. The second is their enormity either way. According to Statistics Canada, Canada invested $112 billion in infrastructure projects across the entire economy in 2022, of which $24.8 billion went to electricity infrastructure and assets. Applying the Conference Board’s forecast, the country would need to grow its annual electricity investments by 2.5 times and devote more than half of Canada’s annual infrastructure investment to electricity alone for every year over the next quarter-century.

It is not just the scale of change that is breathtaking. It is the pace as well. Between 2010 and 2020, the grid’s capacity grew by just 13 percent. For 2.2 to 3.4 times growth, generation capacity by 2050 must grow at a pace at least triple that of previous decades, according to the Canadian Energy Regulator, and as much as six times as fast, according to the Canadian Climate Institute. The path ahead involves adding more installed capacity in the next quarter-century than we have in the 101 years since the Adam Beck station began large-scale generation at Niagara Falls. To up the ante further, this rapid increase in the historic pace of electricity expansion must occur in a period of profound labour shortages and rising supply chain vulnerabilities for such key ingredients as copper, aluminum and polysilicon.

This is not to say it cannot be done. Only that taking anything for granted would be ill-advised.

Everything about electrification is drawn on a giant canvas. Workers? According to a 2017 Columbia Institute study, Canada’s electrification buildout will require 1,177,055 worker-years between now and 2050. Energy efficiency? Experts speak about having to retrofit some 400,000 dwellings a year until 2050 at costs in the vicinity of $20 billion to $32 billion, an astronomical sum for fiscally pressed governments having to invest in health care and other energy transition demands – but one that proponents maintain would return more than its weight in new economic activity. Charging stations? An August 2022 study for Natural Resources Canada by Dunsky Energy and Climate Advisors estimates the country will need about 50,000 publicly accessible charging stations by 2025 (from fewer than 20,000 today), 200,000 by 2030 and more than 400,000 by 2035. That’s in addition to even larger numbers of household charging stations. Supply chains? The International Energy Agency cautions that the global energy sector’s demands for critical minerals could increase by as much as six-fold by 2040. Similarly, McKinsey & Co. researchers forecast the production of copper (the foundation stone of electricity systems) will need to increase 45 percent by 2031 – equivalent to doubling production from the top four copper-producing countries. Demand for lithium, nickel and cobalt (core battery metals) is expected to increase by eight times, two times and 1.8 times, respectively. And the supply of rare earth metals (crucial for electric motors) will need to double.

Electricity tends to be generated in remote areas and consumed in more populous places, so significantly more transmission capacity will have to be put in place: towering pylons in the ground, high-voltage wires in the air and transformers along the route. By one estimate, a doubling of electricity entails more than 40,000 kilometres of additional transmission lines, enough to traverse the Canada-U.S. border 4.5 times. Each transmission kilometre, on average, requires 5.32 workers during construction and takes $1.1 million to build, operate and maintain Using the 40,000-kilometre estimate, it would take $44 billion and 215,320 workers to erect the necessary transmission lines. In today’s tight labour market, it is unclear where these skilled workers would come from, not to mention the highly coveted components.

When the net-zero transition is done in 2050, electricity is expected to comprise just 41% of the energy pie, more than twice today’s 18% slice, but with the majority of the load still coming from other sources, including fossil fuels. The Canadian Energy Regulator forecasts that oil products will occupy second place with an 18% share, followed by natural gas at 17%, biofuels at 13% and hydrogen at 12%.

As clean electricity ripples through the Canadian economy, it can be expected to create new competitive advantages in a carbon-constrained marketplace. Export industries will be scouring the globe for reliable, affordable and clean electricity to power production; importers will be looking for low-carbon goods to help meet their own climate targets.

Access to low-carbon electricity has already become a major factor in investment decisions, from steel and batteries in Ontario to semiconductors in Quebec, iron ore in Newfoundland and Labrador, potash in Saskatchewan, liquefied natural gas in British Columbia and so on. With the EU and the U.S. looking at imposing tariffs (carbon border adjustments) on products that gain pricing advantage by failing to invest in decarbonization, Canada, with its head start in clean energy, has the potential to gain competitive advantage.

According to the International Energy Agency, the LNG Canada plant in Kitimat, B.C., will emit at a rate 60 percent lower than the global average. Future projects such as Woodfibre, Cedar, Ksi Lisims, FortisBC’s Tilbury expansion and a second phase of LNG Canada would feature emissions profiles closer to 90 percent lower than global competitors but are only achievable if those sites all have access to enough electricity. The stick in the spokes is a dearth of available electricity and transmission.

Quebec’s Economy Minister Fitzgibbon said he currently has more than 50 proposals on his desk for projects that need 50 MW or more of power. Not all can be supplied. “As we look toward 2050, I know one thing: nobody really knows. But one thing is for sure, the needs will be huge. And for the next 10 years, it will be tight and choices will have to be made.” Officials in the Windsor region of Ontario worry that electricity transmission will play a limiting role in how many battery plants can be accommodated. On the West Coast, BC Hydro issued an expression of interest (EOI) in the spring of 2023 for industrial customers wanting to connect to the power grid in northwest B.C. Twenty-nine responses were received, representing more than 5,000 MW of potential load (ranging from 10 MW to 700 MW). About a third each came from mining, LNG and pipelines, and hydrogen, with a small percentage from ports. The response has pushed forward planning for a major transmission line for the region, but Ottawa and the province have yet to agree on who pays what.

The federal budget specified its 15 percent tax credit was only available for lines that tie together two or more provinces. But a separate and unheralded provision did leave the door open for “intra-provincial transmission” projects such as the B.C. one, with the federal government committed to “consult on the best means, whether through the tax system or in other ways, of supporting and accelerating investments in projects that could be considered critical to meeting the 2035 net zero.” One way or another, a failure to make electricity available will squelch future growth or perhaps impel project proponents to put their investment dollars instead into additional natural gas infrastructure, conceivably locking out a move to electricity for the next couple of decades.

The challenge of electricity allocation within industry becomes even more complex if hydrogen also becomes a mainstay energy source and export of the future. Hydrogen from electrolysis is enormously electricity intensive. In fact, some characterize the export of hydrogen as the export of electricity in another form, except with most of it lost in the production process. The Energy Future Forum’s electrification working group reviewed Natural Resources Canada calculations showing that if, for instance, hydrogen were to be used for heating, it would require a staggering 634 TWh of electricity – roughly equivalent to Canada’s entire generation today. Obviously, that wouldn’t happen if a more efficient technology (i.e., heat pumps) was available or disproportionate infrastructure investment was required. But hydrogen is widely seen at least as a key clean fuel for long-haul transport and a solution for storing inflexible electricity supply, among other usages. The Canada Energy Regulator’s Energy Future 2023 report estimates that hydrogen will fill 12 percent of the country’s end-use energy supply in 2050 – about two-thirds from electrolysis – which would translate into dedicating about 36 percent of present Canadian generation capacity to this single use.

Canada is best served by the strongest possible net-zero economy, but with scarcity becoming a real possibility – at least temporarily – and with the perpetual challenge of Canada having “too much geography,” policymakers need to give more thought to whether explicit planning should go into sequencing the allocation of electricity supply.

Some de facto sequencing decisions have already been made. Zero-emission vehicles are sitting in the pole position for available electricity supply. What should come next? Where should industrial production, especially that which feeds the clean energy supply chain, fit in the scheme of things versus home heating systems, for instance? Will we use our available electricity to add to the competitiveness of the country – and help pay for the energy transition – before or after we move to change the way we heat our homes and abandon all that infrastructure? Will the abatement of gas and the expansion of renewable gas be allowed to relieve the pressure?

Without a credible plan, the goal of policy coherence runs the risk of being knocked off course by the piecemeal decisions of different orders of government – municipal regulations vis-à-vis gas heating and appliances, for instance. Which usage gets the next unit of electricity is too important a factor to the health of the environment and economy to leave to chance. Even within industry, should initiatives that reduce global emissions, such as mining of critical minerals, battery manufacturing and LNG exports, be awarded special status? So far, Canada has taken an all-of-the-above approach rather than a sequencing one. By allowing decisions to be made ad hoc, we may inadvertently lose control of our ability to think through trade-offs and set priorities as to where our electricity should go first, second and third in the energy transition.

The trendlines of the energy transition are moving in a single direction of massive capacity additions. But there are ways to flatten the curve at least somewhat.

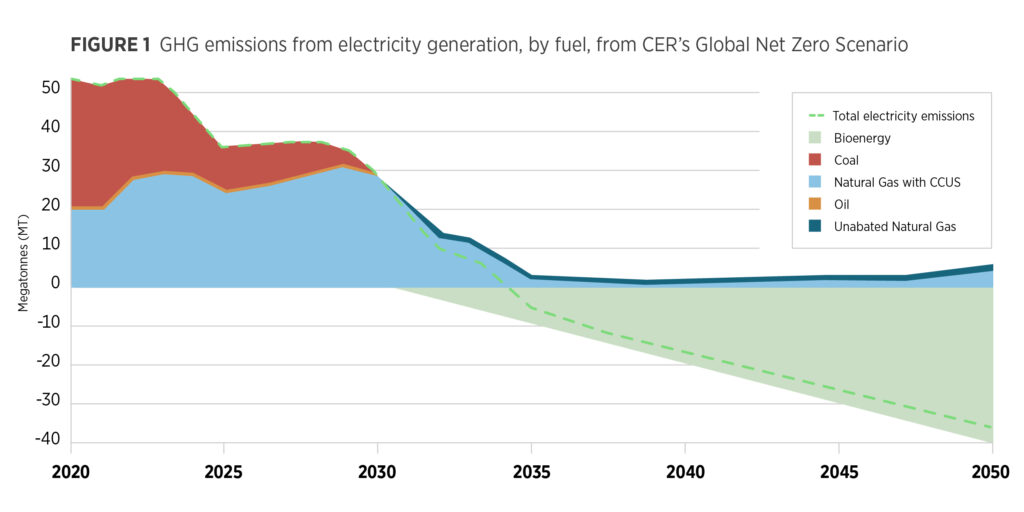

Some provinces, such as B.C., are building momentum on the use of biomass for electricity. The latest 2023 modelling results from the Canadian Energy Regulator envision an important supporting role in electrification for the utilization of bioenergy with carbon capture and storage (BECCS) in decarbonizing the electricity sector. The study projects that BECCS will make its debut in 2035 and contribute four percent of Canadian electricity output by 2050. What sets this generation apart is that BECCS not only provides electricity to the grid but also stores carbon permanently, which similar to nature-based solutions, results in negative emissions – thus taking pressure off the rest of the grid.

Even more to the point is the potential found in a new generation of smart meters that utilize data to make electricity consumption more efficient – so-called demand management. The most economical new electron is the existing electron not used. Classically, energy efficiency has been about retrofits of existing buildings and stricter building codes for new buildings – part of the public agenda, at least since the energy crises of the 1970s. Today, data and digital technologies and widespread connectivity can optimize electricity usage by smoothing demand peaks and better balancing demand with available supply. Much of this optimization can occur automatically with appliances for refrigeration, cooking, heating and cooling communicating with the grid to draw power when it is most available. Still, we are just scratching the surface. Although the number of smart power meters worldwide exceeded one billion last year, a 10-fold increase since 2010, we are only exploiting four percent of available data. There is lots of room for the impact of demand management to grow.

Electricity, unlike oil, natural gas or coal, has historically been difficult to store. Therefore, grids need to be overbuilt so more supply will be available at the highest peaks of demand. Keeping surge capacity in constant reserve for these periodic peak demand moments – cold days, hot days, certain hours of the day – is highly inefficient and expensive.

We are approaching the point where a combination of improving battery storage and the application of these smart grids will allow for the instant and automatic fine-tuning of demand and supply. This means storing electricity in off-peak moments and hours – even seconds – and discharging it as demand spikes. Managing real-time data in this way can relieve utilities of some of their capital requirements by lowering the overall call on the system than would otherwise be the case. California recently set the 2030 goal of shifting 7,000 MW – more than the capacity of the Bruce Power nuclear plant – from its peak load through demand management. If successful, that would translate into powering millions of homes without having to build new generation facilities or transmission lines.

A pilot project across Nova Scotia is experimenting with marrying battery storage with software controls. Nova Scotia Power, the regional utility, has installed more than 100 energy storage batteries in homes across the province. Software programs and operators will control the timing of when the batteries get charged, such as overnight when demand is low, and discharge power from them during peak load. The pilot also uses smart technologies to charge electric vehicles at optimum times and tap into them for additional battery storage.

Electricity alone can’t deliver a net-zero future – that requires an accompanying expansion of clean fuels, energy efficiency, carbon capture and more – but it is both the enabler and driver of the energy transition. Electricity forms the backbone of the net-zero energy economy of the future. We have to be clear-eyed and hard-headed in actually bringing home the Project of the Century.

Sizing up Canada’s decentralized grid, an International Energy Agency expert remarked at one of the Energy Future Forum’s electrification roundtables that “Canada is not a country.” What he meant was that in contrast to railways and pipelines or the electricity systems of other nations, Canada lacks a unified grid. Instead, each province operates an independent system consisting not only of differing generation mixes but also bespoke market structures, debt loads, governance and pricing mechanisms. Sometimes two provinces cooperate in tying part of their systems together, but it remains more the exception than the rule.

Canada, as we all know, is a highly decentralized federation with economically and resource-differentiated constituent parts. Electricity falls squarely within provincial jurisdiction and the composition of grids varies greatly. The supply of electricity is considered of such profound economic and political consequence that most provinces have chosen to put generation and transmission into the hands of closely controlled Crown corporations. Moreover, Canadians tend to view affordable and reliable electricity as something of a birthright and are not hesitant to hold to account provincial governments that disappoint them on rates or policy. As any elected official in Canada knows, political graveyards are littered with the bodies of those who ran afoul of public opinion over electricity. Those governments have grown predictably vigilant. Since provinces can be expected to forcefully assert their constitutional responsibilities and political prerogatives, it is incumbent on any national action plan to eschew top-down approaches in favour of bottom-up ones.

To be sure, the federal government has a vital role to play in the energy transition. The division of powers notwithstanding, the Supreme Court of Canada in 2021 supported Ottawa’s right to impose a carbon pricing scheme in keeping with the peace, order and good government provision of the Constitution. More recently, the federal government has been working on a rulebook, expected imminently, for arriving at a net-zero electricity grid by 2035 – the so-called Clean Electricity Regulations (CER). Several provinces oppose at least one of its expected central tenets: the curtailment in the use of natural gas to generate electricity by 2035. Ottawa, in turn, now appears prepared to take these concerns into consideration with flexible, although not infinitely flexible, compliance measures.

The simple upshot is that the federal government needs to carry, not coerce the provinces when it comes to electrification within its international responsibilities to meet 2030 Paris targets and its 2050 net-zero pledge.

Converting to a net-zero system and more than doubling that system’s capacity cannot be imposed from the centre as easily as a price on carbon. It takes an intricate web of decisions, not just between the federal government and provinces, but with Indigenous nations, utilities, industrial users, regulators, investors, etc. Beneath a series of common principles, it will require different tactics and different transitional flexibilities for different jurisdictions.

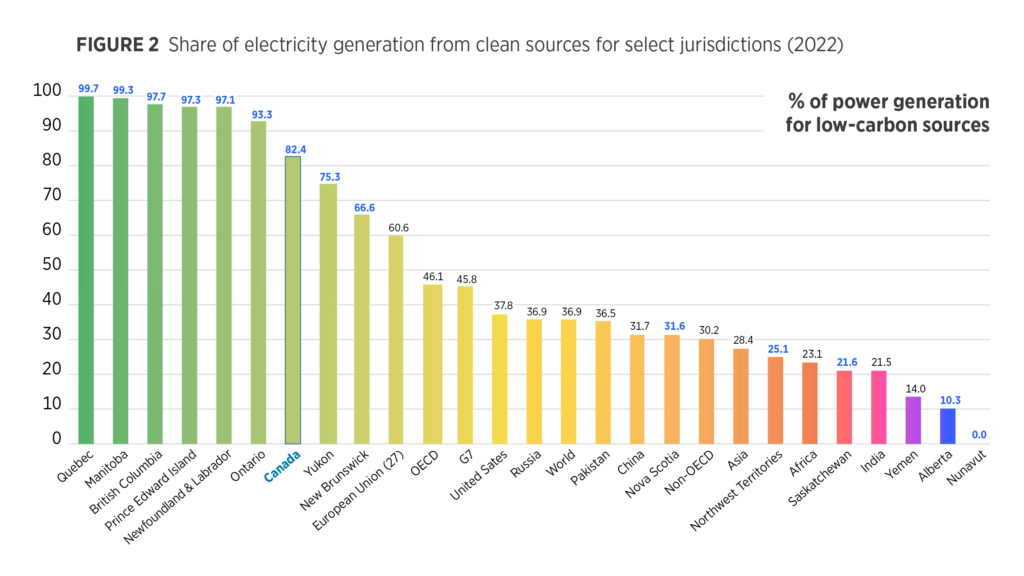

Canada is in a better position than most nations when it comes to reaching the destination of clean electricity. As policymakers like to point out, Canada’s grid is already 82.5 percent emissions-free. Our current clean power quotient is more than twice that of the United States and 20 points better than the European Union. But that’s an average. Three Canadian provinces and two territories actually operate electricity systems with higher proportions of GHG-emitting electricity than the OECD average – even higher than Russia and China. There is much work to do on clean supply and, importantly, the investment and effort it will take to create that clean supply. Significantly, the task falls unevenly across the country.

Share of electricity generation from clean sources for select jurisdictions (2022)

The main tool of influence at the federal government’s disposal, beyond carbon pricing, is its so-called spending power. For decades, the federal government has used the “power of the purse” to try to influence policies beyond its ambit, inducing such areas of provincial responsibility as health care and, more recently, a national daycare program. The Canadian Climate Institute has dubbed federal money coupled with provincial responsibility “electric federalism” – a made-in-Canada arrangement where Ottawa and the provinces cooperate to deliver an affordable, reliable and clean energy future. In essence, the federal government commits taxpayers’ funds in pursuit of what it views as essential national objectives and the provinces leverage those funds with their own expenditures and private capital to finance the transformation of their electricity systems in accordance with those national principles.

The spending power can be seen in action in the electrification incentives in the 2023 federal budget, with the main 15 percent refundable tax credits even available to non-taxable, provincially owned utilities for:

- Non-emitting electricity generation systems: wind, concentrated solar, solar photovoltaic, hydro (including large-scale), wave, tidal, nuclear (including large-scale and small modular reactors);

- Abated natural gas-fired electricity generation (which would be subject to an emissions intensity threshold compatible with a net-zero grid by 2035);

- Stationary electricity storage systems that do not use fossil fuels in operation, such as batteries, pumped hydroelectric storage and compressed air storage; and

- Equipment for the transmission of electricity between provinces and territories.

A second tax credit of 30 percent is intended to attract private investment in solar, wind, water energy, battery storage, solar heating equipment, heat pumps, small modular reactors (SMRs), some zero-emission vehicles and geothermal.

The key points are that meeting our Paris and net-zero commitments can only happen with provincial co-creation, and different provinces are grappling with different circumstances.

There is no uniform Canadian energy reality. For instance, Canada is a net exporter of oil and gas, fourth and sixth in the world, respectively. But infrastructure constraints, largely self-imposed, mean the eastern half of the country imports its hydrocarbons, sometimes from the United States but often from Africa or OPEC states. This diversity is even more true for electricity. Five provinces have developed hydro potential, with four of them exporting into U.S. markets. Two provinces have embraced nuclear power while two have formally banned it. Four provinces still burn at least some coal, with Alberta about to join Ontario as an off-coal jurisdiction.

Every province feels at least one of the twin challenges of clean electricity and more electricity. Alberta’s retreat from coal has been accomplished by switching to natural gas (also a fossil fuel but a significantly less carbon-intensive one) and renewables. It is seeking flexibility from Ottawa over the treatment of natural gas and the timing of a net-zero grid. Edmonton-based Capital Power is in the midst of switching its Genesee generating station west of Edmonton from coal to natural gas in 2023 and is close to a final investment decision on staying onside federal regulations through investments in abating gas emissions via carbon capture and storage. ATCO Group’s Canadian Utilities is diversifying its portfolio by developing hydrogen in both Australia and Alberta and, in early 2023, closed a $713-million deal to acquire Suncor’s wind and solar assets in Alberta and Ontario.

Meanwhile next door, Saskatchewan still relies on coal for more than 30 percent of its electricity supply. It is counting on small modular reactors to enable a major pivot to nuclear, but a final decision won’t be made till at least 2029, with sufficient scale not achieved until well beyond 2035. So, what replaces coal in the interim? Saskatchewan Premier Scott Moe says it must be natural gas, regardless of whatever Ottawa’s pending Clean Electricity Regulations may say.

Ontario is looking to refurbish and add new nuclear, both SMRs and big nuclear. It also plans to extend natural gas. New Brunswick is looking to build on its nuclear legacy with aggressive targets for SMR production; it may also have a temporary supply gap to fill. Nova Scotia currently generates 37 percent of its power from coal and 17 percent from natural gas and is looking over the next dozen years to replace or decarbonize more than half the system it has erected over five decades. To do so depends on growing its portfolio of wind and hydro (through the Atlantic Loop) and continued use of some natural gas.

As the 2021 Supreme Court judgment on carbon pricing reminded us, federalism involves a continuous balancing act between a nation’s jurisdictional diversity and its quest for unity of purpose. The climate crisis produces a central imperative, but the array of provincial electricity tapestries does not easily lend itself to a one-size-fits-all conception.

With its responsibilities for inter-provincial commerce, the federal government naturally has long touted electricity interties between provinces as a means of efficiently knitting together the clean energy strengths of some with the clean energy needs of others. Its 2019 climate plan said: “The government will work with provinces and territories to connect parts of Canada that have abundant clean hydroelectricity with parts that are currently more dependent on fossil fuels for electricity generation – including by advancing strategic intertie projects.”

Expanding east-west interties makes sense in a number of ways: raising the efficiency of neighbouring grids; enhancing resiliency in times of emergency; creating a better distribution of Canada’s hydro assets; and, of course, nation-building. Whatever its virtues, it became clear at each gathering of our Energy Future Forum’s electrification table that the notion is anything but an easy sell. Some provinces fought hard to secure control over their resources within Confederation and jealously guard their prerogatives. Others are leery of spending their taxpayers’ dollars on infrastructure situated in another jurisdiction or simply don’t sufficiently trust neighbours coping with their own supply challenges to come through when the chips are down. A plethora of battles over the years about the ability to transit one province’s energy through another – Churchill Falls, Energy East, Northern Gateway – has fed hesitancy around electricity burden-sharing.

Ontario and Quebec have conducted on-again, off-again negotiations to increase intertie capacity over many years. There are obvious efficiencies to be seized – Quebec’s demand peaks in winter (due to widespread electric heating), while Ontario’s peak is in summer (due to its greater reliance on gas for heating but electricity for air conditioning). Quebec has long preferred to export its abundance south, in any case, where prices tend to be higher. And Ontario is leery of establishing dependencies to the hydro-rich provinces to its east and west.

In the 1990s, Saskatchewan premier Roy Romanow proposed that his province would fold SaskPower into Manitoba Hydro if Manitoba would merge its Crown-owned phone company into the more advanced SaskTel. Manitoba said thanks but no thanks and instead privatized its phone company. Today, Saskatchewan is still trying to escape its more expensive, less stable and dirtier reliance on coal. But it evinces no enthusiasm for putting its destiny into the hands of a utility accountable to the government of another province, nor of investing capital into that other province. Neither is it convinced that Manitoba has enough hydro to meet its own domestic and export obligations.

Further west, the smart talk around British Columbia’s costly Site C dam as recently as two years ago concerned whether its cost overruns and apparent lack of markets rendered it an instant white elephant. Energy analysts and even then-premier Christy Clark proposed pairing up the 1,100 MW dam in the province’s northeast with the perceived need of Alberta’s oil sands for clean and reliable energy supplies. Except Alberta felt a reluctance to create an external dependency, displaying a natural bias in favour of its local utilities over the monopoly Crown corporation to its west. Today, Alberta is one of four Canadian provinces (Saskatchewan, Ontario and New Brunswick being the others) kicking the tires on small modular reactors. Meanwhile, British Columbia says it will need additional supplies of electricity beyond Site C as early as 2028.

As it is, an intertie between the two provinces was completed in 1986. It has been a source of friction and does not operate close to its maximum capacity.

It is probably not a comforting statement about the functionality of the federation that east-west flow of electricity is dwarfed by north-south arrangements. Provincial electricity trade with the U.S. totalled about 73 TWh in 2021 versus about 57 TWh for inter-provincial electricity trade. And the majority of that inter-provincial movement comes from the controversial Churchill Falls project, with its large flows from Newfoundland and Labrador to Quebec. Without it, north-south trade is nearly three times east-west. Because of weather-related electricity consumption patterns on either side of the border and more attractive export prices in the United States, north-south infrastructure outruns lines running east-west.

Even the eminently sensible Atlantic Loop to bring hydropower from Newfoundland and Labrador and Quebec to the Maritimes as part of the energy transition is anything but smooth sailing. As always, there is the question of who pays what, a tension that broke into the open during a June 2023 trip to Nova Scotia by Prime Minister Justin Trudeau. “Not only is (the Atlantic Loop) the fastest and most cost-efficient way to get off coal,” Trudeau said, “it will also make sure the Atlantic region has the power to meet growing electricity demands.” Nova Scotia Premier Tim Houston countered, “What the federal government is talking about, it’s just not an economically feasible project for Nova Scotians.” In the too often zero-sum game of Confederation, Nova Scotia is yet another province sensitive to the idea that some of its money might be applied to build infrastructure outside its borders – the same concern one hears elsewhere.

However compelling the logic of interties to experts, resistance is real and explicable. We will learn over time how much the electric federalism incentives for interties in the 2023 budget might tilt the balance. For now, the interties debate is perhaps best looked at as an economically rational response running up against a politically prudent one. Both sides of the argument have a reasonable story to tell. But the resulting uncertainty will, at best, slow progress and most likely relegate interties to one among a portfolio of solutions.

With Canada’s (and British Columbia’s) adoption of the United Nations Declaration on the Rights of Indigenous Peoples (UNDRIP), developers of electricity projects crossing into Indigenous territory will need to seek “free, prior and informed consent” – often referred to as FPIC. Increasingly, First Nations, Métis and Inuit peoples are taking equity stakes in resource and clean energy projects, from pipelines and liquefied natural gas to wind farms, transmission lines and battery storage. Far-sighted corporations are creating conditions to support this process, including helping to overcome the frequent stumbling block of financing the Indigenous ownership position.

The old standard of simply consulting or engaging with Indigenous nations doesn’t suffice anymore, if it ever did. Today’s emerging standard is that Indigenous communities occupy decision-making roles through the project lifecycle, with the option of equity-based partnership or other forms of participation on the table. Such ownership arrangements help ensure that Indigenous values are represented from start to finish, and they provide confidence to markets, governments and the public. They deliver a measure of social justice and economic opportunity along with putting real meat on the concept of reconciliation and self-determination. For what is a nation without a functioning economy?

In 2020, the Public Policy Forum published a paper by five prominent Indigenous leaders called We Want Real Partnership. It mapped out what true economic reconciliation would look like and outlined a vision for “real partnership,” including:

- First, we want to see more Indigenous people in executive leadership positions in Canadian corporations and boards.

- Second, we want to see greater equity for Indigenous communities. Having a voice and financial stake will be fundamental to economic reconciliation with Indigenous Peoples.

- Third, it will be essential to foster and strengthen the capacity and competencies of Indigenous communities by integrating Indigenous knowledge and experiences into our education system and business practices.

- Fourth, we must incorporate Indigenous Peoples into the decision-making process.

The First Nations Financial Management Board (FNFMB) has also published a helpful roadmap to self-determination, with a strong emphasis on economic development. Importantly, it offers a menu of options since not all First Nations or other Indigenous communities will want to pursue the same development path. There is no one size fits all, but there is definitely a trend toward tangible manifestations of respect, including equity positions. That means a different relationship, but also different institutional and governance arrangements. As the roadmap states: “It is impossible to unlock Indigenous potential without transferring both the authority and the revenue required to govern.”

The choice to pursue genuine partnerships with First Nations marks a critical pivot point as to whether or how much a given electricity development can put the adversarial days of lawsuits and protests in the rear-view mirror in favour of a speedier path paved in the values of social justice and shared prosperity. As the First Nations Major Projects Coalition (FNMPC) made clear in the title of its 2022 conference, “The only road to net zero runs through Indigenous lands.” Doing so promises rewards.

Failing to do so could end in the market penalizing project proponents. In a 2020 report, Moody’s Investors Service warned that companies unable to negotiate Indigenous involvement in their projects could see their credit ratings negatively affected. Moody’s called on them to factor self-determination and self-sufficiency into their project planning. This increasing equilibrium makes it easier to achieve enduring agreements.

On a mid-2023 trip to Ottawa, the FNMPC and large corporate supporters lobbied for federal loan guarantees for Indigenous investment in projects to help expedite the supply build. RBC senior vice-president John Stackhouse stated that about half of the advanced critical-mineral opportunities in Canada sit on Indigenous territory. Many solar and wind sites are also situated on First Nations’ traditional lands. RBC estimates that some $10 billion to $50 billion in Indigenous equity needs to be raised over the course of this decade to advance mining and energy projects alone.

“In order to get these projects built, you’re going to need Indigenous participation and consent,” FNMPC chair Chief Sharleen Gale said on the trip. Any other course spells costly delay. “And then we’re in court. And then we win, and we win, and we win,” she said. “I feel like, by having First Nations involved, you see the regulatory process speed up. You see these projects built on time, without delay.”

Ontario’s Hydro One, with support from the FNMPC, introduced a new policy in 2022 that wherever it builds new (greenfield) linear infrastructure over $100 million, Indigenous communities will be given the opportunity to invest in up to 50 percent equity and play a major role in procurement. Critically, Hydro One has also committed to backstopping Indigenous investment (guaranteeing loans in case of default).

Penny Favel, Hydro One’s vice-president of Indigenous affairs, told our electrification roundtable that such arrangements are not only the right thing to do, but the smart business move. The number one way to de-risk projects and avoid delays, she observed, is having Indigenous Peoples as partners at the planning stage. The Indigenous partners can help with planning and approvals and can also assist with human capital for the building stages.

Transmission infrastructure is especially tricky since it often crosses multiple communities and land claims. Where there are competing claims, bringing in Indigenous communities early and allowing them to resolve matters is obviously preferential than the natural corporate inclination to wait for the government to try to come to the rescue.

These types of partnerships are sprouting all over, creating a learning curve for the next one up. The Watay Power transmission project is a significant Indigenous-run initiative in partnership between 24 First Nation communities (51 percent share) and FortisOntario and other private investors (49 percent share). The project is aimed at connecting 17 remote communities in northern Ontario currently powered by diesel generation to the provincial power grid. The 250-megawatt Oneida Energy storage project – Canada’s largest battery storage farm and the third largest in the world – provides another example. The project will be 50 percent owned by Six Nations of the Grand River and is being supported by different orders of governments. The Canada Infrastructure Bank, which has become an important middleman in investments like Oneida, provided a recent contribution of $170 million in funding, while Ontario has instructed its systems operator to establish a 20-year contract with the storage initiative.

Given the urgency of Canada’s electricity buildout and the key relationship between the Crown and Indigenous communities, the federal government has a special role to play in expediting processes and easing financing. Some provinces, including Alberta and Ontario, have introduced discrete Indigenous finance programs or funds to make up for longstanding barriers to capital at competitive rates. The electrification process furnishes a golden opportunity to get behind economic reconciliation and genuine self-determination. Given it is an industry with regulated rates of return, lender risks are lower and government backing should ease the entry of private capital.

“True partnerships” are the only way to a reasonably paced clean energy future. Access to competitively priced capital is the ticket to those partnerships.

Expectations are high that governments, particularly the national government, will shortly create a fund or development bank as well as more actively leverage existing institutions, such as the Canada Infrastructure Bank, already building lending portfolios in Indigenous communities. In the interests of full Indigenous economic sovereignty and a timely energy transition, Canada needs institutions that can assess and ameliorate risk and bring the cause of reconciliation and the world of financing together.

We are on the clock. The manifestations of climate change – melting ice, increased flooding, forest fires, warming temperatures and human migration – are worsening, and room to manoeuvre is shrinking. If this were a football match, the two-minute warning would have sounded. In our far more serious climate change contest – humans versus nature – the time has come to employ a hurry-up offense, a meticulously planned and focused series of tactics employed to beat the clock.

In past energy transitions – water to steam; steam and coal to fossil fuels and electricity; horsepower to the internal combustion engine – the marketplace in the form of innovators and consumers dictated the pace of change. Governments were along for the ride. This time around, they are the main drivers of change. They are calling the plays as the offense tries to defeat the many defenses against forward progress.

The nations of the world have set targets to reduce their emissions and sought to encounter the task with ever-increasing ambition. For Canada, these commitments come up in 2030 (Paris targets, phaseout of coal generation), 2035 (clean grids, last sales of new internal combustion engine vehicles) and the biggie, 2050 (net-zero total emissions). The demands of a clean energy supply buildout are not theoretical; Ontario’s Hydro One, which hasn’t built a major development in more than a decade, is preparing to break ground on several projects set to come on stream in the next 10 years. Quebec has never had so many project proposals in the hopper. The amount of building required is mind-blowing and is meant to happen while addressing a politically sensitive housing supply and affordability crisis.

Although not all net-zero nations are operating on the same timeline – China has only committed to a 2060 goal and India 2070 – their sense of urgency is the same. Given limited resources such as critical minerals and the rise of carbon content as a factor of competitiveness, each of the 196 parties to the Paris Agreement is jockeying for advantage in getting to net zero.

Scientists have calculated how much more carbon the atmosphere can tolerate before a domino effect of catastrophes spins out of control. By many estimates, this so-called carbon budget has about 10 years before it is depleted. Since GHGs accumulate in the atmosphere over time, the quicker we can reduce them and slow the draw on the carbon budget, the more time we have to complete the energy transition.

With so much at stake, timeliness is essential in effecting the energy transition and must be a top-of-mind policy value, as was articulated in the March 2023 federal budget. “If Canada does not keep pace, we will be left behind. If we are left behind, it will mean less investment in our communities, and fewer jobs for an entire generation of Canadians. We will not be left behind.”

Given the long lead times and high upfront costs for electricity generation and transmission projects –and with our allies and partners also busily investing in their own electricity grids – all nations are feeling the exigency to make decisions with imperfect lines of sight. Underinvestment in Canada’s grid today will risk our ability to power our economy and deliver cleaner and cheaper energy tomorrow. It will hamstring Canada’s electricity-intensive resource and manufacturing sectors and impede the development of new electricity-intensive sectors, such as hydrogen, that can be a future source of well-paid middle-class jobs.

By now, nearly everyone agrees we are not moving at a speed commensurate with the threats at hand. A 2017 survey by EY concluded that Canadian infrastructure megaprojects, on average, run 39 percent – or US$2.2 billion – over budget and 12 months behind schedule. A 2018 study found that federal project approvals typically took 49 months for new generation and 38 months for transmission, with some taking substantially longer. Ontario’s Independent Electricity System Operator says it can take four to five years, including planning and construction time, for new wind and solar generation, 10 years for transmission and even longer for large, capital-intensive infrastructure undertakings. The table below from the 2018 study shows the timeline for the federal stage alone of environmental (or regulatory equivalent) review processes for projects completed between 2010 and 2016.

| Project | Project Category | Timeline (months) |

| Darlington New Nuclear | Generation | 68 |

| Muskrat Falls | Generation | 64 |

| Labrador-Island Link | Transmission | 57 |

| Site C | Generation | 41 |

| Darlington Refurbishment | Generation | 36 |

| Keeyask Hydro | Generation | 35 |

| Maritime Link | Transmission | 19 |

In 2019, the federal government passed the current Impact Assessment Act to replace the 2012 Canadian Environmental Assessment Act. It is still early to measure its influence on timeliness, as noted in a 2023 Canada West Foundation paper. Nonetheless, the examination of 25 projects proposed after the new act came into force did point that despite a 180-day performance standard for the act’s initial planning phase, the clock was stopped and the impact process put on suspension, as allowed, for long stretches of time. The number of days actually spent in the initial planning phase ran between 127 and 693, with a mean of 322 days. Clock stoppages occurred for a variety of reasons: coordination with provincial processes, pandemic interruptions, requests for further details, and additional time for Indigenous consultation, as well as a proponent re-evaluating whether they wanted to move forward with the project.

If the energy transition is going to make a material difference to climate threats, speed is a huge variable. Even the current federal government, author of the 2019 Impact Assessment Act, said in its recent budget that it’s “making it a priority to expedite major project reviews while maintaining strong regulatory standards” and vowed that before the end of 2023, it would “outline a concrete plan to improve the efficiency of the impact assessment and permitting processes for major projects, which will include clarifying and reducing timelines, mitigating inefficiencies, and improving engagement and partnerships.” Attention is being paid almost everywhere to the extent to which review processes expedite or obstruct the grand goal of clean energy, and how to right the balance.

A new wave of frustration is emanating from business groups charged with delivering a low-carbon future. The Business Council of Alberta said in a June 2023 report that project proponents can spend years trying to clear regulatory hurdles without securing a line of sight to when construction might begin. Indeed, even after approval, they often get further slowed down in municipal and provincial processes for construction, right-of-way and other necessary permits. “The same regulatory systems that were designed to keep bad things from happening are now preventing high-quality projects from being built in the first place,” the report states. It lays out a series of recommendations, including a senior coordinating body for permitting. Some jurisdictions are considering having certain infrastructure designated as being of major national interest (e.g., electrification), which could exempt them from the justification step in the process, potentially saving 18 to 24 months on project delivery. Other proposals call for a different level of scrutiny for green energy projects than others, though that may prove a difficult line to define.

In environmentally minded California, Governor Gavin Newsom introduced executive orders in May to cut project timelines by three years; streamline environmental planning; limit to nine months the time courts have to weigh challenges; provide agencies with extra funds to speed up reviews; dramatically reduce the number of documents in scope for reviews; carve out more exemptions to allow critical projects to bypass certain aspects of the environmental review process; and repeal four statutes designating species as “fully protected.”

“We need to build,” he told the New York Times. “You can’t be serious about climate and the environment without reforming permitting and procurement in this state.”

Newsom also has formed a cross-government “strike force” to maximize federal funding and expedite project completions. A similar idea was suggested at PPF’s 2023 Canada Growth Summit by former federal transportation minister Lisa Raitt, co-chair of the Coalition for a Better Future. She called for a swat team of four deputy ministers to serve as champions for individual projects deemed of national importance.

The regulatory and permitting reform bandwagon is gathering momentum in Europe, Asia and the United States. Our electrification working group heard that delay does not just slow projects down but can kill them altogether by driving up construction and financing costs and scaring off investors.

The good news is that, unlike many issues, such as the pace of technological change or supply chain accessibility, fixing regulatory inertia lies totally within our control. And the last federal budget indicates the federal government is on the case – although once again, time is of the essence. Serious environmental jurisdictions like California and Europe provide possible pathways. So do other regulatory areas. During the pandemic, for instance, vaccine decisions were sped up without compromising Canadians’ health and safety by telescoping different stages of the process. In one example, this involved the simple administrative measure of allowing previously consecutive parts of the process to be carried out concurrently.

The better news is that some progress on streamlining processes is being seen at home. The B.C. government greenlit the Haisla-controlled Cedar LNG project in March 2023. The federal government followed suit the next day. This was the first project that fell under a new regime intended to reduce duplication.

Policymaking also needs to raise its speed limits. So-called contracts for difference, which would improve private sector certainty about future carbon prices, have been touted but not locked down. The recent budget said the government will consult on the development of a broad-based approach to this measure without providing any timeline. In the same vein, after years of lobbying for parity with U.S. carbon capture and storage tax credits, the federal government first embraced the concept in its 2021 budget. After consultations, it announced the size of the credits in budget 2022. Today, Ottawa and Alberta still have not put forward a final formulation of how much combined burden the two levels of government will take onto themselves and how much will be left to the private sector. In the meantime, several European countries have put their carbon capture supports into place and the U.S. Inflation Reduction Act (IRA) has put a further US$52 billion to work in attracting carbon capture investment.

Ever since the IRA became law in August 2022, Canadian companies have warned that its generous and simple provisions will draw investment away from Canada and into the United States. A recent article in The Logic recounted how a private investor had proposed to SaskPower that it could build a natural gas plant with carbon capture two kilometres into the United States that would provide cleaner power on behalf of the Saskatchewan utility while taking advantage of superior subsidies offered under the Inflation Reduction Act.

Uncertainty is the enemy of action. If the energy transition is really the biggest thing going on the planet, we need to be unrelenting in our policy focus, fleet-footed in bridging policy differences and focused on filtering everything – everything – through the lens of whether it accelerates or slows the transition. What will the impact of protecting more land mean for wind development? What will the failure to align federal-provincial policies around an Atlantic Loop mean for using up the remaining carbon budget, or ensuring Atlantic Canada has a clear path to its 2030 and 2050 goals? What will support or lack of support for the decarbonization of fossil fuels mean for Canada’s chronic current account deficit and therefore our ability to cover the importation of solar panels and wind turbines and smart grids? What will obstacles to Indigenous ownership mean to containing counterproductive litigation that nobody desires? What is the strategic plan to unlock the potential of offshore wind in a country with the largest coastline of any nation (twice that of Indonesia, Russia, the United States and China combined) but without a single wind turbine on water?

Good policy must be joined-up policy, and it must include such factors as skilled labour availability and well-functioning supply chains. The employment narrative in the 2020s has shifted from one of chronic oversupply of workers to suddenly finding the economy hobbled by labour shortages. In both cases, skills were in inadequate supply. One cannot speak about erecting thousands of transmission towers without doing the hard work of determining where the labour and materials will come from.

As with all policy matters, this is not a matter for the government alone. Companies, learning institutions and civil society have a role to play to get out in front of potential impediments to a successful energy transition. Ontario’s nuclear refurbishments provide an example of a proactive approach to mitigating workforce challenges. In 2015, Bruce Power (a public-private partnership) and OPG (a Crown corporation) agreed to an integrated refurbishment schedule that will last nearly 20 years. A staggered progression of work at both the Darlington and Bruce sites enables greater efficiency in the timing of vendor and workforce contributions. The two companies have coordinated schedules to minimize having the same trades in demand at both sites at the same time and have worked together with worker associations and unions to standardize training and qualifications at the two sites.

As for supply chains, the spiking demand for the critical minerals and rare earths embedded in clean technologies raises all kinds of security-of-supply issues, including dependencies on unreliable or unstable trade partners such as China, Russia and the Democratic Republic of the Congo. The International Energy Agency warns that the global energy sector’s demands for critical minerals could increase by as much as six-fold by 2040. It notes that “unlike oil – a commodity produced around the world and traded in liquid markets – production and processing of many minerals such as lithium, cobalt and some rare earth elements are highly concentrated in a handful of countries, with the top three producers accounting for more than 75% of supplies.”

In response to these opportunities and geopolitical tensions, Canada is focusing on the development of its own critical mineral reserves, including another new tax credit. But these projects are subject to the same slow processes as energy developments; until those impediments are removed, Canada’s energy transition will be subject to the vagaries of the international marketplace in a time of geopolitical flux.

Timelines will also be affected by the difficult-to-ascertain progress of many net-zero technologies. One of the most influential studies to date is the Canadian Climate Institute’s 2021 report, Canada’s Net Zero Future: Finding Our Way in the Global Transition. It uses the analogy of “safe bets” to refer to technological choices that show up consistently across all scenarios, rely on commercially available technology, face no major barriers to scaling, have a reasonable expectation of continued cost declines and are therefore capable of delivering affordable energy. It also identifies “wild cards”: technologies that could play a critical role in unlocking deeper, cost-effective emissions reductions needed in 2050 but are still in early development, have uncertain costs or face barriers to scaling. Examples of wild card solutions include direct air emissions capture, second-generation biofuels, SMRs and hydrogen.

The climate institute believes that safe bets will deliver at least two-thirds of emissions reductions to meet Canada’s 2030 targets. But by 2050, wild card technologies may be necessary to achieve deep reductions in hard-to-decarbonize sectors. We have already noted the number of provinces leaning on SMRs and carbon capture, both of which it classifies as wild cards.

The challenge becomes how to ensure the biggest bang-for-their-bucks technologies are given a shot and that actions required to promote safe bets do not squeeze out potentially more effective solutions down the road. Our electricity grid must be able to integrate these technologies as they prove themselves but, in the meantime, remain focused on providing access to consistently reliable and affordable electricity that inspires confidence. The question becomes: how can we reduce the risks of what may turn out to be wrong choices by building a logical bridge from 2035 to 2050? Policymakers have to be careful not to inadvertently encourage near-term decisions that are subtractive rather than additive to the long-term goal. There is only so much money, input and labour to go around. We can’t afford to apply it inefficiently. Two energy transitions would likely be one more than can be managed in such a short time frame.

Let’s remember that, like the Germans and their LNG intake facilities, Canada also, for different reasons, has to put the offence on the field now – hurry-up offense. But there are defensive players on the field as well. They stand between the offensive forces of change and the goal line. If the hurry-up offense falls short – or is not employed – the only remaining option may be a final-seconds desperate gamble on high-risk and low-probability Hail Mary passes.

That would not be a recommended way to implement something as critical as the electrification Project of the Century.

On Feb. 2, 2022, 22 days before the invasion of Ukraine, the European Commission reversed course on its energy policy by reclassifying both natural gas and nuclear power as transitional fuels that now would qualify for green financing. This dramatic about-face came after a winter of discontent across much of the continent and the United Kingdom as natural gas shortages combined with low winds led to energy prices more than doubling. The self-inflicted damage was the product of European leaders swapping out proven systems before renewables had sufficiently worked through their reliability issues.

Canada will want to be cautious to avoid such a fate, which quickly brings us to the question of the role of natural gas-fired power generation in Canada’s energy transition: How policy moves away from unabated fossil fuels while accommodating the risks of turning away from a foundational fuel too early and putting the reliability of supply and affordability of electricity issues into play.

One thing is certain: nothing is permanently certain. Nuclear power was in disfavour with Canadian policymakers when it was excluded from eligibility for green bonds in March 2022 – about the same time Europe was adding it back in. Then in the March 2023 budget, nuclear was fully rehabilitated, with both new small modular reactors and refurbishments of larger facilities qualifying for tax credits, the Canada Infrastructure Bank making a $970-million loan in support of Canada’s first SMR, Ontario examining a major new nuclear plant next to the existing Bruce Power facility, and the number of provinces committed to a nuclear presence in their fleets jumping from two to four. Nuclear enjoys a rare consensus among governing political parties. In April 2023, alongside the president of Germany, Prime Minister Justin Trudeau said “very, very, very” in terms of how serious Canada is about nuclear. Conservative Leader Pierre Poilievre has stated: “There is no carbon-free future without nuclear power.”

This isn’t purely a Canadian phenomenon. A decade after the Fukushima disaster turned Japan against nuclear power, a combination of energy insecurity and carbon reduction commitments persuaded the Japanese to again shift gears in late 2022 with a plan to extend the lifespan of remaining reactors and build new ones. Sweden, too, has changed its stance on nuclear, changing its 2045 electricity target from “100% renewable” to “100% fossil-free.” Four decades after a non-binding 1980 referendum to get off nuclear, plans now are afoot to expand beyond its three remaining plants.

The run-up to Canada’s long-awaited Clean Electricity Regulations is turning attention to the role of natural gas and whether it will also make a comeback as a necessary transitional fuel or, perhaps, even more permanently if coupled with carbon capture.

To get a sense of the uncertainty of the energy transition and the anchor position of natural gas, you need to look no further than the Canadian Energy Regulator’s June 2023 energy scenario planning document. As with any modelling exercise, the analysis is based on a set of assumptions that may or may not live up to billing – except even more so given the “wild cards” nature of the transition. The inability to yet nail down some key future technology developments leads CER to put forward a list of “what ifs” that could well disrupt its scenarios.

One notable example is the model attributing almost all nuclear power generation growth of the new class of small modular reactors on the planning boards. However, “what if” SMR technology matures less quickly than supposed and is more expensive to implement? Well, that leads to 34 percent lower SMR generation. Where to make up for the shortfall? Through the use of CCUS-retrofitted natural gas generation. But “what if” CCUS is cost-prohibitive, or “what if” electric vehicle charging patterns result in higher peak electricity demand? The report’s uncomfortable answer is that natural gas without CCUS will be used more often.

For those provinces without a clear path to net-zero electricity, the place of natural gas in the energy transition is especially important. Saskatchewan, for instance, needs to wean itself off coal by 2030 and hopes for an SMR future in the 2040s. It doesn’t have confidence that wind or solar can bridge that gap. In May, Premier Scott Moe condemned Ottawa’s 2035 net-zero electricity goal as “impossible and unaffordable” and asserted he was setting his own 2050 target.

Although a fossil fuel, natural gas (with major assists from nuclear and renewables) has played the leading role in Canada’s single greatest emissions-reduction success story – the phaseout of coal in Ontario and Alberta. For each unit of natural gas displacing a unit of coal, emissions fell 50 percent.

The pressure, at least in the medium term, on electricity supplies makes getting off natural gas while retaining reliability and affordability a difficult line to tread. The problem becomes especially acute if and when electricity displaces natural gas as the main energy source for home heating. Simply put, there is currently not nearly enough power available, even at the peak, to heat homes on Canada’s coldest days. On Dec. 27, 2021, the lowest temperatures ever recorded in British Columbia’s Lower Mainland caused a sudden and steep spike in home heating demand. If there had been no gas system and heating was fully electrified with conventional heaters, the demands on the provincial grid would have required approximately three times the province’s entire installed generating capacity. Even if high-efficiency electric heat pumps were to replace today’s home furnaces, the combined load from heating homes on such a frigid day, along with additional loads required to reduce GHG emissions such as from vehicle charging, would require additional generating capacity with storage equivalent to six Site C hydroelectric projects.

The same phenomenon occurred in Alberta in December 2022, as cold temperatures stilled the wind and blocked the sun. The province’s 5,000 MW of renewable capacity only generated 187 MW to 1,796 MW of power through the month. It was left to natural gas to pick up the slack. Swapping electricity with the utility next door could theoretically offer a way to manage this risk, but weather-related seasonal peaks in neighbouring provinces tend to move in similar cycles.