Rhetoric vs. Results

Shaping policy to benefit Canada’s middle classExecutive Summary

In the 30 years after World War II there was a remarkable growth in the Canadian standard of living. Average real weekly earnings grew at a rate that more than doubled every 28 years. The typical family not only experienced a steady material improvement, but parents could expect that their children would have double their own standard of living.

The fruits of this growth came not just in the form of higher private living standards, but the “social wage” also grew through the expansion of publicly provided health care, better pensions for seniors, and resources to address personal and regional income disparities. Public support for the taxes needed to fund this expansion was supported by the steady increase in real purchasing power the typical Canadian family was experiencing.

This remarkable growth was the result of the policy framework outlined in the White Paper on Employment and Income tabled in Parliament by C.D. Howe in 1945 which established raising the standard of living of Canadians as a “great national objective, transcending in importance all sectional and group interests.”

Since 1976, however, the growth in average real weekly earnings has slowed dramatically, and now would take more than 400 years to double. Because housing prices are imperfectly reflected in the Consumer Price Index this understates the stagnation of wages relative to the most significant cost for the Canadian dream. In 1976 the average price of a house represented 3.8 years of average earnings; in 2019 the average price represented 9.8 years of average earnings.

This stagnation was the result of the revised policy framework that emerged after the economic challenges of the 1970s. For most of the past 40 years Canada has been in a “bad equilibrium” wherein real wages have essentially stopped growing. In the absence of rising real wages the need for private sector innovation was reduced, resulting in lower investments in productivity-boosting capital, new products, and technologies. Because the rate of productivity increase has fallen significantly, business is more and more focused on keeping labour costs low. Stagnant real wages and a sense that workers are viewed as a cost to be minimized undermines workers’ commitment to innovation and productivity improvement. Government policy, consciously or unconsciously, has sustained the resulting low-wage-low-productivity model of competitiveness, hence keeping Canada in the bad equilibrium.

Turning this around will require a fundamental re-commitment to a steady improvement in the standard of living of the broad middle class – families that are reliant on employment for their primary source of income and that have limited individual market power to affect the wages they receive – as a central priority of government.

This commitment needs to be much more than pledging fealty to the middle class at election time and various boutique programs. It will require conscious and coordinated changes in key policy areas that will move the Canadian labour market from being the “buyers’ market” which it has largely been over the past 40 years, to a “sellers’ market” where real wages begin to rise again. This in turn will drive an increase in productivity growth, thus moving Canada to a “good equilibrium” – a higher-wage-higher-productivity model of competitiveness.

The policy changes required are:

- A re-orientation of monetary and fiscal policy to put more emphasis on achieving full employment;

- Paying attention to the basic arithmetic of wealth generation – wages paid, and net government revenue generated – in determining which economic-base industries to encourage or discourage;

- An approach to innovation that is based on a realistic analysis of what will, in the Canadian context, ensure benefits are broadly shared across the Canadian population;

- A shift away from immigration policy that is focused merely on increasing GDP to one focused on increasing GDP per capita and the economic success of newcomers and existing Canadian residents.

In April 1945, with the end of World War II imminent, C.D. Howe, Canada’s minister of reconstruction, presented a report to Parliament called the “Canadian White Paper on Employment and Income.”[1] On the surface it was quite an unremarkable document — no gloss, no pictures, virtually no “spin.” Just 14 pages of dense type, with a prose style that could most charitably be described as workmanlike.

But in substance and effect, it stands out as one of the most remarkable documents in Canadian economic history. It established that the most important role for the Canadian government in the postwar period would be to engineer a steady increase in the standard of living of Canadians. And it laid out methodically and comprehensively how it would do that.

The White Paper reflected a general policy consensus amongst the countries that later would form the OECD that can be labelled the Keynesian mixed economy — a market economy, but with active macroeconomic policy to achieve and maintain full employment and an understanding that economic progress would be a collaborative effort of the public and private sectors.

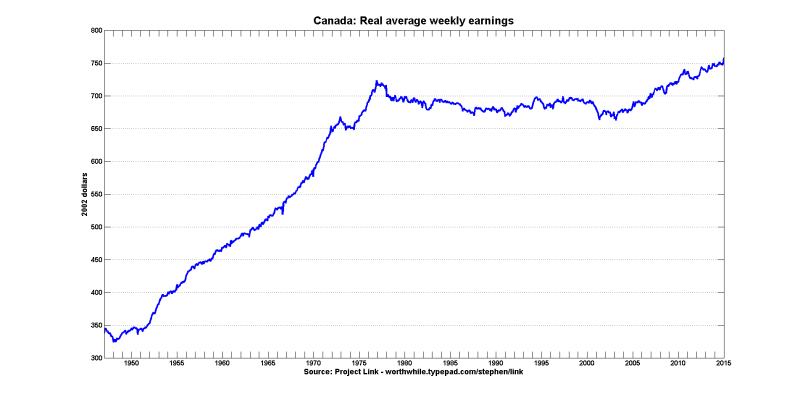

The outcome of this policy orientation was an unprecedented growth in Canadian standards of living over the next 30 years. The period up to 1976 in Figure 1 captures the best single snapshot of this. Over that time, the average real weekly earnings more than doubled. They grew at an average annual rate of 2.54 percent — doubling every 27.6 years. Essentially, a generation would enjoy double the standard of living of its parents thanks to rising income from employment.

The fruits of this remarkable growth came not just in the form of higher private living standards, but the “social wage” also grew through the expansion of publicly provided health care, better pensions for seniors and resources to address personal and regional income disparities. Public support for the taxes needed to fund this expansion was enhanced by the steady increase in real purchasing power the typical Canadian family was experiencing. It was, in contemporary lingo, a win-win.

Then, after three glorious decades, this all came to a screeching halt. Figure 1 shows the pronounced flattening of real weekly earnings after 1976. Between 1976 and 2019, they rose at a miserly annual rate of 0.16 percent. A generation would now have to live well over 400 years — an Old Testament lifespan — to double the standard of living of its parents.[2]

Figure 1 – Canada: Real average weekly earnings

This stagnation in living standards should be of great concern for three fundamental reasons.

The notion that the typical family can look forward to its standard of living steadily rising over time, and that people can expect their children and grandchildren to enjoy an even better life would seem to be a not unreasonable expectation of government for the people. It certainly would have been the expectation of virtually all the immigrants who have come to Canada over the centuries.

The international research shows a strong relationship between happiness/well-being/life satisfaction and rising real incomes.[3]

Yes, there are other influences on life satisfaction — other dimensions of the good society — but as that great modern philosopher Kanye West put it succinctly, “Having money isn’t everything. Not having it is.”

Zero-sum societies don’t make for healthy politics. A society where improvement for some can only come at the expense of others is a perfect recipe for a war-of-all-against-all. The alternative rising-tide-lifting-all-boats society facilitates more trust and generosity — among different groups and between citizens and their government. Increasing trust promotes “social capital” enabling society to function more effectively on multiple dimensions.

People are less prone to resent taxes paid to government if they see that their disposable income is steadily rising and that they are benefiting from investment in public goods.

The good society does not come cheap

There are many imperatives that need to be advanced in Canada’s desire to become more equitable and sustainable:

- Reconciliation with First Nations;

- Poverty reduction;

- A more inclusive society generally; and

- Decarbonization.

These will all require significant sums of tax dollars. Generating those tax dollars will require robust economic growth where the broad population is seeing a steadily rising standard of living in order for this to be politically sustainable.

It is concerning how blasé those that have dominated society’s narratives and decision-making[4] have been about this end of personal income growth. It has, of course, been noted and discussed with some concern.

And at every election, competing parties pledge fealty to the middle class, and declare how they will turn things around if they are awarded a mandate by voters. But nothing fundamental changes.

A few boutique tax breaks here, some topping up of childcare programs there, but nothing serious, coherent or ambitious to address the fundamental supply-and-demand dynamics in the labour market, where the middle class earns the preponderant share of its income.

In some ways, voters appear accepting of this, perhaps because of a generalized cynicism toward their leaders, perhaps because of an under-developed understanding that things can and should be different. In other ways, we can see the consequences of stagnant personal incomes and entrenched inequalities in the form of political restiveness, populism and polarization.

This paper will argue that Canada no longer can afford to treat this 0.16 percent factor so lightly, that it is imperative it turn it around for reasons of fairness and cohesion, not to mention economic success. To do so will require taking a significantly different approach than the one taken for the past 40 years. What that looks like comprises the heart of the paper.

To foreshadow, the outline of the argument is as follows. For most of the past 40 years, Canada has been in a “bad equilibrium,” in which real wages have largely stopped growing. The absence of rising real wages has resulted in a less innovative private sector, with lower investments in productivity-boosting capital, new products and technologies. Because the rate of productivity increase has fallen significantly, business is more and more focused on keeping labour costs low. Government policy, consciously or unconsciously, has sustained the resulting low-wage-low-productivity model of competitiveness, hence keeping Canada in the bad equilibrium.

Moving from this bad equilibrium to a “good equilibrium” — a higher-wage-higher-productivity model of competitiveness — will require conscious and co-ordinated changes in several policy approaches that will move the labour market from being the “buyers’ market” which it has largely been, to a “sellers’ market” where real wages begin to rise again. This in turn will drive an increase in productivity growth.

The argument will be structured in four sections. First, it will go back to the 1945 White Paper and identify the crucial elements of that policy framework that worked so well to deliver rising living standards for a generation. Second, it will briefly explore why things changed after the 1970s. Third, it will shift to the prescriptive part of the argument, laying out the key elements of what needs to change. Finally, it will offer some concluding comments.

The policy framework that Canada shared with the other OECD countries provided the basis for 30 years of steadily rising living standards. The White Paper situated that framework in Canada’s particular circumstances. A quick review of its essence is important context to inform our consideration of Canada’s current challenges. The White Paper contained eight visionary elements tucked into its 14 pages.

1. An unequivocal commitment to full employment

In its conclusion, the White Paper states:

“In this paper, the Government has stated unequivocally its adoption of a high and stable level of employment and income, and thereby higher standards of living, as a major aim of Government policy.”

Prior to that concluding call to arms, the White Paper stated that “the Government is not selecting a lower target than ‘full employment’.”

The White Paper made it clear that the government would use both fiscal and monetary policy to achieve this:

“The Government will be prepared, in periods when unemployment threatens, to incur the deficits and increases in the national debt resulting from its employment and income policy, whether that policy in the circumstances is best applied through increased expenditures or reduced taxation.”

2. Prudent management of the public debt

While the government was willing to use fiscal policy to stimulate the economy in downturns, it also was explicit, in classic Keynesian terms, that this had to be balanced off on the upside of the business cycle:

“In periods of buoyant employment and income, budget plans will call for surpluses. The Government’s policy will be to keep the national debt within manageable proportions and maintain a proper balance in its budget over a period longer than a single year.”

3. An appreciation for appropriate private and public sector roles and collaboration

The private sector would remain the primary driver of investment decisions:

“The decision to invest private funds in capital goods will depend on the [businessman’s] view of the prospective margin of profit to be made on the investment.”

But the creation of wealth would be viewed as a collaborative exercise amongst government, business, organized labour and other key stakeholders:

“It has been made clear that, if it [high employment and rising living standards] is to be achieved, the endeavour to achieve it must pervade all government economic policy. It must be wholeheartedly accepted by all economic groups and organizations as a great national objective, transcending in importance all sectional and group interests.”

There was also a clear recognition that public investment had a productive role to play alongside private investment.

4. An understanding of Canada’s economic base

The White Paper featured an extensive discussion of the fact that Canada was a small economy and as such needed to secure access to world markets, and to export goods for which it had a comparative advantage — the resource industries as well as the expanded manufacturing industry that developed as a result of the war effort.

5. An understanding of the need to continually improve productivity levels

“A higher degree of productivity efficiency is necessary to maintain the desired level of income and a correspondingly high standard of living.”

To this end the government indicated its intention to continue to invest in hard infrastructure — the seeds of the domestic civil airport system, the St. Lawrence Seaway and the Trans-Canada Highway were sown here — as well as “soft infrastructure” — purpose-driven science and industrial research and worker training.

There was also an implicit understanding that what we now call creative destruction was an integral part of raising living standards. There are several references to the need for resources to be reallocated to new consumer demands, new industries and new materials. This is a key point to which we will return throughout the paper.

6. An expectation that the benefits of productivity increases would be shared with workers

The paper put forth that increased productivity and higher wages were inextricably linked:

“Labour, which will benefit most from high levels of employment, will make an essential contribution to the solution of the postwar problem by assisting management in making high labour earnings compatible with low costs through skilful, abundant and efficient production.”

7. Social safety nets to mitigate the costs of creative destruction

In particular, the extension of the Unemployment Insurance Act (which had only come into operation in 1941) to the postwar period, the provision of worker training programs and the payment of higher unemployment benefits to workers participating in those programs all reflected the government’s understanding of the ongoing need to reallocate resources from industry to industry and to reward those willing to retool their skills as the economy evolved.

8. An understanding of the need for business to have a reasonable prospect of a competitive return on its investments

“The Government recognizes that wartime taxation, both in its forms and rates, is discouraging to investment. … The Government proposes not only to reduce taxation as rapidly as possible, but to develop its fiscal policy so as to encourage the increase of private investment to a high and stable level. It is proposed particularly to eliminate or minimize taxation which contributes to a higher level of production costs.”

The White Paper was bold and balanced — with a relevance that resonates through the ensuing decades. Three further comments are useful context for the arguments in this paper.

First, one doesn’t have to strain very hard to see a strong social contract based on high productivity, high wages and full employment. Those can all go together.

Productivity increases provide the basis for increases in real wages, while the “tight” labour market fostered by full employment will compel employers to raise wages in line with the productivity increases lest they lose workers to employers who will.

And a significant role for unions — both to level the asymmetry in bargaining power between employers and individual workers and, ideally, as a partner in “assisting management in making high labour earnings compatible with low costs” — buttresses this.[5]

Second, despite its ambition, the framework cannot be described as “big government,” at least in the current sense of that term. Through the 1950s and the first half of the 1960s, total federal expenditures stayed in a relatively narrow range of 14 to 16 percent of GDP.

Rather than big government, it was ambitious, focused and capable government. Informed by the success of the war effort — a full employment economy, the massive increase in the industrial base, the understanding of the productivity potential of scientific and industrial research and the experience curve — the government put a single-minded focus on raising the standard of living of Canadians.

It was only after the major expansion of federal-provincial cost shared programs in the Lester Pearson era that the GDP percentage of federal expenditures began to climb. It was as if Canada had decided to make itself richer first and then decided to spend some of that increased wealth to expand — in both absolute and relative terms — public programs.

The final point is of critical importance to the argument that follows. That is the implicit acceptance of the inevitability and value of creative destruction. We have shown the government’s recognition of the need to support workers who would be dislocated. But the even more significant point is what this meant for business.

The government was committed to full employment and the sharing of productivity gains with workers, which resulted in a steady year-over-year increase in real wages.

Full employment and rising wages, in turn, created an imperative for companies to innovate — to develop better processes, develop new and more valuable products or develop better business models so that they would remain viable as real wages continued their steady rise. Even non-unionized companies would have to deal with this — a failure to increase real wages would result in workers voting with their feet, and the company would go out of business for lack of a workforce.

To put it succinctly, the 1970s happened. None of the OECD countries had a good decade. Unemployment and inflation both rose — “stagflation” — to postwar highs, stock markets tanked, productivity growth slowed and OPEC delivered a “supply shock” by way of significantly higher oil prices,[6] government deficits started rising. And then there was disco. It was a terrible decade all around.

We could spend a lot of time debating the underlying reasons for all of this, but two key points stand out.

First, the Keynesian model didn’t properly account for how economic actors will adjust their behaviour in response to changes in policy. As inflation rose, companies and workers revised upwards their expectations of inflation and incorporated that into pricing, wage-setting and investment decisions. Policymakers could not buy a permanently lower unemployment rate with a slightly higher but stable rate of inflation.

Second, governments found it increasingly difficult to manage the politics of countercyclical fiscal policymaking. It was easier to run deficits than to run surpluses, even when the Keynesian prescription called for surpluses. This was most significant in the U.S. where the administration was reluctant to raise taxes to finance an unpopular war in Vietnam, and the economy overheated to the point that inflation started to accelerate. Under the fixed exchange rates of the Bretton Woods system, this inflation was exported to the rest of the world.

Canada also struggled with the politics of balanced fiscal policy, and federal expenditures and deficits climbed through the 1970s and early ’80s. Federal expenditures peaked at 25 percent of GDP in 1982 and the federal deficit reached a high of eight percent of GDP in 1984.

Through the 1970s, governments tried all kinds of different approaches to deal with stagflation. The U.S. walked away from the Bretton Woods regime, which had disciplined the postwar policy regime in the OECD countries. Fixed exchange rates were replaced by floating exchange rates. Many countries — including Canada and the U.S. — experimented with different variations of price and wage controls. Nothing seemed to work.

In 1979, Paul Volker became head of the U.S. Federal Reserve and set out to bring inflation under control with a vengeance. Margaret Thatcher became prime minister of the United Kingdom and committed to a thorough rewrite of that country’s social contract. Ronald Reagan defeated Jimmy Carter in 1980 with a similar, albeit more genially delivered, agenda. Thatcher and Reagan took measures to reduce the power of organized labour. After the most severe global recession in 50 years, inflation did come down significantly, the stock market rebounded and economic growth recovered.

Canada was largely swept along by all of this. Interest rates went sky-high, exports were hurt by the global turndown, and it shared in that severe global recession. While economic growth did resume in 1983, it was weaker than in the previous decade and there was another recession in 1991. A decade after the 1982 recession, the annual unemployment rate was as slightly higher than it had been in that year — 11.2 percent versus 11.00 percent.

Finally, the collapse of communism in the Soviet system and the redefinition of China’s version of communism to be “socialism with Chinese characteristics” led to a sense of “triumphant capitalism” as the only viable model of economic development.[7]

What emerged from all of this was a new dominant policy consensus — variously dubbed “neoliberalism” or the “Washington consensus” — that had three main components:

- Central banks would be charged primarily with engineering low and stable inflation — by the 1990’s this “low” came to be defined as two percent;

- Increased liberalization of trade and capital flows, including fully integrating the formerly communist countries into the world trading system; and

- A general belief that the private sector should play a more dominant role in determining investment directions (e.g., the widescale privatizations of state enterprises.)

There was a complementary development that, while it wasn’t explicitly part of the dominant policy consensus, did reflect many of the same intellectual responses to the economic challenges of the 1970s. This was the rise of the “shareholder primacy movement,” which argued that a significant part of the explanation for the suboptimal performance in the 1970s was ineffective corporate governance, and led to corporate raiders, leveraged buyouts and expanded use of incentive pay for executives focused on short-term increases in stock prices.[8]

This truncated history isn’t meant to paint all the policy response as wrong. The postwar policy framework had come apart under its own “internal contradictions.” Constantly accelerating inflation would undermine the health of the economy and society more broadly. Central planners cannot possibly obtain and analyze all the information to make price and wage controls work over any extended period in peacetime. Many major corporations did seem to suffer from a middle-aged bloat and complacency that was undermining their ability to meet consumer needs — e.g., Detroit in the 1970s.

And yet.

It seems in the process that Canada lost something even more substantial. It lost its focus on continually raising the standard of living of the broad middle class.[9]

After unemployment peaked at 13.1 percent in December 1982, it is understandable that the focus would be on the “Jobs, Jobs, Jobs” that Brian Mulroney made the centre of his successful election campaign in 1984, without as much concern about job quality — wage levels, working conditions and job security. But in the almost 40 years since, there really has never been a clear and unadulterated policy focus on raising the average real wage of the Canadian worker. Why is that?

The effect of the policy changes and corporate governance changes was to significantly undermine the bargaining power of middle-class workers — whether explicitly through their certified bargaining agents if they were unionized, or implicitly through the general supply and demand dynamics in the labour market. It is a central tenet of this paper that this weakened bargaining power is the primary reason why real wage growth has been so disappointing for so long.

It is useful to briefly trace through the causation chains that led to these results.

The impact of targeting low and stable inflation

The Bank of Canada was successful in engineering low and stable inflation. Between 1982 and 1992 CPI inflation in Canada decelerated from 12.5 percent to 1.5 percent and thereafter has stayed tightly bound around 2 percent.

Arguably, the Bank was too successful. Between 1992 and 2019 CPI inflation averaged 1.8 percent and it was below 2 percent more often than it was above that target. This outcome is understandable — if central bankers are told their primary objective is to maintain low inflation, it is predictable that they will err on the side of a lower rate of inflation rather than a lower unemployment rate.

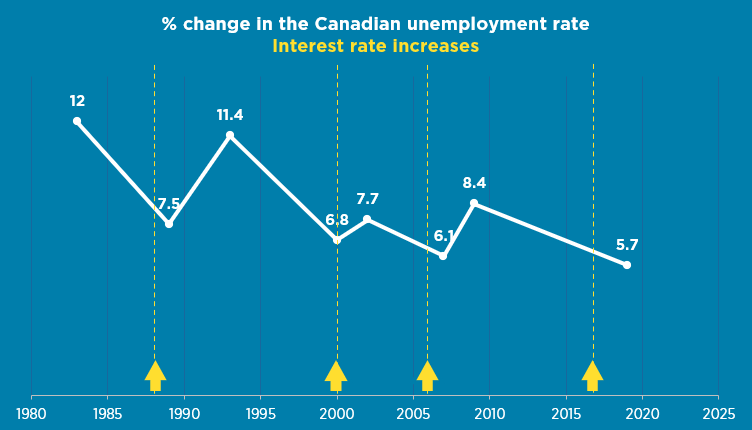

The default of the last 40 years has been to tap on the brake at the first prospect of an uptick in the rate of inflation, as was done in 1988–90, 2000, 2006–07 and 2017–19 — a pattern that was roughly consistent in Canada and the United States.

What is clear in retrospect is that the U.S. and Canadian economies were capable of running “warmer” — that unemployment rates never got low enough to risk a replay of the late ’60s/early ’70s. The figure below is instructive in this regard. At each instance of interest rate increases the unemployment is higher than it subsequently gets to in the next cycle – suggesting that, at least through 2017, the Bank of Canada consistently began trying to slow the economy down prematurely.

A similar pattern prevailed in the U.S. Prior to the pandemic, the unemployment rate in Canada was lower than it had been in 45 years. In the U.S. it was lower than it had been in 50 years. And even then, there was little indication that inflation was starting to accelerate. In other words, there was room to run the economies in both countries at higher levels of employment.

For virtually all of 1982, Canada was running at less than full employment — the labour market was mainly a “buyers’ market” where workers had very weak explicit or implicit bargaining power. In such a situation, it is little wonder that real wage growth was weak.

The distributional consequences of globalization

Before the 1990s, China, the Soviet Bloc and India were not significant participants in the global market economy. Then, suddenly, they were. In essence, the labour supply in the global market economy virtually doubled overnight. At the same time, these economies did not contribute anything like a proportionate amount of capital to the global capital base, so labour now became relatively more plentiful, and capital became relatively scarcer.

From the perspective of the developed economies, this was going to be good for owners of capital, but not good for workers. This is something that economists have known since at least 1941,[10] but this has been finessed with a notion that on net there are gains from trade and that the losers can, in theory, be compensated.

Rarely, however, is this theoretical compensation made a reality. It was not provided in the context of this effective doubling of the global economy’s labour force. The impact on working class employment and wages in OECD countries was profound. The literature on this is quite extensive,[11] but is perhaps best captured by Canada’s current Minister of Finance in her 2013 Financial Times Best Book of the Year, Plutocrats: The Rise of the New Global Super-Rich and the Fall of Everyone Else:

“Both globalization and technology have led to the rapid obsolescence of many jobs in the West; they’ve put Western workers in direct competition with low-paid workers in poorer countries; . . . median wages have stagnated, as machines and developing world workers have pushed down the value of middle-class labour in the West.”

There is another dimension to the distributional impact of globalization that has not received the attention that it should. Klein and Pettis argued in an important book last year[12] that countries that habitually run significant current account surpluses — in absolute terms the largest surpluses have recently been run by China, Germany and Japan — impose significant burdens on countries that have deep capital markets, are considered hospitable to foreign investment and do not put restrictions on capital inflows. The major country in this category is the United States, but Klein and Pettis note that other “anglosphere” countries — the United Kingdom, Canada and Australia — also fit the description.

The current account surplus countries don’t generate sufficient domestic demand to consume the equivalent of their GDP and make up for their lack of domestic demand by “forcing” the capital hospitable countries to run equivalent current account deficits.

It is not the case that the receiving countries need the capital — productive investment opportunities are adequately funded out of domestic savings. Rather, capital imports get channeled into asset classes that destabilize or create claims against future income of the receiving countries. For example, Klein and Pettis make a convincing argument that the U.S. housing bubble of the mid-2000s, which was at the heart of the great financial crisis, was fuelled in significant part by inflows of capital from the current account surplus countries. The impact of foreign capital flowing into real estate also has its analogue in Canada, although the form of the investment has tended to be direct purchases rather than loan capital.[13]

Their analysis is sophisticated and complex, and this short summary doesn’t do it justice. But a key result is that this effectively suppresses real wages of the middle classes in both the surplus and deficit countries, and if a current account deficit country wishes to fully address the distributional implications of globalization, it may need to be prepared to put some restrictions on the inflow of capital from current account surplus countries. This will be discussed briefly below when we turn to looking at ways to get middle class living standards rising again.

There was a significant productivity slowdown in the OECD countries starting in the 1970s. There is still great debate about what caused this, and whether it is remediable or not.[14] Since 1976, Canada’s productivity performance has been the worst of all countries that were OECD members in that year.

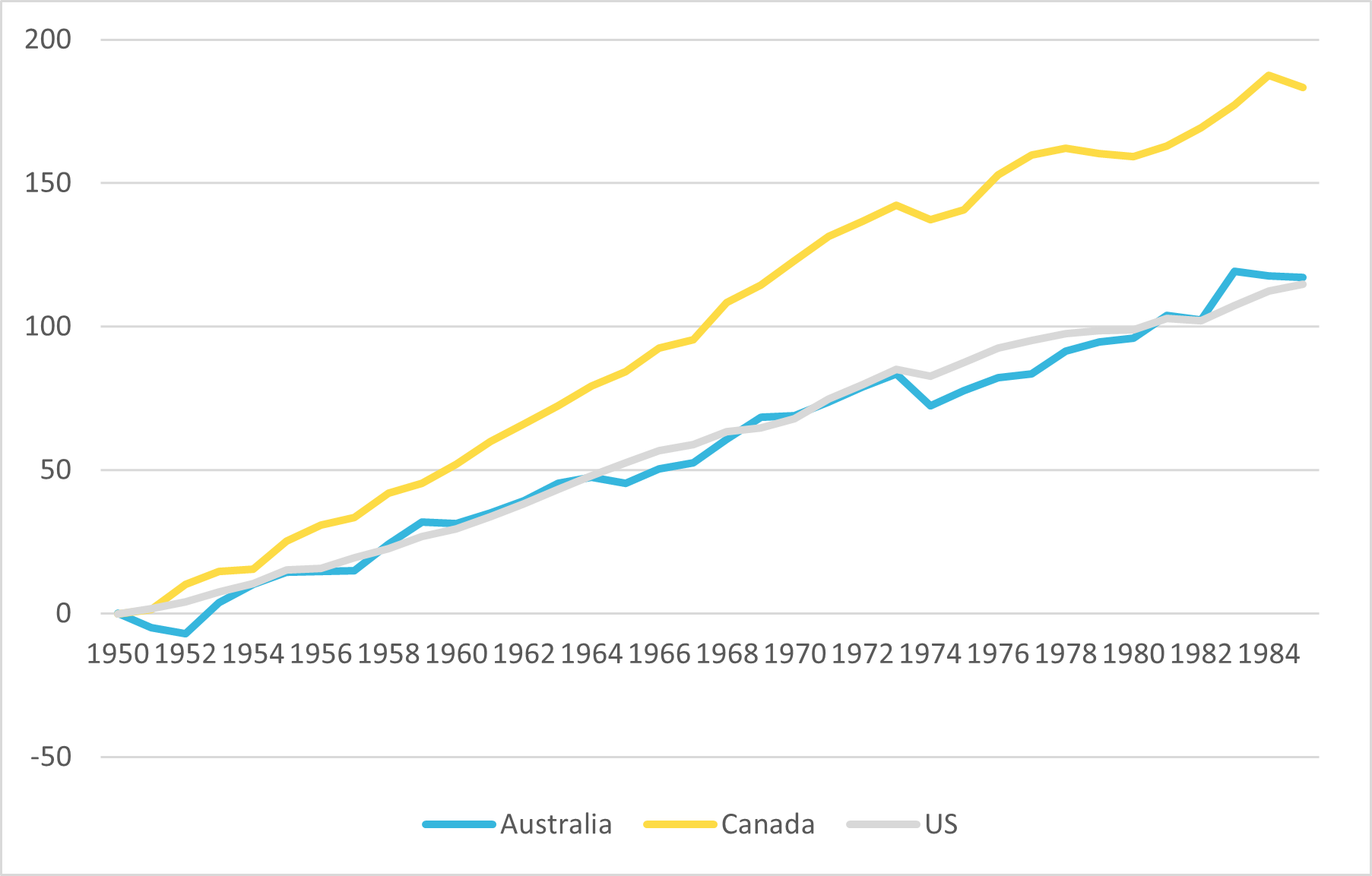

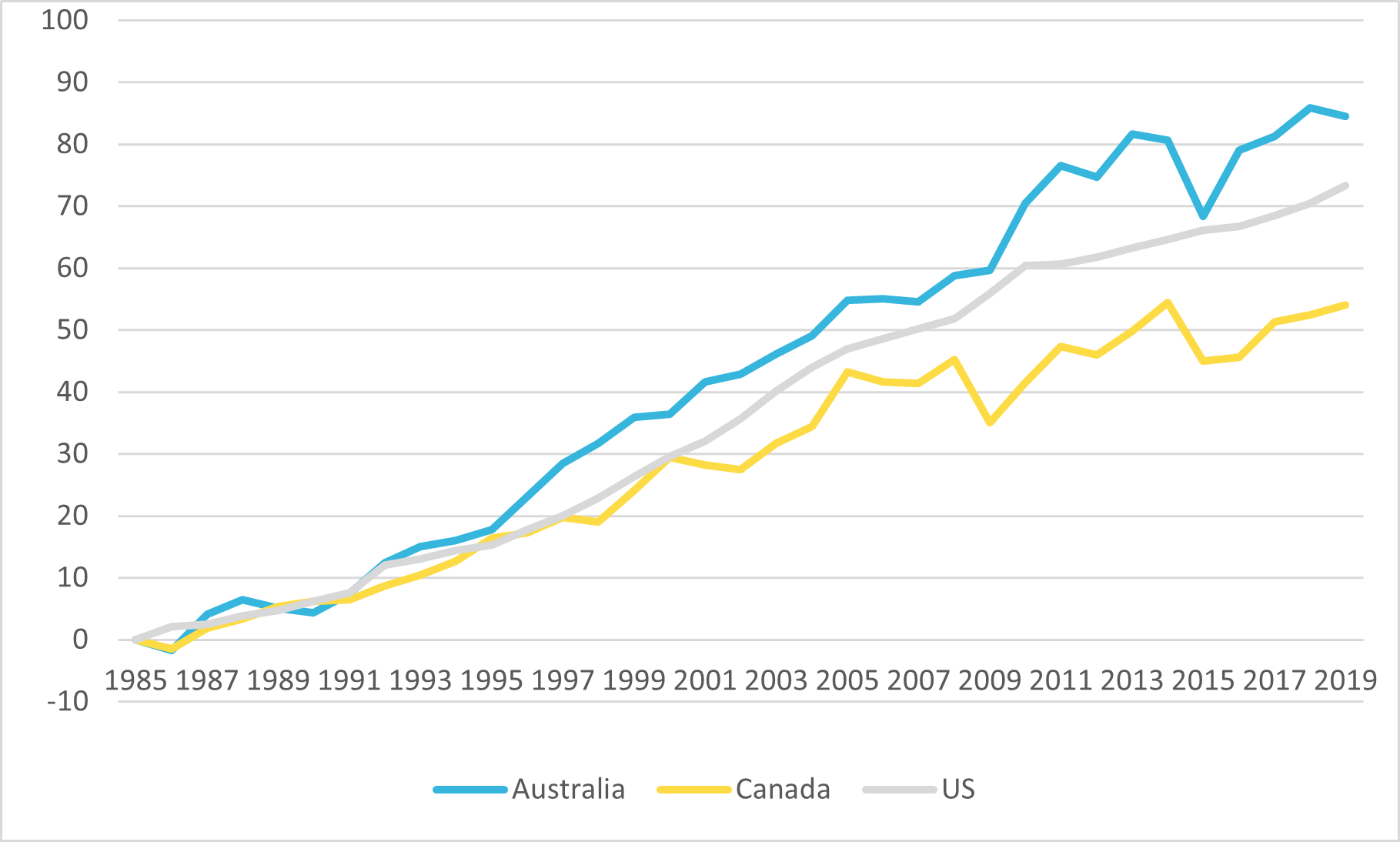

To keep comparisons simple, compare Canada’s performance to just two countries — the United States and Australia — the former because the U.S. is Canada’s largest trading partner, the latter because it is often argued that Canada’s poor performance is a function of its reliance on natural resources, and Australia is the best OECD comparator to Canada in that regard. Figure 2 below shows the cumulative increase in productivity for these three countries between 1950 and ’85; Figure 3 shows the cumulative increase in productivity between 1985 and 2019.

Between 1950 and ’85 Canada did relatively well. While all three countries had a slowdown after 1973, Canada’s productivity grew at a faster rate over the entire period. Canada significantly improved its productivity relative to the United States — in 1950 its productivity was only 66 percent of that of the U.S.; by 1985 it had risen to 87 percent. This relatively strong performance was reversed after 1985. Canada’s performance was the poorest of the three countries, and its productivity relative to the US had fallen back to the 78 percent. And note that the “resource curse” did not hold Australia back relative to the U.S.

Is this disappointing productivity story the major explanation for the reduction in the rate of growth of living standards? On the face of it this seems plausible. Certainly, a business could not stay viable if it kept increasing real wages faster than productivity growth. So, the argument would go, weak productivity growth leads to weak real wage growth, and the solution is straightforward — just get productivity growth back up to healthy levels. Obviously easier said than done.

Figure 2 — Percent Increase in productivity per hour worked, Canada, Australia and the United States between 1950 to 1985

Source: Feenstra et al 2015 Penn World Tables 10.0

Figure 3 — Percent increase in productivity per hour worked, Canada, Australia and the United States between 1985 and 2019

Source: Feenstra et al 2015 Penn World Tables 10.0

While there is a superficial plausibility to this, there is a bit of an anomaly to explain. Disappointing as productivity performance has been since the 1970s, real wage increases have lagged increases in productivity in Canada and the U.S. This anomaly hints at the possibility that the direction of causation between productivity increases and real wage increases in this explanation is not quite right.

Disappointing real wage growth has coincided with a very weak productivity performance. While the direction of causation has generally been defined as flowing from weak productivity to weak real wage growth, a core thesis of this paper is that causation flowed in the opposite direction. Specifically, changes in business executive incentive structures, business “norms” and slack in the labour market led to a change in businesses’ strategic focus away from innovation and productivity improvement and towards minimizing costs, and in particular labour costs, instead.

Business executives’ time, the capital they have available to invest and their shareholders’ patience are all scarce resources. While textbook economics have businesses optimizing their decisions over all possible strategies, the reality is that executives live in a world of “bounded rationality” and “satisficing.”[15] There will naturally be a narrowing of focus to the strategies that offer the relatively easiest and safest ways to maintain their companies’ viability and hopefully maintain a healthy return to shareholders and their own jobs. The “strategy solution set” available to a firm will reflect the competitive conditions it faces, as well as the general business norms of the day.

Recall the comments above about what creative destruction meant in the postwar period. Real wages were rising steadily year-after-year and this created an imperative to develop better processes, products or business models — to innovate. If a company had pursued a strategy of holding down labour costs in this environment, it would likely have been unsuccessful because its workforce would have gone on strike if it were unionized or non-unionized workers would have simply walked out the door one-by-one as better employment opportunities came up elsewhere.

But the environment changed dramatically in the 1980s:

- As noted, central banks became single-minded in pursuing low and stable inflation. Consequently, unemployment was quite high relative to the unemployment rates of the 1950s and 1960s. In the 1950s and 1960s, the Canadian rate averaged 4.6 percent and never got higher than 7.1 percent. In the 1980s, it averaged 9.4 percent and never got lower than 7.5 percent. If we can depict the labour market through the early 1970s as a “sellers’ market,” it clearly became a “buyers’ market” thereafter until at least the few years prior to COVID;

- We discussed the impact of trade liberalization above, but in addition to the reduced tariff penalty for offshoring, advances in technology continued to make it easier to manage global supply chains. This meant business could offshore production and, even if it didn’t, it could credibly threaten to do so, undermining workers’ bargaining power;

- Union density in the private sector fell steadily.

In addition to these macro factors, the changes in corporate governance and executive compensation — shareholder primacy, corporate raiders, leveraged buyouts, expanded use of incentive pay focused on short-term stock prices — increased executive focus on short-term results. A boost to short-term results is much easier to achieve through cost-cutting than methodical investment in productivity improvement.

In sum, management had an increased incentive/imperative to reduce costs in the short-term, and an increased ability to achieve those costs either through outsourcing or through lowering real wages. Workers had much weaker bargaining power to resist this because a “loose” labour market resulted in a reduced ability for workers to vote with their feet, and unions knew they were facing a more credible threat to outsource or shut down entirely. In such an environment, more firms will focus their strategy on cost containment rather than investing in innovation with its long and uncertain payoff.

This focus on cost-containment and labour cost-cutting eroded the workforce commitment, enthusiasm and trust needed to achieve higher productivity. Contrast this with the White Paper’s emphasis on how workers, because they will benefit, “will make an essential contribution … by assisting management in making high labour earnings compatible with low costs through skilful, abundant and efficient production.”

Now, this is painting with a rather broad brush. Not every company re-oriented its strategy this way. Furthermore, this is not meant to criticize business decisions — to repeat, the feasible strategy solution set that a business considers reflects the competitive environment it is facing. But it is a general enough tendency that it needs to be considered as Canada formulates a plan to turn things around.

This suggests that the relationship between productivity increases and real wage increases is more complex than a unidirectional causation that goes from productivity increases to higher real wages. Productivity increases will only translate into higher wages if workers’ bargaining power is strong enough to compel this. Furthermore, in the absence of steadily rising real wages, businesses will have less incentive to invest in productivity improvements. Steadily higher wages will lead to higher productivity.

That too many businesses are locked into a low-wage-low-productivity model of competitiveness is exemplified by the common business argument for more immigration — whether permanent or temporary. When businesses say they cannot find enough suitable workers, what they are really saying is they cannot find enough workers willing to work at the wage businesses want to pay.

Increases in the standard of living are driven by companies developing better processes, products or business models and by companies unable to do so making way for companies that can – creative destruction. Canada needs to migrate away from the low-wage, low-productivity model back to the high-wage, high-productivity model. This will not happen unless there is enough “tightness” in the labour market driving up real wages. Innovation is driven by scarcity and urgency, not by abundance and comfort.

Having sketched out the diagnosis, what is the prescription for a cure? Below are four general recommendations. As the main objective of this paper is to engender further discussion, it won’t get into details. The plan is to explore details in subsequent work.

Put raising the standard of living of the broad middle class back at the centre of policy

Saying that Canada needs to make a priority of raising the standard of living may seem unnecessary. Doesn’t every contender for political office say they are going to do that? Look for, example, at the title of the last federal budget before COVID — Investing in the Middle Class.

Anybody who has spent any amount of time in government or been a close student of government will be aware that a, maybe the, primary challenge is one of focus. There are so many “worthwhile Canadian initiatives” to be pursued; there are so many interest groups to be placated; there is so much inertia wired into large, only partly coherently managed bureaucracies; and there are always “events, dear boy, events!”

Unless a goal is established as one of a very, very few long-term priorities, and receives the commitment of, hearkening back to the 1945 White Paper, “all economic groups and organizations as a great national objective,” it likely will disappear into the bureaucratic ether.

Governments need to commit fundamentally to raising the standard of living of the broad middle class as a core, permanent objective. This commitment needs to be made real by a defining benchmark. Consider, for example, an emphatic rejection of the view that children will have a lower standard of living than their parents.

Rather, Canadians should expect that each generation will have roughly double the standard of living of the preceding generation. It will be government’s responsibility to ensure that the conditions necessary for this are put in place.

The historical reality is that governments in Canada have not acted as if this is one of the most important objectives of government for a long time. While there are many good programs delivered by provincial and federal governments, none of them has for more than 40 years focused on the only dynamic that is the sine qua non of a rising standard of living for the broad middle class.

Specifically, until the dynamics in the labour market translate into a “sellers’ labour market” for the labour services everyday people can provide in the present, real wages are not going to rise, and not enough businesses will be driven to invest in innovation. This requires governments to give explicit consideration to the demand-side and the supply-side of the labour market in a much more significant way than they currently do.

Until governments begin to put this at the centre of their thinking, they will continue to offer up Costco samples to the middle class when the middle class desperately needs a full course meal.

Recalibrate monetary and fiscal policy to run the labour markets “warm”

This follows naturally from the first point. Canada needs labour markets to be “tight enough” to create this sellers’ market for workers.

As discussed, the default of the last 40 years has been to tap on the brake at the first prospect of an uptick in the rate of inflation, as was done in 1988–90, 2000, 2006–07 and 2018–19. With the benefit of hindsight, the U.S. and Canadian economies could have run warmer.

Furthermore, as discovered after the global financial crisis in 2008, and as Canada is experiencing again now, there is less room to manoeuvre with monetary policies when inflation rates are near zero. Low inflation leads to low nominal interest rates. Low nominal interest rates make it extremely difficult, if not impossible, to get interest rates low enough to stimulate demand during downturns in the economy. The massive balance sheet expansions of central banks in 2008-09 and again in 2020 have led to some unhealthy distortions in asset prices, but not as much traction on the real side of the economy.

There are lots of factors to consider here, but we don’t need to get bogged down in the technical details in this paper. The basic point is that central banks need to be given a different objective function — one that is more focused on pushing the economy to full employment.

This need not be inconsistent with a stable average rate of inflation, hence my suggestion of the highly technical adjective “warm” rather than “hot,” though my intuition is that the optimal inflation rate is likely to be somewhat higher than 2 percent and the rate of inflation itself may not be the best intermediate target.

The Bank of Canada has been reviewing its mandate in the context of the quinquennial renewal of its inflation-control target with the government of Canada.[16] One of the options that has been discussed in its consultations is a “dual mandate” in which the bank would target both full employment and a low and stable inflation rate. While not privy to the internal thinking of the bank, a read of its summary of consultations and remarks made by the governor seem to be pointing at a renewal of a single target of a low and stable inflation rate, probably continuing with 2 percent as that target.

The arguments marshalled in this paper point to this being a mistake. If Canada repeats the same approach of the past decades, why would it expect a better outcome in the future? It is unlikely to see the degree of tightness in its labour markets, which will lead to increases in real wages and push businesses to be more innovative.

At the very least, the bank should be encouraged to be less risk averse in discovering how low it can get the unemployment rate before tapping the monetary brakes.

There are indications that the Federal Reserve in the U.S. is shifting towards such a stance. In August of last year, it updated its Statement on Longer-Run Goals and Monetary Policy Strategy. The Brooking Institute published a good commentary on what this means.[17] One passage in is worth quoting:

“The [Fed] is essentially saying it will not raise interest rates just because the projected unemployment falls below its estimate of the NAIRU [non-accelerating inflation rate of unemployment] unless there are signs of inflation increasing to unwelcome levels. In practice, this means that the FOMC [Federal Open Market Committee] will allow recoveries to go on unimpeded by monetary policy — even if unemployment rates get very low — as long as inflation remains subdued. This more inclusive definition of the employment mandate is thought to be especially beneficial to minority groups and low- and moderate-income communities. Research shows these groups get disproportionate gains from very low unemployment rates.”

The Bank of Canada should be encouraged to recalibrate along similar lines.

The title of this sub-section referred to a recalibration of both monetary and fiscal policy. We need to be careful here because governments are going to have to deal with the massive increase in public debt levels resulting from pandemic spending.

There is a fair amount of magical thinking floating around these days, suggesting that governments don’t have to worry about deficits because interest rates are so low. This is nonsense, as any simple exercise in looking at the pathway of debt servicing costs that result when debt is growing at a faster rate than GDP demonstrates, regardless of low interest rates.

Furthermore, interest rates are not going to stay low if Canada is at all successful in getting the economy to true full employment. It is essential that all governments dial back their pandemic deficits as the economy recovers.

Having said that, the very slow recovery from the 2008-09 recession and the current situation have demonstrated that when interest rates are very low, monetary policy alone cannot get Canada back to a healthy economy in any useful timeframe. Indeed, this was the primary point of Keynes’ General Theory in 1936. Canada should be prepared to use fiscal policy aggressively if it gets into a similar situation of a depressed economy with very low interest rates.

An overreliance on monetary policy in situations like this has very unhealthy distortionary effects — witness the current inflation of the housing market, investors taking on too much risk in the search for yield, and bizarre prices for bizarre assets such as nonfungible tokens.

To be clear, however, outsized deficit spending is only justified in the very unusual situation of very low interest rates. Unchecked increases in the debt-to-GDP ratio pose great risks for sustaining the capacity of government to play its fundamental positive role.

There is one other dimension to this recalibration that is important to consider. We mentioned above the Klein and Pettis thesis on the burden that current account surplus countries impose on countries that accommodate free capital inflows. One way of stating this is that the surplus countries free ride on the aggregate demand of countries such as the U.S., U.K., Canada and Australia. So, if Canada by itself takes monetary and fiscal measures to stimulate demand, a considerable portion of that will flow out to the current account surplus countries and it will accommodate that by taking in capital flows from those countries. These capital inflows are unlikely to be building the future wealth-generating capacity of Canada, but rather will destabilize real estate markets and accumulate claims against future Canadian income.

While Canada, by itself, is unlikely to be able to completely remedy this — although it is not without tools that could make a difference — it does suggest that the country make common cause with the U.S., U.K. and other countries[18] that are impacted by this to bring a greater degree of balance and reciprocity in the way globalism works. Ironically, as Klein and Pettis point out, this will also benefit the working classes of the current account surplus countries as well as Canada’s.

Some nuance on immigration policy, please (it’s GDP per capita, stupid!)

There is a growing push from opinion leaders and decision makers to significantly raise the level of immigration.[19] The current federal government has raised the target for annual immigration levels and seems on a path to raise it further down the road.

Let me state upfront that I am in favour of maintaining immigration at significant levels. Over the past 60 years Canada has evolved into a wonderful multiethnic, multicultural nation. That doesn’t mean it doesn’t have issues with tolerance and inequitable socioeconomic outcomes. But the general view of the population is that immigration continues to be positive for Canada.[20] Furthermore, Canada has a moral obligation to do its share of ameliorating the suffering of the millions of refugees created from regional wars, civil wars, ethnic cleansing and failed states.

Given the emphasis in this paper on the essential need for tightness in the labour market, however, it is important to consider whether higher immigration levels will be helpful or harmful in re-establishing a rising standard of living.

The rationale for the need to increase immigration levels weaves together four elements:

- To offset the challenges of the aging baby-boomer bulge in the population pyramid;

- To keep GDP growing by increasing the labour supply and the demand for goods and services;

- To realize greater economies of scale; and

- To supply employers with the workers they cannot find.

The first of these sounds reasonable on the face of it. But there is much less there than one might suppose. The age structure of immigrants is not that different from the existing population in Canada. On average it is somewhat younger, but not dramatically so. This is because, in addition to prime working age adults and their children, the immigration mix also includes family class parents and grandparents. This has led at least one analyst to joke that the only way immigration could be a solution to the population pyramid problem is if Canada only accepted 15-year-old orphans as immigrants.

A recent analysis[21] shows that “changes in immigration levels have impacts on the margin only: no increase within the realm of practicality can prevent population aging. Other policies to ease the demographic transition, notably encouraging people to work longer are at least as powerful.” The authors calculate that Canada would need to raise immigration levels to 1.4 million a year to even out the population pyramid. In 2019, 341,000 — a record level — arrived in Canada.

The second is more than a little specious, hence the somewhat rude subtitle for this sub-section. Almost daily news items quote somebody of influence saying the only way to increase the rate of growth of GDP is to increase immigration. Some interests will benefit from increasing immigration levels — employers who would prefer a buyers’ labour market to a sellers’ labour market, the real estate industry, financial institutions that provide mortgages and people who already own their homes. But the critical metric is not GDP; it is GDP per capita and how it is distributed.

Increasing the size of the economy might boost the national ego, but unless it translates into an increase in average real income levels, what’s the point?

The third is an interesting concept, but a lot more analysis needs to be done to prove that this can be accomplished while ensuring that the standard of living of the broad middle class is elevated. Canada has, in essence, been running an “experiment” of the concept since the 1980s — it has increased immigration levels, and its population has grown at a higher rate than that of the United States. And yet the absolute improvement in Canada’s standard of living has been disappointing — the central motivation of this paper — and its productivity performance relative to the United States has been weaker. While this might not be dispositive evidence against the economies-of-scale argument, at the very least it suggests that concept remains unproven.

It is the fourth element that really needs to be interrogated, because it cuts to the heart of the whole argument of this paper.

The standard of living of the typical Canadian family is significantly affected by two key elements:

- The wages that members of a family earn; and

- A family’s cost of living.

When a labour market is tight employers must compete for workers, which will lead to higher wages and better working conditions. To repeat, when businesses complain about having difficulty finding enough workers, what this really means is that they cannot easily find the workers they want at a wage they want to pay. But, within reasonable limits, this is a good thing. It forces employers to pay higher wages, provide better working conditions and drives the creative destruction that leads to higher productivity, more valuable products and better business models.

Too often, the rationale for higher immigration levels sounds like business wanting to avoid this creative destruction dynamic — “just provide more workers who will be happy to work for the current prevailing wage and we won’t have to worry about all that innovation stuff.” Canada needs to change this mindset. It’s not going to do that if it continues to signal that employers can expect increased immigration levels when they cannot find the workers they want domestically at the wages they want to pay.

And then there is the issue of affordable housing. The cost of housing is the single largest component of the cost of living for Canadian families. The brutal reality is that Canada has “succeeded” in making housing in its major cities to be amongst the most unaffordable in the world.

Every year Demographia[22] ranks the housing affordability of major housing markets in the United States, United Kingdom, Australia, New Zealand, Singapore, Hong Kong and Canada. It divides affordability into four categories — affordable, moderately unaffordable, seriously unaffordable and severely unaffordable.

Vancouver, Toronto, Montreal and Ottawa are all in the severely unaffordable category, Calgary is in the seriously unaffordable category while Edmonton is only moderately unaffordable.

Vancouver has the distinction of being the least affordable market after Hong Kong. Toronto is the fifth least affordable. Both Vancouver and Toronto are more unaffordable than any American city.

Close to 75 percent of immigrants settle in these six major cities. There are multiple reasons why Canada’s housing has become so unaffordable, but it defies credulity to argue that high levels of immigration will not exacerbate the growing unaffordability of housing in Canada.

The interaction of supply and demand is a real thing. Immigration levels of between 400,000 and 425,000 per year (the current target of the federal government) means an additional demand for approximately 170,000 new homes each year. For context here, Scotiabank recently came out with a piece arguing that Canada already has a structural housing shortage.[23]

As noted above, this is good news, at least on paper, for those who already own their homes. It may only be on paper because we all must live somewhere and the house equity a family has can only be converted into an increase in their standard of living if they are able to move to a more affordable city. But the real concern is with those who don’t already own a home. How is the next generation going to be able to afford what is a core part of the Canadian dream? Those who are lucky enough to be able to count on “the bank of mom and dad” may be able to swing it. But think about the prospects for upward mobility for those whose parents don’t have the capacity to contribute, or who immigrated to Canada without home equity here.

Canada knows it has a growing problem with decreasing intergenerational income mobility.[24] It should be careful about making that worse.

There seems to be a reluctance to challenge the arguments for growing immigration levels. Perhaps that is because they have been repeated so often, they are generally believed to be true. At least in part, however, it is because the promoters of large immigration numbers are quick to label as racist, parochial or small-minded any questioning of larger immigration numbers. Canada needs, however, to be a little more nuanced in its thinking than just accepting that more is always better. The question of what the optimal level of immigration should be over time is a legitimate question of public policy debate.

This is about the standard of living of both Canadians already here and new Canadians. Frankly, Canada has not been doing a great job at providing new Canadians with pathways into the economic mainstream. Between the 1980s and 2015, the earnings gap between new immigrants and Canadian-born counterparts expanded. There was some slight improvement between 2015 and 2019,[25] but it appears this has been reversed by the pandemic.[26]

The rate of poverty amongst recent immigrants is 2.4 times that of Canadians born here — a gap that had widened since 1980.[27] Statistics Canada has been compiling data that shows that on many dimensions, the pandemic has disproportionately harmed immigrants, a function of the types of employment in which they are concentrated and the neighbourhoods and homes they can afford to live in.[28]

This all should prompt Canadians to ask themselves some uncomfortable questions with a social justice lens about the country’s immigration policy. Is it right to view immigrants primarily as a source of low-cost workers? And, in the case of temporary foreign workers, are Canadians comfortable with the very attenuated rights these workers have?

It should be possible to square the circle of significant immigration levels and re-establishing a rising standard of living for the broad middle class. But it will take a much more nuanced set of policy ideas than “more people mean a bigger GDP.” It is somewhat bizarre that it is necessary to be explicit that Canada’s concern should be GDP per capita and how income is distributed, not the absolute level of GDP. But apparently it is.

This is an example of why making a rising standard of living the explicit centre for public policy considerations is critical. Rather than determining immigration levels based on arguments for higher GDP, or to satisfy employers needs for workers, we should be calibrating immigration levels based on what is happening in real wages. If real wages are rising at a healthy rate — say between two and 2.5 percent a year — then immigration can be increased. But if real wages are stagnant or even declining, what exactly is the rationale for higher immigration levels?

Could it not be better in the near term to lower the level of immigration, while significantly improving support to new immigrants, giving them a better chance to more easily integrate into the economic mainstream? As Canada proves it can do this while the broad middle class starts seeing a steady increase in their standard of living again, the political, social and economic circumstances for increasing immigration levels will be much more favourable.

Again, there’s a need to re-establish the creative destruction dynamic that drives businesses to invest in increasing productivity: Canada is not going to do that if it continues to signal that employers can expect increased immigration levels when they cannot find the workers that they want domestically at the wage they want to pay. Government needs to stop sustaining the bad equilibrium discussed in the introduction.

Beware of shiny objects, wishful thinking and bad arithmetic

A country’s economic base is not static — it evolves over time in response to changes in international markets, the development of new technologies, the emergence of new products and entire new industries and political choices about which industries will be encouraged and which industries will be discouraged by government policy.

Canada’s economic base in 2021 is not the same as it was in 1945, nor will it be the same in 2097 as it is today.

In making political choices about which industries to encourage or discourage, however, there is some basic arithmetic that warrants attention.

Canada’s standard of living ultimately depends on its ability to sell goods and services to the rest of the world, or replace goods and services that it purchases from the rest of the world, at competitive prices.

Canada can do this with industries that pay healthy wages and generate healthy net government revenues; or it can do it with industries that pay lower wages and/or require significant subsidies from government. Other things being equal, the country should want to have a lot of the former and not very many of the latter — in a global economy a country should specialize in those industries in which it has a comparative advantage. The Howe White Paper’s attention to the industries making up Canada’s economic base in 1945 reflected this basic wisdom.

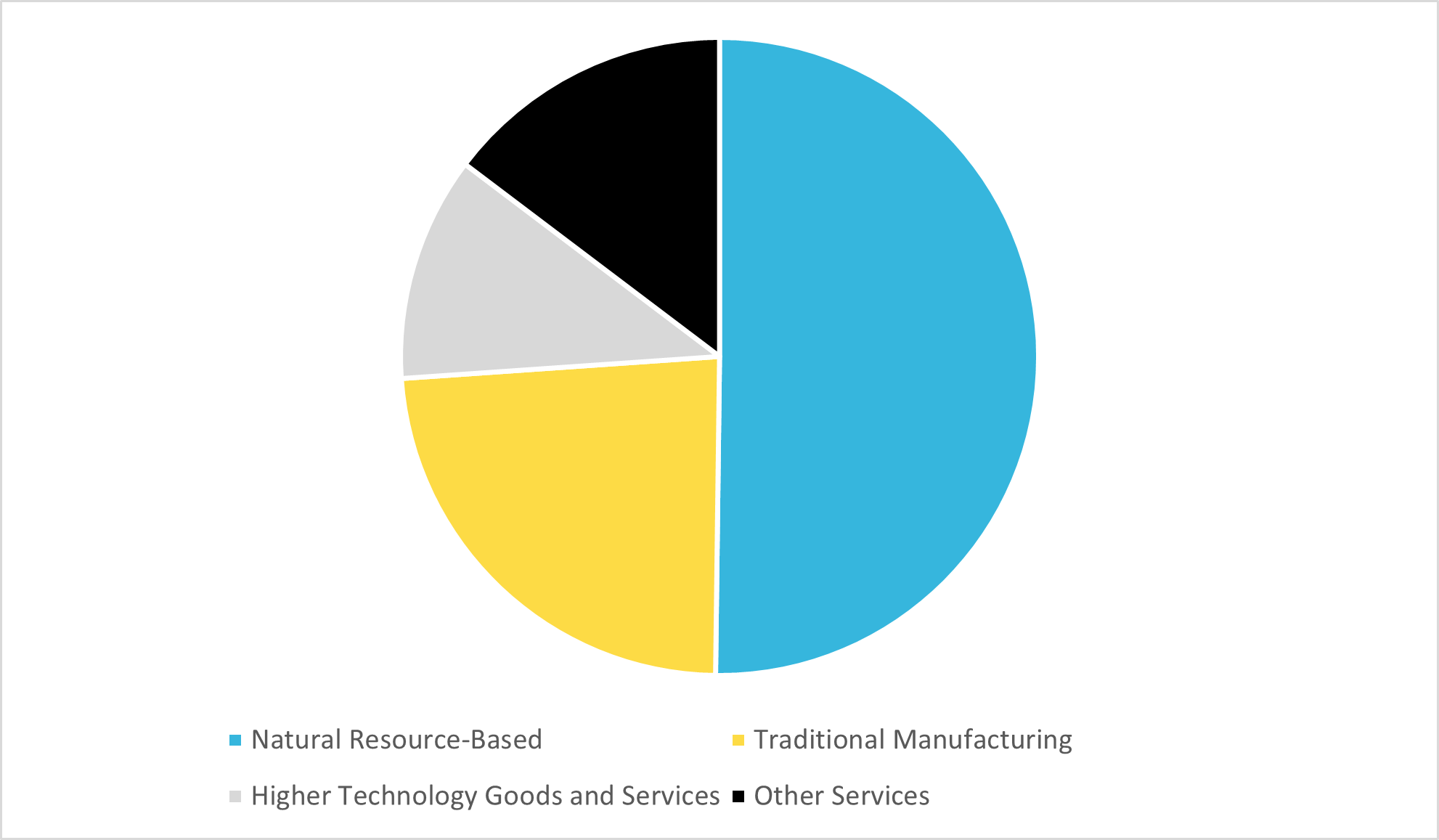

Canada’s current economic base is reflected in Figure 4 below, which shows the proportion of exports accounted for by four broad groupings:

- Natural resource-based exports — either the export of the “raw” commodity or after further processing;

- “Higher technology goods and services” — electronic and electrical equipment, aircraft and aircraft parts, pharmaceuticals, optical and medical instruments and apparatus, IT services, payments for intellectual property and research and development services;

- “Traditional manufacturing” — all other merchandise exports — e.g., vehicles; and

- Other services.

Figure 4 — Composition of Canadian goods and services exports, 2019

Source: Author’s calculations based on StatsCan 36-10-0021-01 and Canadian International Merchandise Trade Database

The StatsCan data on service exports is not as granular as that for commodity exports, so it is not possible to attribute most of these exports to specific sectors. We do know, however, that some of those service exports are driven, directly or indirectly, by the goods sectors. For example, some transportation and financial services are related to goods exports, and some exported consulting services are based on expertise developed from servicing Canadian goods industries.

Natural resource-based industries account for more than half of Canada’s economic base. These industries tend to pay higher-than-average wages[29] and generate higher-than-average direct government revenue per employee.[30]

They enhance the Canadian standard of living. They can generate these higher-than-average benefits because of the value of Canada’s natural resources — its natural capital.

In 2012, Statistics Canada published a study that looked at the income implications of Canadians’ reliance on natural resources between 1870 and 2010.[31] Its conclusion was that Canadians were 18 percent richer in 2010 than they would have been in the absence of their natural resource industries.

Notwithstanding the undeniable contribution natural resource industries make to a higher standard of living, there is currently considerable discourse about the need to migrate away from this part of Canada’s economic base to one based on the new, emerging, green, intangible economy. The underlying model for this transition is explicitly or implicitly a version of the “Silicon Valley Model” — that Canada should invest in creating the technology ecosystems that will allow it to build its own Googles, Amazons and Microsofts.[32]

How can this be done in the context of the need to raise the Canadian standard of living? How does Canada plan to replace those higher-than-average-paying jobs and the significant net government revenue it will forgo if it shrinks the resource sector? To the extent that there is much of an answer to that, it seems to rely on the pandemic-induced notion of “free money” through debt financing — that Canada no longer has to worry about government deficits and debt levels, so that it can just buy (i.e., subsidize) whatever type of economy it wants.

But, as it will be forced to re-learn in the not-too-distant future, government debt financing is not really free, and the debt-financing approach to sustaining people and businesses during the pandemic will have to stop sometime soon.

Yes, Canada needs to continue to evolve how it generates wealth for Canadians, as it always has. But it needs to pursue this informed by rigorous thinking, paying careful attention to the arithmetic of wealth generation. If new industries can only be viable with significant, likely permanent, subsidies, they are going to lower, not raise, Canada’s standard of living.

In a new book,[33] Dan Breznitz from the University of Toronto synthesizes the work he and colleagues have done about innovation policy — what works and what doesn’t; who benefits and who pays; what approach will deliver the most benefits for the broad population. He argues persuasively that for most jurisdictions around the world, the dream of creating another Silicon Valley is a false god. Even if a jurisdiction can be successful in this endeavour — and success is by no means assured[34] — the evidence from jurisdictions such as California and Israel are that this doesn’t bring general prosperity to the middle class, but rather enriches a small segment — founders and early employees, venture capitalists — and increases income inequality.

There are different models of innovation-based growth, and Breznitz argues that each jurisdiction needs to do the hard work of identifying what its natural advantages are, what its capabilities are, what capabilities it can build, how it can foster a self-reinforcing innovation culture that will work in that jurisdiction, what model of innovation-based growth will ensure that the benefits are broadly shared across the entire population, and how it can sustain the commitment of key stakeholders in the public and private sector to this path.

Breznitz has a particularly sobering passage about Canada, which he describes as a “tragic, morbidly fascinating innovation paradox.” :

“Canada has everything that academics and consultants alike argue is needed to excel in innovation. It has extremely high levels of education, with students constantly scoring well on international tests from kindergarten through university. Public investment in R&D is 0.8 percent of GDP, which is the highest among English-speaking countries. Canada has maintained significant investment in science, with three universities ranked in the world top’s fifty (Israel, Finland, Ireland and Taiwan combined have zero), which translates to an impressive outpouring of high-impact scientific publications — more than 2,500 scientific papers per million inhabitants annually. Further, many important technologies, in fields as diverse as materials science, robotics, agriculture, energy, artificial intelligence, web search, vaccination, telecommunication, and media originated in Canada.

Yet once we turn our gaze away from invention and look at innovation, the trends go in the opposite direction. Private-business R&D expenditures took the opposite trend to the public ones and have been continuously shrinking, dropping to a steady level of below 1 percent of GDP. This figure makes Canada one of the worst performers in the OECD. Not surprisingly, with this level of business R&D investment, patents and other forms of IPR have followed the same downward trend and labour productivity is stagnant and abysmal. The most damning statistic of all is that since 2007, the more the Canadian government has invested taxpayers’ money in trying to spur innovation, the less Canadian private businesses have done so. Canada easily wins the wooden-spoon award for the worst innovation policy among all developed economies.

The reason: Canadian politicians and policymakers have always confused innovation with invention.

Innovation is not invention, nor is it research. Indeed, it is not even R&D. Innovation is, pure and simple, any activity along the process of taking new ideas and devising new or improved products and services and putting them in the market. – Dan Breznitz

It comes in all stages of innovation specialization, from the first vision to design, development, production, sale, usage, and after-sale products and services. This definition should also immediately tell you who the agents of innovation are: firms and individuals. The rest of the players in and around innovation, even the world’s most amazing research universities, are at best enablers, and at worst a distraction.

. . .

Canada is the most striking example of how people from all venues of life can consistently refuse to learn the most basic economic lesson: If you want success in innovation, focus on its agents. Having a higher-education policy is a wonderful thing; having S&T and research policy should also be celebrated; having intellectual-property policy is a true blessing. Nevertheless, these elements are not to be confused with innovation policy. Further, a “strategic” industrial policy that focuses on “high-tech” sectors is not an innovation policy.”

Breznitz’s book is rich with insights. My key takeaways:

- Don’t be enchanted with the bright, shiny objects of the day;

- Build on what you have, and grow, stretch and evolve from it through a clear-headed and rigorous approach to innovation; and

- Pay particular attention to whether the benefits of innovation are going to be broadly shared across the population.

They’re all echoes of the Howe White Paper many years ago.

Much of Canada outside the major concentrations of population in the southwest corner of British Columbia, southern Ontario and Greater Montreal have relatively little hope for a significant economic base save for the natural-resource sector.

While there is much speculation about how the virtual economy allows for the decentralization of the new economy, this should not be oversold. There are powerful agglomeration economies available in large urban centres that will never be available in more remote, smaller centres.

This point is particularly salient with respect to reconciliation with First Nations. The recent revelation of the appallingly large number of children’s remains at the Kamloops residential school provides a stark reminder of how generations of Indigenous people were treated and Canada’s collective debt to do better. There are multiple dimensions to reconciliation, but among them must be a moral obligation to current and future generations who deserve to participate in the economy on equal footing with other Canadians, wherever they reside. If a First Nation’s traditional territories are in, or close to, major metropolitan areas, the opportunity set for First Nations to choose from will be quite large. If those traditional territories are in more remote parts of the country, the opportunity set is likely to be dominated by the resource sector.

For all of these reasons, Canada will be making a major mistake, with profoundly negative consequences for its standard of living, if it prematurely sunsets what has historically been its major comparative advantage — its natural resource-based industries. Rather than sunset them, Canadians should be building on them through a no-illusions innovation strategy that will stretch and evolve those industries and use them as a platform to support the growth of its “intangible economy.”

The distinction between “technology industries” and “traditional industries” is a false binary. Every industry will have to be a high technology industry if it is to remain competitive. The application of new technologies — computer optimization, artificial intelligence, virtual reality, big data, geospatial technology, genomic science and many others — is as advanced in the forestry, mining, energy and agriculture sectors as in other sectors.

In the Canadian context, natural resource industries and emerging green industries should be viewed as complements to, rather than substitutes for, each other. Developing new technologies to reduce carbon emissions in resource industries can provide the base upon which emerging green technology solutions can be developed and proven out, and then sold to other industries and other countries. The development of mass timber technologies will allow the substitution or wood for concrete and steel, significantly reducing carbon emissions in the construction of new buildings. Electrification will require significantly greater supplies of copper, molybdenum, aluminum and other metals. Hydrogen may well emerge as a key decarbonization solution, and Canada’s existing natural gas sector may be able to develop technologies to extract hydrogen without significant emissions. Agri-tech will continue to have a key role in increasing food security and regenerative agriculture could play a key role in sequestering carbon.

Just as Canadians would be making a major mistake if they turned their backs on their natural resource industries, they also would be making a major mistake if they do not develop a feasible strategy to grow the contribution of the “intangible economy” to their standard of living. The natural resource base will become narrower and narrower relative to a growing population, and wealth creation is becoming more and more a function of intangibles — patents, business know-how, brands, trade secrets and data.

A good discussion of the challenges Canada faces in this regard is provided by two Public Policy Forum papers.[35] There will be little value in re-plowing the same field here. There is one challenge, however, that warrants a short discussion.

A core factor that Canada needs to do some hard thinking about is the point that intangibles are, indeed, intangible. The owner of an intangible asset is free to deploy it anywhere. An intangible asset is not inherently “anchored” in the jurisdiction that has fostered it.

When a successful technology company is acquired by a larger company headquartered in another country, those intangible assets in essence move to that other country. The initial investors in the Canadian startup may have done relatively well in the sale, but those intangible assets will no longer be generating wealth for Canadians, even though Canadian taxpayers may well have provided significant financial support in the creation of those assets.[36]

This is much different than natural resource industries that must stay anchored where the natural resources are, or even traditional non-resource manufacturing where the significant investment in plant and equipment serves as a disincentive to move to another jurisdiction.

Developing strategies to anchor intangible assets in Canada will be a key challenge going forward. As Breznitz points out, Canada has a long way to go in developing such strategies.

The consistent focus in this paper on the need to make businesses compete vigorously in labour markets does not mean that I am “anti-business.” I believe that market capitalism, as mediated by democratic governments, has been the dominant driver of the incredible increase in global standards of living over the past 200 years.